There’s no doubt, these are challenging times for Lucid Group (NASDAQ:LCID). The luxury EV maker recently announced it will layoff around 1,300 employees – around 18% of its global workforce. The cull is part of the company’s aim to get laser focused on lowering cash burn, amidst restructuring efforts. The workforce reductions are expected to be completed by the end of Q2.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Lucid’s issues don’t end there. The company has seen dwindling demand for its luxury electric sedans – priced at a starting point of $87,000 – with Q4 deliveries missing Street targets. Moreover, the company’s aim to produce up to 14,000 vehicles this year amounted to a bit of a disappointment for investors.

Assessing Lucid’s situation, Fox Advisors founder Steven Fox believes the company is at a “critical juncture in its ambitious commercial development plans.” Lucid is also looking to ramp “into a tough macro,” and that could result in other unforeseen challenges.

That said, Fox also thinks the company has “big potential to differentiate” in the luxury market. Lucid’s EVs offer comfort and functionality, and most importantly, with 400+ miles and 4.5+ miles per kilowatt-hour or kWh, battery range and efficiency. Thus, says Fox, investing in Lucid shares, is a “high reward/high risk play for its start-up execution at massive scale.”

“However,” he goes on to add, “Lucid also comes with what we think proves to be a valuable backstop’ of intellectual property around battery efficiency enabling vehicle designs that are more spacious inside with more compact and efficient exteriors vs. virtually all other competitive brands in the $500B+ luxury passenger vehicle market we see moving more and more to electrification.”

Moreover, it’s not too farfetched to imagine Lucid eventually generating “substantial shareholder value” from licensing core technologies, which going by Fox’s recent visit to its Arizona hub, appear to be well suited for mass production. Possibilities as a technology supplier include the aerospace, defense, heavy equipment, agricultural, and marine industries, as well as auto brands where there are no direct competitors.

In the meantime, Fox sees a “reasonable path” ahead for Lucid to scale from sales of $608 million on EBITDA losses of ($1.97 billion) in 2022 to ~$6 billion and ($100mm), respectively, by 2025E.

To this end, Fox initiated coverage of LCID stock with an Outperform (i.e., Buy) rating alongside an $11 price target. At current levels, this target suggests a 44% upside for the year ahead. (To watch Fox’s track record, click here)

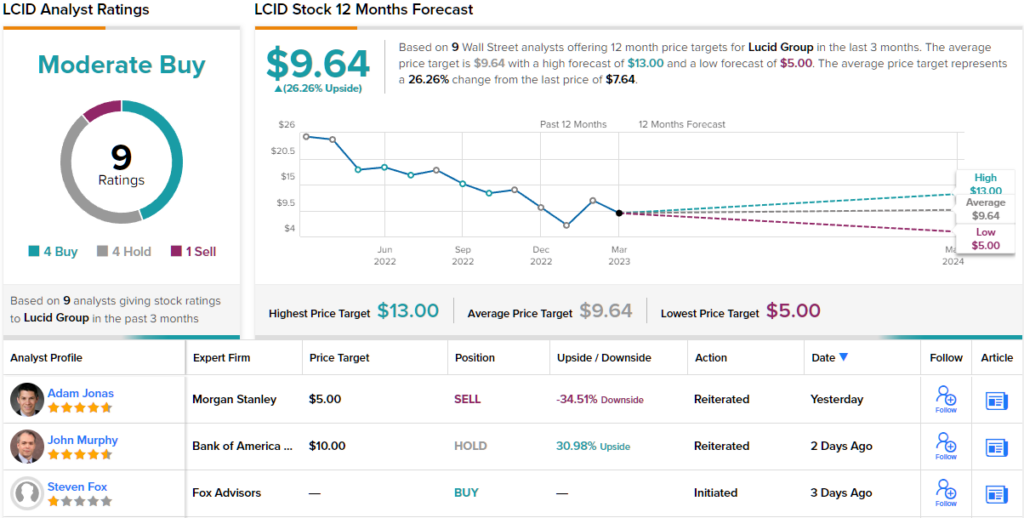

All in all, the Street rates this stock a Moderate Buy, based on 4 Buys and Holds, plus 1 Sell. Going by the $9.64 average target, a year from now the shares will be changing hands for a 26% premium. (See Lucid stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.