For more than a year now, the markets have been preoccupied by the Fed with the focus squarely on inflation’s trajectory and the central bank’s counter measures of rising interest rates.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

“With this in mind,” says Larry Adam, Chief Investment Officer at Raymond James, “it is understandable that the market is analyzing every development in these two dynamics within the framework of what it means for the Fed.”

However, with the spotlight turned solely on those factors, Adam thinks increasingly promising economic data is not being “warmly welcomed as it would have been in the past.” Consumer spending has stayed robust, and after a lull, mortgage applications are up, while the labor market remains strong. While the “good is bad” narrative applies here and could result in further rate hikes to cool down the activity and bring inflation down faster, Adam believes it is “important to assess economic data beyond the immediate impact to the Fed’s next decision.”

“In doing so,” Adam goes on to say, “long-term investors may conclude that the recent ‘good news’ is indeed ‘good news’ for the economy and markets, especially if the Fed does not ‘overtighten.’ We still expect only two more 0.25% increases (last in May) in this cycle.”

Going forward, Adam has forecast the S&P 500 to reach 4,400 by year’s end, a gain of 11% from current levels.

Against this backdrop, Adam’s analyst colleagues at Raymond James have pinpointed an opportunity in 3 stocks they consider right now as Strong Buys. We ran these tickers through the TipRanks database to see whether other market experts agree with these choices. Let’s check the results.

Frontier Communications (FYBR)

First up is a telecom company, Frontier Communications. This full-service telecom firm operates in 25 states, serving a total of 3.133 million customers. The company provides a wide range of telecom services, including local and long-distance telephone landlines, broadband internet, digital TV, and even computer tech support. Frontier is well-known for its presence in rural areas, where it is a major service provider, but it is also making inroads into more urban areas.

Over the past year, Frontier’s stock performance has been highly volatile – even as the company’s business performance has led to solid results. In the Q4 and full-year 2022 results, released last week, Frontier reported company records in operational results – for the quarter, Frontier added 76,000 fiber broadband customers, and extended its fiber service to 381,000 locations. For the full year, the company reported adding a net total of 250,000 new fiber broadband customers – again, a company record.

At the top line, the company had quarterly revenues of $1.44 billion, down 6% year-over-year yet beating the Street’s forecast while EPS of $0.63 came in well ahead of the $0.20 consensus estimate. For 2022 as a whole, revenues came to $5.78 billion, up 38% from 2021. The company’s annual net income, of $441 million, was up from $414 million in the prior year. At the bottom line, Frontier’s diluted EPS of $1.80 represented a 7% y/y increase.

Weighing in with the Raymond James view, following the print, analyst Frank Louthan saw fit to upgrade FYBR from an Outperform rating to a Strong Buy. Explaining his stance, the analyst wrote, “4Q22 saw a continuation of the inflection in fiber sub adds, a trend we expect to continue, and which should bode well for share price appreciation. We believe the EBITDA inflection has begun, and y/y growth will ensue into 2023, as the successful marketing ground game is driving higher penetration.”

To go along with his Strong Buy rating, Louthan also gives FYBR a price target of $37, implying a gain over the next year of ~34%. (To watch Louthan’s track record, click here)

Overall, this telecom company has picked up 5 recent analyst reviews from Wall Street, including 3 Buys and 2 Holds, for a Moderate Buy consensus rating. The shares are trading for $27.63, and the $32 average price target suggests ~16% one-year upside. (See FYBR stock forecast)

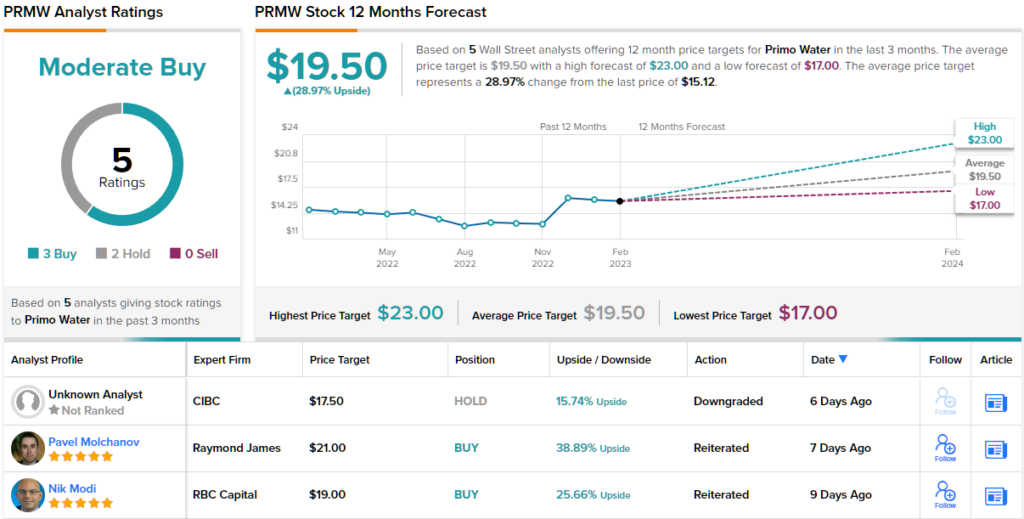

Primo Water Corporation (PRMW)

The second stock on our list, Primo Water, is a pure-play provider of solutions for fresh supplies of drinking water. The company specializes in large-format water deliveries – that is, bottles of 3 gallon capacity or greater – for water cooler dispensers at the customer’s location. Primo provides both the dispensers and bottles, and will deliver to both commercial and residential customers. The company generated some $2.2 billion in revenue last year, and $2.07 billion in 2021.

