Back when the COVID-19 crisis temporarily capsized the global economy, the definition of office attire shifted dramatically, benefiting athletic leisurewear specialist Lululemon (NASDAQ:LULU). However, both economic and social circumstances have pivoted away from favoring the apparel retailer. Adding to the woes, institutional investors may be signaling the risk of future downside. Therefore, I am bearish on LULU stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Unpleasant Backdrop for LULU Stock

Back in December 2020, an op-ed from The Washington Post noted that the U.S. workforce was having its “pajama moment.” Naturally, this framework benefited Lululemon. Formal office attire was out. Casual wear was in. However, shifting circumstances no longer decisively favor LULU stock, posing anxieties for shareholders.

For one thing, major corporations appear to have had enough with the aforementioned pajama moment. Now, they want – no, demand – their workers to return to the suit-and-tie moment. For example, TipRanks contributor Steve Anderson pointed out that Amazon (NASDAQ:AMZN) issued an ultimatum regarding its return-to-office mandate. Other companies could follow suit.

Moreover, and just as pertinent for LULU stock, Federal Reserve Chair Jerome Powell warned that inflation remains too high. Therefore, it’s not out of the question for the central bank to issue more rate hikes. Of course, higher borrowing costs stymie business growth. Subsequently, such a hawkish framework could force mass layoffs, and the threat of such could cause workers to obey return-to-office directives.

Fundamentally, that would be a negative double whammy for LULU stock — lose to competitors selling professional attire and also lose to monetary policy.

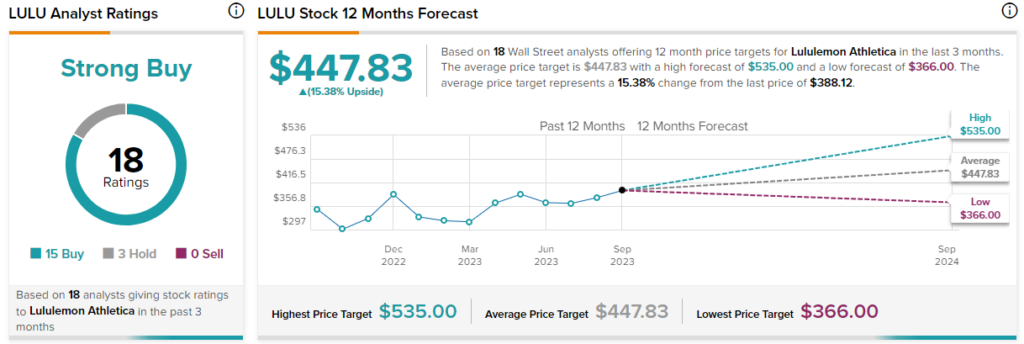

To be sure, most analysts remain generally optimistic about LULU stock. Still, the most recent assessment comes from Bernstein’s Aneesha Sherman, who pegged Lululemon as a Hold. Also, the expert’s price target landed at $366, implying 5.7% downside potential.

Unfortunately, that might not be the only source of rough news for LULU stock. Indeed, options traders don’t seem very confident.

Smart Money Seemingly Anticipates Downside for Lululemon

While analyzing the options market (where the smart money often plies its trade) isn’t a foolproof trading strategy, it’s a valuable practice, nonetheless. Basically, professional traders – or better yet, institutional investors – have resources and information that regular retail investors do not. However, deciphering the options arena helps to even the playing field.

For LULU stock, one of the biggest concerns is that following the expiration of the $420 calls on October 20, 2023, the options flow screener I use (which looks for big block trades likely made by institutions) presently shows no major bullish activity in 2024 and early 2025. Instead, the only significant transactions feature negative sentiment.

Specifically, traders bought $300 puts with an expiration date of June 21, 2024, and bought $280 puts with an expiration of January 17, 2025.

More importantly, the volatility smile – or the implied volatility (IV) of options plotted at various strike prices – for LULU stock presents a concerning profile. Basically, IV is relatively muted at the strike prices closest to the open market price and beyond. In sharp contrast, IV spikes higher in the strike prices much below the open market price.

Technically, this setup suggests that options traders are hedging their bets against tail risk (basically, a black swan event). If so, that doesn’t bode well for LULU stock.

Financials Present a Contrasting View

Despite some worrying signals for LULU stock, it would be unfair to characterize the underlying apparel retailer as wholly troubled. Indeed, as TipRanks contributor Nikolaos Sismanis pointed out, Lululemon posted a top-and-bottom-line beat for its second-quarter earnings report, part of the reason why Sismanis is bullish on LULU.

Looking at the financial performance, it’s not an unreasonable assessment. For example, Lululemon saw significant growth in its international business, thanks in large part to China. Also, Sismanis mentioned that Lululemon benefits from superior economies of scale because of its business expansion initiatives.

While not disputing this framework, a fundamental challenge is that social trends for attire may shift (i.e. back to work). Also, the rumblings in the derivatives market imply that professional traders don’t share the same optimism for LULU stock.

Is LULU Stock a Buy, According to Analysts?

Turning to Wall Street, LULU stock has a Moderate Buy consensus rating based on 15 Buys, three Holds, and one Sell rating. The average LULU stock price target is $439.68, implying 15.4% upside potential.

The Takeaway: Caution is Key for LULU Stock

Although Lululemon continues to perform impressively, the major headwind it faces is a shifting consumer economy. Whether from a return to the office or a decline in the economy (or both), the athletic apparel retailer may not be able to depend on prior upside catalysts. With the smart money seemingly hedging their bets, investors, at the very least, should approach LULU stock with skepticism.