Home improvement retailer Lowe’s Companies (NYSE:LOW) is scheduled to announce its third-quarter results before the market opens on November 16. The company’s Q3 performance is expected to benefit from its efforts to grow its Pro customer base.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Lowe’s CEO Marvin R. Ellison recently hinted at a strong performance in Q3 while announcing the sale of its Canadian retail business to Sycamore Partners.

“We remain confident in our short and long-term outlook for the U.S. business, underscored by improved sales trends and strong profit flow-through in the third quarter, as well as our expectations for solid business performance for the remainder of 2022,” said Ellison.

Currently, the Street expects Lowe’s to post an adjusted profit of $3.09 per share in Q3, 13.2% higher than the prior-year period figure of $2.73 per share. Meanwhile, revenue is pegged at $23.1 billion, representing a year-over-year growth of nearly 1%.

Analysts Cut Price Target Ahead of Earnings

On Friday, J.P. Morgan analyst Christopher Horvers lowered the price target for Lowe’s stock to $205 from $235, while maintaining a Hold rating. The analyst is of the opinion that in the coming year, housing stocks “should see a greater degree of lagged negative revisions.”

Also, David Bellinger from MKM Partners cut the stock price target for Lowe’s stock to $205 from $220 and maintained a Hold rating as well. Bellinger finds the forward outlook to be uncertain, given mixed signals across the housing industry.

Is LOW Stock a Buy, Sell, or Hold?

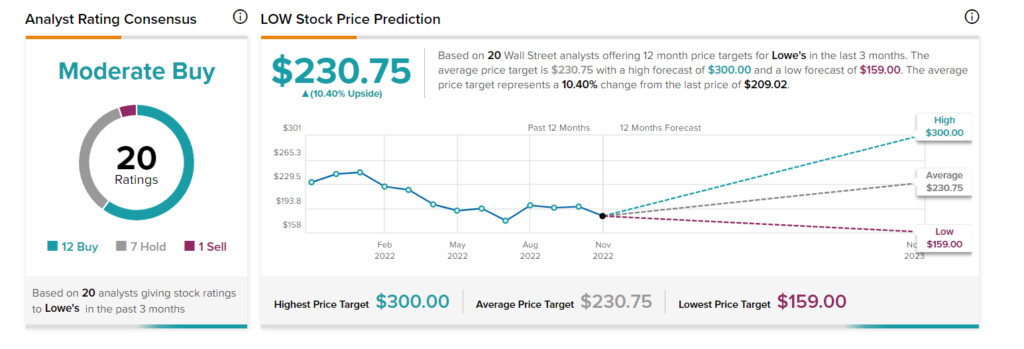

With 12 Buys, seven Holds, and one Sell rating, Lowe’s stock has a Moderate Buy consensus rating. On TipRanks, the average LOW stock price forecast of $230.75 implies 10.4% upside potential to current levels. Shares have declined nearly 19% year-to-date.

Conclusion

Lowe’s third-quarter results might have benefited from the lack of seasonality, which widely impacted performance in the first half of 2022. Thus, the demand for do-it-yourself products is likely to have picked pace. Further, the company’s Pro MVP loyalty program is expected to have attracted more Pro customers.

Nevertheless, several macro challenges, including soaring inflation and lingering recession fears, might have limited consumer spending to some extent.