Apparel stocks — such as LULU, ADDYY, and GIL — have been feeling the pressure over the past year, thanks in part to ongoing consumer-facing challenges (inflation, affordability, high rates, and less confidence about the state of the economy). Despite recent share price sluggishness in the broader batch of apparel plays, Wall Street still finds a number of names quite stylish.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Undoubtedly, there are some truly magnificent brands in the apparel space. That said, apparel tends to be a tougher sell when economic growth pulls the brakes. And no apparel brand is magnificent enough to completely overcome the recent onslaught.

However, a good amount of damage is already in the books when it comes to the broader basket of apparel retail plays. When the economy finds its footing again, battered apparel stocks could prove too cheap at these levels. As such, it’s no mystery why so many analysts aren’t ready to turn their backs against apparel plays here, at least not while expectations have come down.

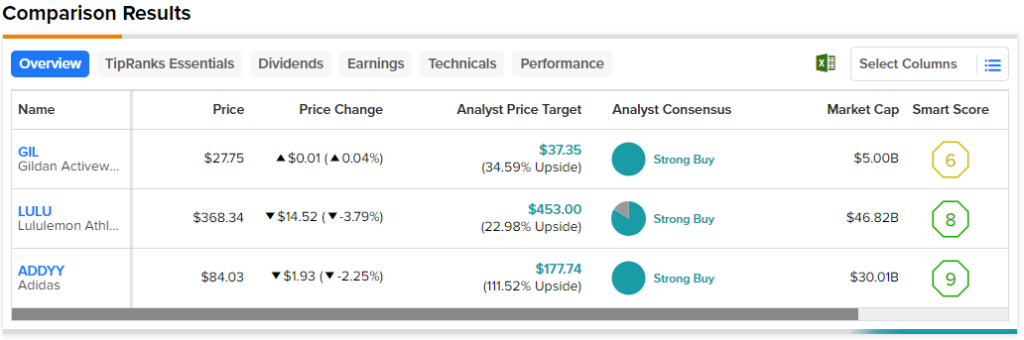

Therefore, let’s check out TipRanks’ Comparison Tool to weigh in on how Wall Street views the following trio of apparel plays.

Lululemon (NASDAQ:LULU)

It’s almost never a good idea to bet against Lululemon stock, especially in instances where the market finds the yoga pant-maker less than appealing amid macro turbulence. Relatively speaking, Lululemon has been a rather resilient apparel play, with shares having flatlined over the past five months. Still, the stock is nearly 25% off from its late-2021 all-time high of around $485 per share.

Though I’m a big fan of the brand and its longer-term growth opportunity regarding Direct-to-Consumer sales, I can’t say the current valuation makes a lot of sense, at least not when there are other impressive apparel retailers that go for much cheaper. Though Wall Street is standing by the stock, I’m inclined to be bearish and think the path of least resistance is lower from here.

At writing, the stock trades at a hefty 47.8 times trailing price-to-earnings, still miles above the 24.7 times apparel retail industry average. On a forward-looking basis, things aren’t much better, with LULU shares going for 32.5 times next year’s expected earnings.

Its latest partnership with Peloton (NASDAQ:PTON) to sell co-branded products was definitely intriguing, and Raymond James’ recent “Strong Buy” reiteration over “growth opportunities” was encouraging. That said, I just don’t see a sustained path higher unless the economy is able to march higher. At the end of the day, Lululemon’s strong brand affinity and growth runway are already baked in, with shares trading at a lofty premium to the peer group.

Though Lululemon’s long-term roadmap is bright, I just find there to be better opportunities in the space currently.

What is the Price Target of LULU Stock?

Lululemon’s a Strong Buy, according to analysts, with 16 Buys and three Holds assigned in the past three months. Further, the average LULU stock price target of $453.00 implies 23% upside potential.

