Will iRobot (NASDAQ:IRBT) get acquired soon? If not, then iRobot stock might only vacuum up your investable capital. I am bearish on IRBT stock in the wake of a bombshell news report that could keep the share price down for a long time.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Headquartered in Massachusetts, iRobot sells robot-type products for home use. The company’s best-known product is the Roomba floor-vacuuming robot. It doesn’t really look like a robot from an old science-fiction movie, but the Roomba is technically a robot, and it’s a fairly popular product.

However, as we’ll discover, the Roomba hasn’t been popular enough to give iRobot a profitable profile. Without a famous e-commerce company swooping in to save the day, iRobot’s growth prospects aren’t stellar, and investors should exercise caution.

iRobot Stock: The Trend Isn’t Your Friend

I like a good bargain as much as anyone. However, IRBT stock has been in free fall for a while, and dip buyers have gotten burned again and again.

Not to personally insult the iRobot stock chart, but it’s downright ugly. Anyone who bought it above $100 in 2019 or in 2021 lost their shirt, so to speak. This is a textbook example of how chasing stocks higher can be disastrous. Yet, there’s also a lesson here about how bottom-fishing for stocks representing deeply unprofitable businesses can be hazardous to your financial health.

Regarding a stock’s risk-versus-reward profile, it’s typically not a good sign when the stock is halted several times in a single day for extreme volatility. We’ll get to the reasons for this in a moment.

For now, just consider that iRobot hasn’t had a profitable quarter in a couple of years. In 2023’s third quarter, Wall Street predicted that iRobot would report a loss of $1.67 per share; the actual result was much worse, with a loss of $2.82 per share.

That same quarter, iRobot generated revenue of $186.176 million. That’s a substantial decline compared to the $278.191 million that iRobot generated in the year-earlier quarter. Thus, there are unfavorable trends happening with iRobot’s financials, as well as with IRBT stock.

This leads us back to the issues of value and buying the dips in a stock. I certainly don’t recommend buying every stock whenever there’s a blood-in-the-streets situation. Investors should look at a company’s financial health first, and share-price action is of secondary importance. In iRobot’s case, it’s difficult to identify a compelling argument for a dip-buying opportunity based on the company’s financials.

Awful News for iRobot

Now, let’s go back to the report that IRBT stock once got halted for trading multiple times in a single day. That occurred because the European Commission sent Amazon (NASDAQ:AMZN) a statement of objections to the e-commerce giant’s proposed takeover of iRobot.

This was a disappointing development, to say the least. Prior to that, a report had circulated that the European Union (EU) would approve Amazon’s proposed acquisition of iRobot for $1.4 billion. A relief rally in IRBT stock ensued, but it turned out to be a head-fake.

The European Commission had antitrust concerns based on the idea that if Amazon owns iRobot, this would restrict competition in the robot vacuum cleaner market. Hence, in a move that undoubtedly surprised iRobot’s optimistic investors, the European Commission released a “statement of objections” to the buyout based on concerns that Amazon would have “the ability and incentive” to prevent competition against iRobot’s Roomba products on Amazon’s e-commerce platform.

Since that time, Amazon hasn’t made a major effort to come to iRobot’s rescue. Notably, Amazon skipped a concessions offer with the European Commission in regard to the proposed iRobot acquisition. Moreover, as of this writing, it appears that Amazon hasn’t officially proposed any remedies to quell the European Commission’s antitrust concerns.

In other words, Amazon’s lack of recent, decisive action tends to suggest that the company just isn’t all that interested in buying out iRobot. Making matters worse, The Wall Street Journal just reported that the European Commission plans to block Amazon’s proposed buyout of iRobot.

IRBT stock plunged nearly 30% on this bombshell news. Yet, perhaps it’s just the final chapter in a story that was never really meant to happen.

Is IRBT Stock a Buy, According to Analysts?

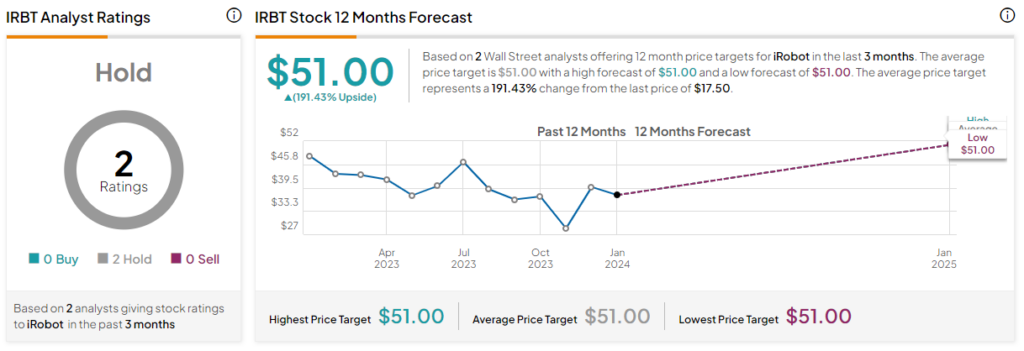

On TipRanks, IRBT comes in as a Hold based on two Hold ratings assigned by analysts in the past three months. The average iRobot stock price target is $51, implying 191.4% upside potential.

Conclusion: Should You Consider IRBT Stock?

How serious is Amazon about buying out iRobot? Maybe Amazon just isn’t so eager that it’s willing to put up a prolonged fight against powerful regulators.

That’s a problem, along with iRobot’s less-than-ideal financials. So, I wouldn’t be hasty if you’re thinking about going on a rescue buy-the-dip mission with IRBT stock. I’m definitely not considering taking a share position in iRobot, and investors might want to look elsewhere for more favorable opportunities.