If you’re invested in growth stocks, you’re likely dealing with a fair share of white-knuckle moments. The volatility around quarterly results over the past few weeks has caused some significant drops. Global supply chain issues and chip shortages are spooking the markets, and not even blue chip companies are immune.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In this environment, retail investors usually let emotions take hold and that is when mistakes happen. Case in point, Lockheed Martin Corp’s (LMT) share price plunged by ~12% on the day of earnings. It was one of the biggest single-day drops in company history.

See Lockheed Martin Stock Charts on TipRanks >>

Mixed Q3 Earnings

Despite the drop, I remain bullish on Lockheed Martin. It is the largest defense contractor in the world and has dominated the Western market for high-end aircraft since being awarded the F-35 program in 2001. Outside of Aeronautics, other segments include Rotary & Mission Systems, Missiles and Fire Control, and Space Systems.

In late October, Lockheed announced mixed Q3 results in which it topped earnings estimates, but revenue was lighter than expected. Earnings of $6.93 per share beat by $0.13 while revenue of $16.03 billion missed by $1.09 billion.

Outlook Disappoints

While mixed earnings were no doubt disappointing, it was the outlook that really spooked the markets. While fiscal 2021 diluted EPS of $27.17 came in above prior guidance of $26.7-$27.00, the company revised revenue to $67B from prior guidance of $67.3-$68.33B.

It wasn’t done there. The company also announced it would be reassessing its five-year business plan, considering “recent external and programmatic events.” If there is one thing the markets do not like in today’s environment, its uncertainty.

Chairman, President and CEO James Taiclet provided some clarity, saying, “Our conclusions…reflect continuing strong cash flow generation, but a slight reduction in revenue in 2022 and roughly flat to low-single-digit growth rates in both revenue and segment operating profit over the next few years, with increasing growth opportunities in the years that follow.”

Flat revenue and operating profit are not what investors have come to expect from Lockheed Martin. Especially when one considers the company has averaged 10% and 16.22% average annual revenue and EPS growth over the past five years.

Compounding the situation, Lockheed also announced that the close of the Aerojet Rocketdyne (AJRD) acquisition was being delayed until Q1 of fiscal 2022. This is a departure from the company’s previous announcement that the deal was expected to close by the end of Q4 of fiscal 2021.

All things considered, the quick correction was effectively the market re-setting company valuation in light of revised growth estimates.

A Strong Dividend Stock

Despite the rough quarter, Lockheed Martin remains a best-in-class aerospace & defense company. While the global supply chain and chip shortages are likely to be headwinds for the short-to-medium term, Lockheed is still poised to deliver strong cash flows and earnings.

Those are cash flows that will support a dividend that currently yields 3.92%. It marks only the third time in the past five years in which Lockheed yielded over 3%, and each time proved to be a buying opportunity.

Lockheed Martin is also a Dividend Contender, with a 19-year dividend growth streak. Over this period, the company has averaged high, single-digit dividend growth. Given the relatively low payout ratio of 59.05%, there is no reason the company won’t be able to extend that growth streak for years to come.

Lately, the market has been overreacting to disappointing guidance, which unfortunately has become the norm.

True, the global economy is on shaky ground, but this is but a temporary headwind. Eventually the situation will be resolved and stocks like Lockheed Martin, which were all but written off, are well positioned to benefit once headwinds subside.

Wall Street’s Take

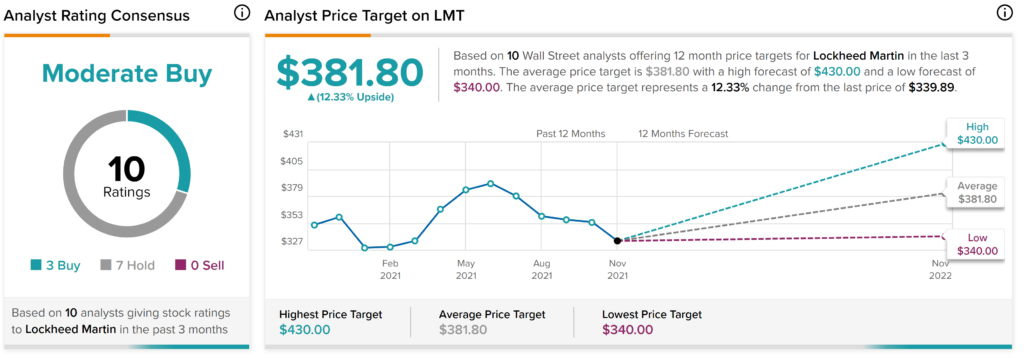

From Wall Street analysts, Lockheed Martin Corp earns a Moderate Buy analyst consensus, based on three Buy ratings, seven Hold ratings, and no Sell ratings.

The average Lockheed Martin price target of $381.80 puts the upside potential at 12.3%.

Disclosure: At the time of publication, Mat Litalien owned shares of Lockheed Martin (LMT).

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.