Adidas (OTC:ADDYY)

Speaking of strong brands, we have Adidas, which also boasts a Strong Buy rating from the analyst community. Like Lululemon, Adidas shares have not done much over the past two quarters. After a brutal 2021-22 sell-off, shares are now off 55% from their all-time high. It’s been such a painful fall that the stock is actually lower than the darkest depths of the 2020 stock market crash.

While there are notable pressures (macro and company-specific), there are potential catalysts outlined by Bank of America Securities analyst David Roux that could prove timely. Mr. Roux was impressed by the company’s gross profit margin in the second quarter. He went as far as to note of a brand inflection. Up ahead, Roux is upbeat about the potential for new year-end product launches, among other things.

Personally, though, I’m inclined to stay neutral for now, as only time will tell if the recent bounce off its 2022 low is anything more than a dead-cat bounce.

Today, the stock trades at 40.5 times forward price-to-earnings, well above the apparel industry average. Though Adidas has an incredible brand with the ability to thrive in a post-Yeezy era, I’m unsure if demand can really heat up in the face of a potential recession. Therefore, I’m taking a wait-and-see approach.

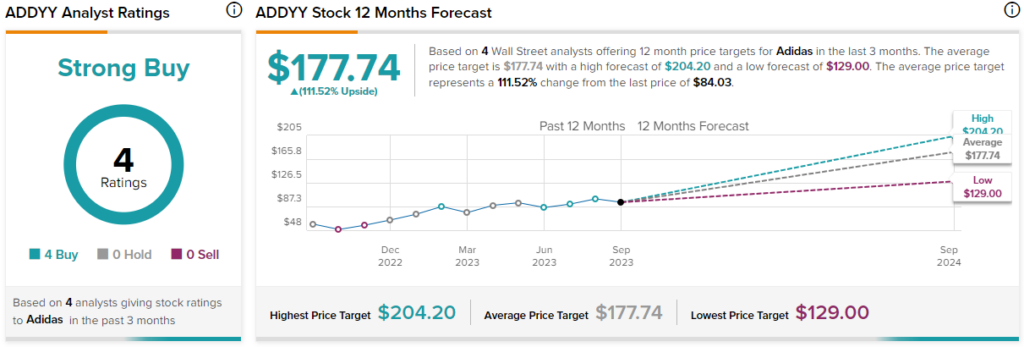

What is the Price Target of ADDYY Stock?

Adidas is a Strong Buy, according to analysts, with four unanimous Buy ratings . The average ADDYY stock price target of $177.74 entails 111.5% upside potential.

Gildan Activewear (NYSE:GIL)(TSE:GIL)

As a Canadian manufacturer of generic clothing, Gildan lacks the brand power of a Lululemon or Adidas. That said, low costs of production and the fact that essential (and imprintable) articles of clothing always tend to be timeless fashions, make it a more defensive play in the face of economic turbulence, though it is noteworthy that the imprintables business has faced fluctuating demand in recent years.

In any case, GIL stock is absurdly cheap after going mostly nowhere for the last year and a half. As such, I am bullish on the name here.

At writing, Gildan trades at 10.3 times trailing price-to-earnings, well below the apparel manufacturing industry average of 15.8 times. The stock also has a nice 2.6% dividend yield and a history of prudent deal-making (the firm bought American Apparel a few years ago).

In any case, I view Gildan as a solid deep-value option. This is especially true for investors who may be enticed to take advantage of the favorable standing of the U.S. dollar versus the Canadian dollar by making the venture north of the border (GIL also trades on the Toronto Stock Exchange).

What is the Price Target of GIL Stock?

Gildan has a Strong Buy consensus rating, with nine unanimous Buy ratings assigned by analysts in the past three months. The average GIL stock price target of $37.35 entails 34.6% upside potential.

Conclusion

Apparel stocks have been under pressure for quite some time now. Still, long-term thinkers could stand to do pretty well by picking them up while they’re down and out. Just look to the praise of analysts! Of the three stocks, analysts expect the most upside from Adidas stock, with a whopping 111.5% in expected upside and a perfect four of four analysts recommending it as a Buy.