Stocks came storming out the gates in October’s first session as if in a hurry to leave a brutal September well behind. Investors will be hoping the rally is more than a one-off after the storm of headwinds – a combination of high inflation, rising interest rates, and slowing economic activity – have hit the markets hard this year. The tech sector has been especially vulnerable. The NASDAQ closed out the third quarter with three consecutive weeks of losses and is still down 31% for the year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

But losses on this scale bring opportunities with them, in the form of lower share prices. The stock analysts at J.P. Morgan haven’t been shying away from that basic market truth, and among their picks are some fundamentally sound tech stocks that are showing steep share price losses. We’ve opened up the TipRanks database to get the latest on these beaten-down stocks. Here are the details, with comments from the JPM analysts.

Vacasa (VCSA)

We’ll start by looking at Vacasa, the Portland, Oregon-based company that makes vacation rental management easy. Vacasa connects property owners with vacationers, making it possible to find affordable digs in 37 states, Mexico, Belize, and Costa Rica. In all, Vacasa has over 35,000 potential rental homes in its listings, and site users can sift through them by categories – homes with hot tubs, homes with fireplaces, homes near golf courses. The site has gathered more than 300,000 positive reviews for the properties it lists.

Vacasa went public less than one year ago, through a SPAC transaction in December that generated approximately $340 million in new capital for the firm. Since then, the shares have shown extreme volatility overlaid on a downward trend. The stock fell sharply in early summer this year, when the post-SPAC lockup period ended, but it bounced back up again after releasing the 2Q22 results and has since fallen back down. For the year so far, VCSA shares are down 63%.

That doesn’t mean the company hasn’t delivered. In the last quarterly release, the 2Q22 mentioned above, Vacasa reported $310 million at the top line, for 31% year-over-year growth. The company’s gross booking value was up 32% y/y, to hit $676 million. Diluted EPS, at 2 cents per share, was positive for the first time in three quarters.

JPM’s 5-star analyst Doug Anmuth, a tech sector expert who’s been following Vacasa since it went public, wrote of the company after its Q2 report, “We note that the Adj. EBITDA guide of -$7M-$0M for the FY at the high end suggests VCSA could reach breakeven this year, 1 year ahead of its target. Overall, we believe underlying trends remain solid & VCSA is executing well.”

Anmuth doesn’t leave it at that. He goes on to point out to particular factors that bode well for the company going forward: “1) Strong guest demand in 2Q that continued into 3Q. Echoing other online travel companies, mgmt suggested that consumers are still prioritizing travel. 2) Remain on track to increase homes under management by 30% in ’22. VCSA already reached its sales force target that was set entering ’22…”

In line with these comments, Anmuth rates VCSA shares as Overweight (a Buy), with a $7 price target to suggest a solid one-year gain of 127%. (To watch Anmuth’s track record, click here.)

While the JPM view is decidedly bullish, the Street’s take is generally more mixed; with 3 Buys and Holds, each, the stock ekes out a Moderate Buy consensus rating. Nevertheless, the stock’s average price target of $6.6 implies a strong 114% upside from the current trading price of $3.08. (See Vacasa’s stock forecast at TipRanks.)

Roku (ROKU)

Next up is Roku, a leader in the online TV streaming field. This is a growing niche, and Roku has built a strong position. The company offers users its eponymous streaming player and customers subscribe for streaming services that are routed through the player. Roku also licenses its hardware and software to other companies. The company profits from the monetization of audience engagement, and from advertisement placement and clicks.

Roku’s shares hit a peak in July of last year, and have been slipping ever since. The stock slid down 75% in the first nine months of this year, and earnings turned negative in 1H22. The company’s shares have suffered as the market shifted from growth-oriented performance to this year’s bear. Roku’s expenses remain high while its profits are lower in a macro environment that sees both advertisers and customers paring back spending in response to high inflation and increased interest rates.

On a positive note, Roku announced in July that it had secured $1 billion in Upfront ad commitments, with commitments made by all seven of the major ad holding companies. The $1 billion total marks a new milestone for Roku, which it achieved despite the current tough environment.

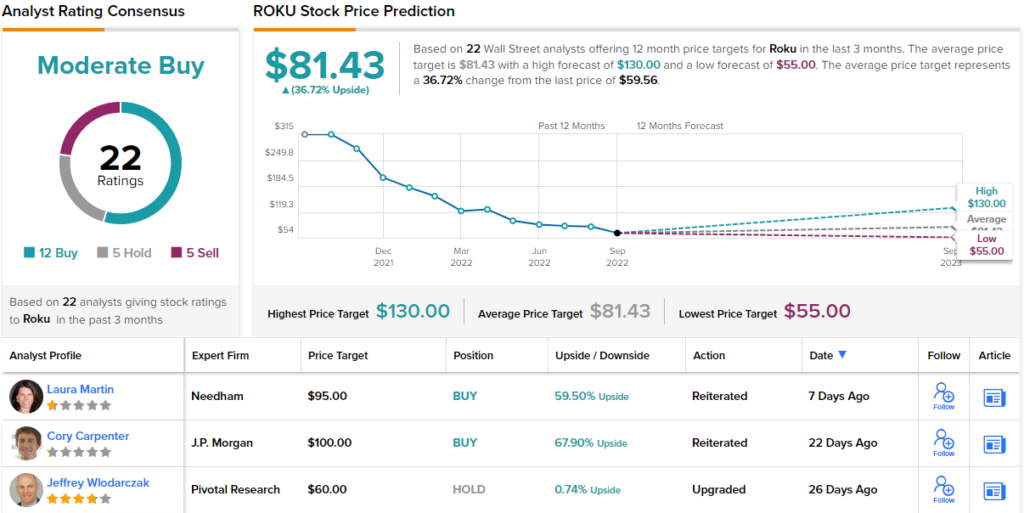

This stock has been the focus of JPM analyst Cory Carpenter, who sees a path forward for Roku – even if it is a bit rocky. Carpenter writes, “Roku’s return to more normalized growth depends largely on improvement in the scatter market, which has the ability to snap back quickly (like we saw in 2H20), but the timing & magnitude of a turnaround, in our view, is largely a function of the macro environment. The good news is that Roku’s 3Q guide does not assume any scatter improvement, and Roku’s record $1B Upfront commitment starts to contribute in 4Q. Mgmt highlighted the significance of closing its Upfronts at the same time as linear networks this year, which along with a record $ commitment & streaming recently surpassing cable in viewership time (per Nielsen) suggests that the secular shift to streaming is as strong as ever.”

Going forward from these comments, Carpenter puts an Overweight (Buy) rating on this stock, complementing it with a $100 price target that implies a robust gain of 68% for the year ahead. (To watch Carpenter’s track record, click here.)

This tech stock has picked up no fewer than 22 recent analyst reviews, which include 12 Buys, 5 Holds and Sells, each, for a Moderate Buy consensus rating. While the ratings are mixed, most appear to think the shares are undervalued; at $81.43, the average price target suggests a 37% gain from the current share price of $59.56. (See Roku’s stock forecast at TipRanks.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.