Lululemon Athletica (NASDAQ:LULU) stock hit a new 52-week high on Monday, October 16. Shares of the athletic apparel, footwear, and accessories retailer closed 10.3% higher ahead of joining the S&P 500 Index (SPX). LULU will replace Activision Blizzard in the S&P 500, effective October 18. While Lululemon stock has trended higher, Wall Street analysts maintain a bullish outlook and recommend a Buy.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With this backdrop, let’s delve deeper into LULU stock.

Why is LULU a Good Investment?

Lululemon stock is up about 30% year-to-date. The growth in LULU stock comes on the back of the company’s solid financial performance, despite macro headwinds. The company recently delivered stronger-than-expected second-quarter earnings. Furthermore, it raised the full-year sales and earnings forecast. This growth reflects Lululemon’s focus on innovation and new product offerings.

Lululemon’s management remains upbeat and expects the momentum in its business to be sustained in the coming quarters. It is focusing on driving brand awareness and has announced a five-year partnership with fitness equipment maker Peloton (NASDAQ:PTON).

Goldman Sachs analyst Brooke Roach sees the partnership with PTON as positive. The analyst believes that the partnership will enable Lululemon to enhance its brand awareness, acquire more customers, and generate incremental revenue through PTON’s online channel and physical stores. Additionally, Roach noted that this collaboration will lead to cost efficiencies and free up resources for the company to concentrate on product development and strategic growth endeavors. Roach reiterated a Buy on LULU stock on September 27.

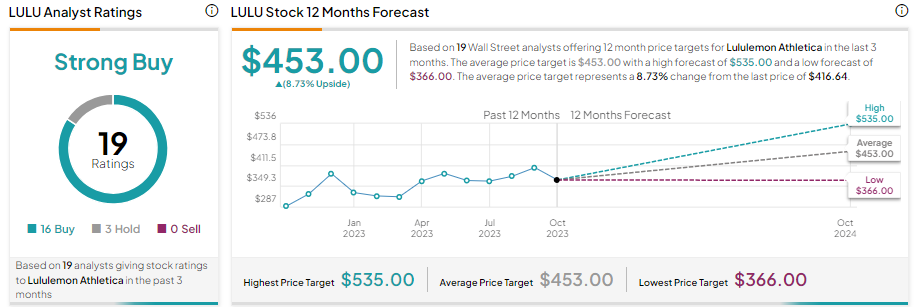

Including Roach, Lululemon stock has received 16 Buy recommendations. Meanwhile, three analysts recommend a Hold. Overall, LULU stock has a Strong Buy consensus rating on TipRanks. Further, analysts’ average price target of $453 implies a further upside potential of 8.73% from current levels.

Bottom Line

The company expects its revenue to grow at a double-digit rate in the coming years, led by growth in men’s, women’s, and e-commerce channels. Overall, Lululemon’s focus on innovation, international expansion, and driving brand awareness bodes well for long-term growth, as reflected through analysts’ strong Buy consensus rating.