Lockheed Martin’s (NYSE:LMT) upcoming dividend hike is likely to entice investors. The aerospace and defense giant behind the F-35 fighter jet, the C-130 Hercules transport aircraft, the HIMARS, and other iconic weapons systems has seen its stock price underperform year-to-date. Shares have dipped by 7% as the S&P 500 (SPX) has risen by 14% during this period. With its 22nd successive annual dividend hike on the way, though, this trend could change. I am bullish on LMT stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Lockheed Martin’s Strong Results Can Support Strong Dividend Hikes

Lockheed Martin has traditionally increased its dividend in September. With its results coming in very strong lately, the company should be able to afford a strong hike this time around. Notably, this will be its 22nd consecutive annual dividend increase, pulling the company one step closer to becoming a Dividend Aristocrat — the elite group of stocks boasting 25 or more years of straight dividend hikes. Thus, I expect strong investor interest in the stock in the next few weeks as news covers the upcoming dividend hike.

To determine by what rate Lockheed Martin is going to increase the dividend this time, let’s examine its profitability prospects for this year. Starting off with its most recent Q2 results, the company posted strong revenues, which landed at $16.7 billion, up 8% year-over-year. As a reminder, Lockheed Martin is currently profiting from the ongoing tailwinds in its industry, which have been, in turn, contributing to the company’s weapons systems, attracting growing demand, and maintaining an attractive backlog.

By the term “tailwinds,” I am specifically alluding to the ongoing conflict in Ukraine. While the ongoing situation in Ukraine is undoubtedly tragic and regrettable, it has resulted in bolstering orders for Lockheed Martin’s array of weaponry, vehicles, and overall military equipment.

Notably, within the context of Western support for Ukraine, Lockheed Martin’s Javelin anti-tank missiles, PAC-3, and THAAD interceptor missiles have come to the fore. Counter-battery radars and guided rocket systems are also being sent to Ukraine.

In the meantime, the U.S. is said to soon begin familiarizing Ukrainian pilots to fly and maintain F-16 fighter jets which are manufactured by Lockheed Martin, joining other allies aiming to reinforce Ukraine’s air defenses. This could be another long-term tailwind for Lockheed, as U.S. allies will likely start gradually replacing these donated jets with more modern ones, also manufactured by Lockheed Martin.

It’s also important to underscore that the current geopolitical volatility encompasses the looming possibility of a crisis in Taiwan. In fact, as recently as the prior month, Congress authorized a substantial allocation of up to $1 billion in weapons aid for Taiwan through the Presidential Drawdown Authority. Therefore, you can see why Lockheed Martin is currently benefiting from massive industry tailwinds.

But back to the company’s results, following strong revenue growth, Lockheed Martin posted adjusted EPS of $6.73, up from $6.32 in the prior-year period. With industry tailwinds and vigorous momentum strengthening management’s confidence, LMT boosted its full-year outlook. Net sales are now projected to land between $66.25 and $66.75 billion (up from $65 to $66 billion previously), while adjusted EPS is expected to land between $27.00 and $27.20 (up from $26.60 to $26.90 previously).

With the midpoint of the management’s guidance at $27.10, Lockheed Martin maintains a forward payout ratio of just 44%. This leaves ample room for the board’s endorsement of a substantial dividend increase. By “substantial,” I am referring to a hike in the high-single digits. The preceding increase was by 7.1%.

Given the context of elevated inflation over the past year, an additional basis exists for the board to authorize a dividend boost at an attractive rate. Therefore, it is reasonable to anticipate that this year’s increase will at least match, if not surpass, last year’s hike.

Is LMT Stock a Buy, According to Analysts?

Regarding Wall Street’s view on the stock, Lockheed Martin maintains a Hold consensus rating based on two Buys, nine Holds, and two Sell ratings assigned in the past three months. At $494.62, the average Lockheed Martin stock forecast suggests 9.35% upside potential.

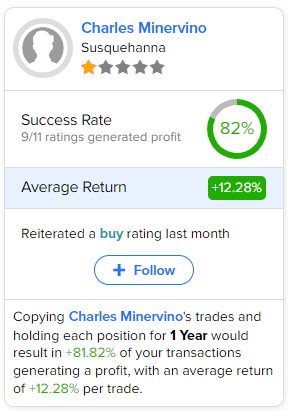

If you’re wondering which analyst you should follow if you want to buy and sell LMT stock, the most profitable analyst covering the stock (on a one-year timeframe) is Charles Minervino of Susquehanna, with an average return of 12.3% per rating and an 82% success rate. Click on the image below to learn more.

The Takeaway

In conclusion, Lockheed Martin’s forthcoming 22nd consecutive annual dividend increase holds the potential to rekindle investor enthusiasm for the stock. The company’s trajectory remains promising, as evidenced by its robust financial results and favorable industry tailwinds. In particular, the escalating demand for its weaponry and military systems, fueled by global geopolitical turmoil, positions Lockheed Martin favorably.

In the meantime, as the company marches toward Dividend Aristocrat status, its prudent payout ratio and historical trends suggest the likelihood of a substantial dividend hike, making LMT an appealing choice for investors seeking both strength in the current market environment and income growth.