Lululemon Athletica (NASDAQ:LULU) is scheduled to release its fourth-quarter results after the market closes on March 28. The athleisure maker witnessed a strong holiday shopping season, which might have supported its top-line growth in the to-be-reported quarter.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, higher freight and raw material costs during the quarter are likely to have impacted the bottom-line growth of the company.

The Street expects Lululemon to post earnings of $4.26 in Q4, higher than the prior-year quarter figure of $3.37. Meanwhile, analysts expect the company to report net revenue of $2.7 billion, up 26.8% from the same quarter last year.

Additionally, the company updated its guidance in January. It increased its Q4 revenue forecast to between $2.66 billion and $2.7 billion, representing a 25% to 27% increase from the prior year. Also, the company expects Q4 gross margin to decline by 90 to 110 basis points versus its prior expectation of an increase between 10 and 20 basis points.

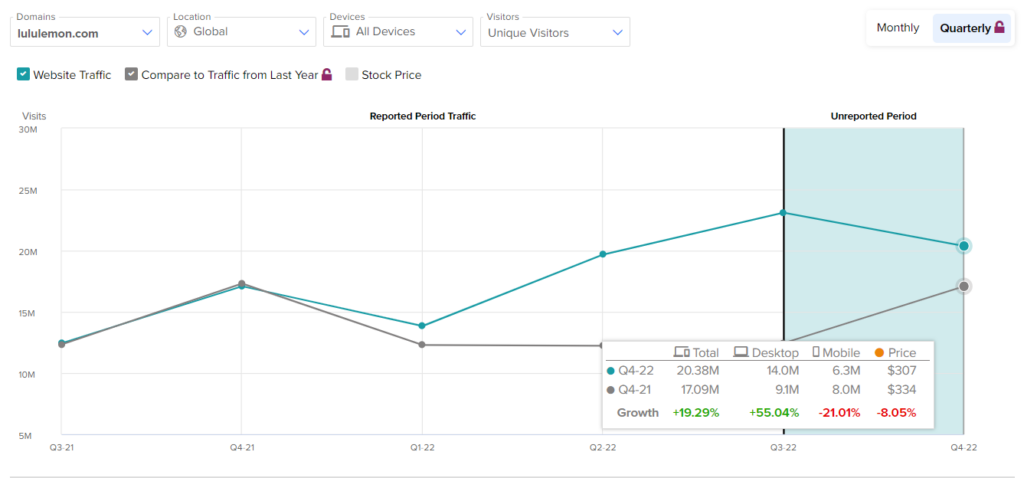

Website Traffic Depicts Growth

TipRanks’ Website Traffic Tool offers insight into Lululemon’s fourth-quarter performance. According to the tool, LULU’s website traffic registered a 19.3% year-over-year rise in global visits during the quarter.

The increase in monthly visits could indicate that demand for the company’s products remained strong during the quarter.

Is LULU a Good Stock to Buy?

Ahead of the quarterly results, Citi analyst Paul Lejuez reiterated a Hold rating with a price target of $350 on the stock, implying an upside potential of 12.8% at current levels. The analyst predicts that the stock will increase after the release of Q4 earnings. Lejuez is confident about China’s growth prospects and thinks the company will provide better-than-anticipated guidance.

Overall, Wall Street is cautiously optimistic about LULU stock. Overall, the stock has a Moderate Buy consensus rating based on 17 Buys, two Holds, and three Sells. The average price target of $370.05 implies 18.1% upside potential from current levels.

Ending Thoughts

Lululemon’s efforts to introduce new products and increase brand awareness may continue to foster expansion. Additionally, the company’s goal to keep growing internationally could boost top-line revenue.