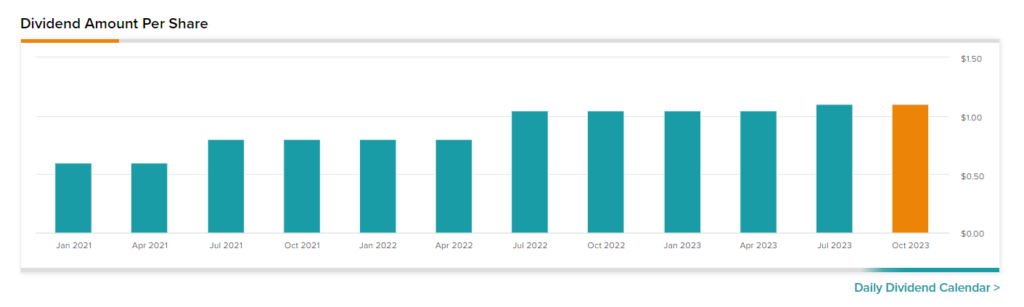

The home improvement company Lowe’s (NYSE:LOW) boasts a commendable history of raising dividends for 49 consecutive years. This impressive streak helped it earn a spot among the esteemed Dividend Aristocrats (stocks that have raised their dividends for at least 25 consecutive years). Further, LOW offers a dividend yield of 1.83%, surpassing the sector average of 0.99%. LOW is currently loved by top Wall Street analysts, as it sports a Strong Buy consensus rating.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Here’s What to Love about LOW Stock

The demand for home improvement is expected to remain robust as individuals consistently seek to enhance their living environments. Furthermore, the industry is expected to show resilience even in the face of a downturn in the U.S. housing market as people continue to invest in upgrading their current homes.

In addition, Lowe’s has been strategically emphasizing digital channels and professional contractors. The company has achieved success with this approach, as both segments experienced sales growth in the second quarter of 2023.

Lowe’s Q2 earnings exceeded expectations, while its revenues remained in line with estimates. However, both of these metrics declined compared to the same quarter of the previous year. This fall was attributed to lower demand in discretionary do-it-yourself (DIY) purchases, influenced by inflation and higher interest rates.

It is worth mentioning that the Mortgage Bankers Association expects total mortgage originations to start increasing in the third quarter on a year-over-year basis. This is a positive sign for Lowe’s, as it suggests a potential improvement in its revenue performance.

Is Lowe’s a Good Stock to Buy?

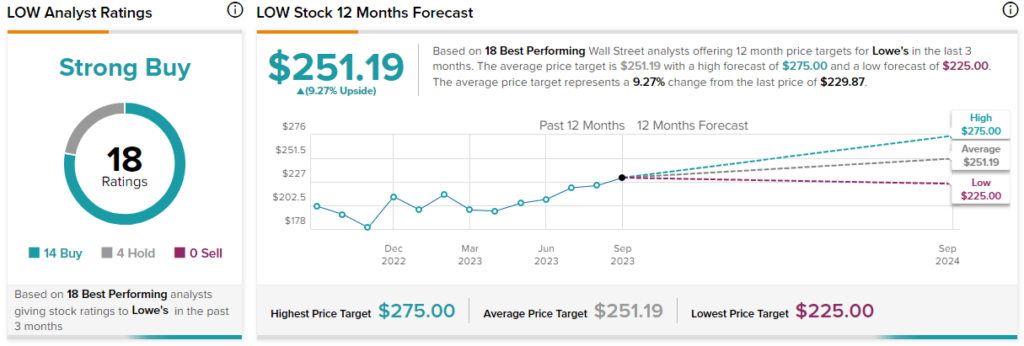

Of the 18 top analysts covering Lowe’s, 14 have a Buy rating, and four assigned a Hold in the past three months. Overall, the stock scores a Strong Buy consensus rating. Meanwhile, the average LOW stock price target stands at $251.19, implying upside potential of 9.3%. Shares are up 16.7% year-to-date.

It is noteworthy that these top analysts have an impressive history of helping investors generate massive returns from their recommendations. Moreover, each analyst has a remarkable success rate.

Ending Thoughts

Given its strong brand recognition and promising future prospects, LOW stock appears to be a dependable choice for income investors. Furthermore, its dividend payments seem to be sustainable, thanks to the firm’s robust financial position.

Interested in learning more about dividends? Join in on the conversation on the TipTalks podcast.