Primo operates in 21 countries, offering dispensers, bottles, refill services, and convenient delivery options. The company can also provide full customer support for its products. Water deliveries offer customers a range of advantages over standard urban and suburban water pipelines, including cleanliness, reduction in contaminants such as mercury, lead, or arsenic, and less waste from disposable plastic bottles.

During 2022 as a whole, Primo sold some 1 million dispenser units to customers and saw a 7% y/y increase in its top line revenue. The company’s Water Direct and Water Exchange services drove that gain, rising 17% y/y. At the bottom line, Primo saw an adjusted net income for 2022 of $108.2 million, or 67 cents per share. This marked a sharp annual increase from the 2021 figures of $91 million and 56 cents per share. Looking forward, Primo expects to see between $2.3 billion and $2.35 billion in revenue for 2023.

Pavel Molchanov follows this stock for Raymond James, and his most recent note is interesting. Molchanov doesn’t see anything spectacular here – but he does see a profitable company with a solid niche in a business with a firm foundation based on consumer needs. The 5-star analyst writes, “Primo’s multi-pronged sales strategy enables consumers and businesses to get high-quality drinking water at a lower price point than single-use plastic bottles, as well as avoiding the associated waste — hence the sustainability aspect of the story. The recurring revenue model is bolstered by tuck-in M&A that provides incremental uplift to estimates. While there are few operational catalysts, regulatory crackdowns on plastics in jurisdictions such as California and Canada should eventually lead to even higher demand.”

Long-term higher demand will justify the Strong Buy rating that Molchanov puts here, and his price target of $21 indicates his confidence in ~39% share appreciation over the coming year. (To watch Molchanov’s track record, click here)

The 4 recent analyst reviews on this stock show an even split, 2 to Buy and 2 to Hold, for a Moderate Buy consensus rating. PRMW shares are currently going for $15.12 and the average price target of $19.50 implies ~29% one-year upside potential. (See PRMW stock forecast)

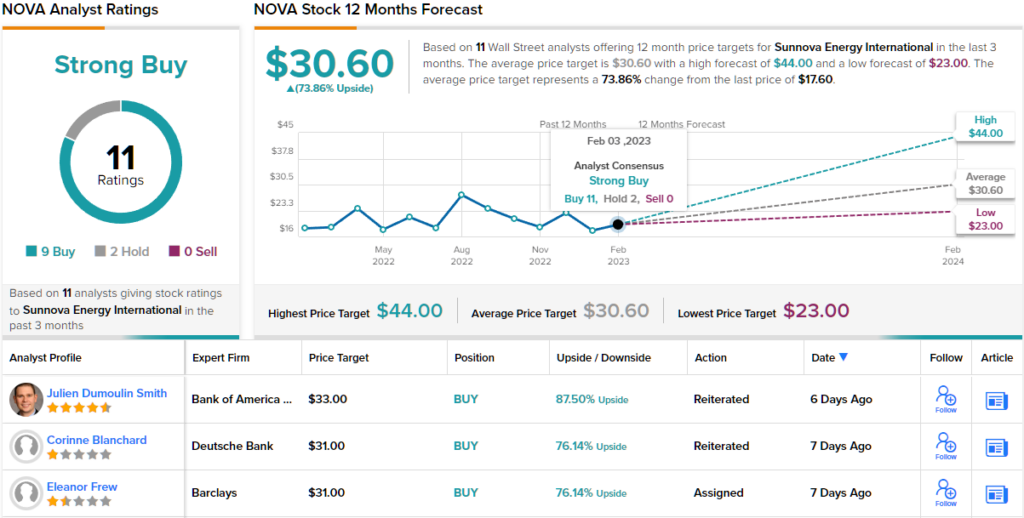

Sunnova Energy International (NOVA)

Last on our list, Sunnova Energy, a provider of residential solar power installations in the US markets. Sunnova operates at every phase of the home solar installation process, from installing rooftop panels to making the connections with the home power system to setting up storage batteries, and in addition provides repairs, modifications, and equipment replacement as needed to keep the installation in good running order and up to local code requirements. Customers can even finance their solar installation purchase with Sunnova, and purchase maintenance plans and insurance.

Sunnova operates in 40 US states and territories, where it serves more than 279,400 customers through a network of 1,116 dealers, sub-dealers, and builders. The company has been expanding its customer base in recent months, and boasted 33,000 new customers in 4Q22. For 2022 as a whole, the company had 87,000 new customers. Looking ahead, the company expects to add between 115,000 and 125,000 new customers in 2023.

The customer adds led to increased revenues last year. In Q4, Sunnova’s top line grew y/y by $130.6 million to reach $195.6 million. The full-year top line of $557.7 million was up by $315.9 million from 2021. The company attributed its gains to the increase in the number of solar installations it has in service, inventory sales to dealers and other customers, and its April 2021 acquisition of SunStreet.

Checking in again with Raymond James’ Pavel Molchanov, who says of Sunnova, “A more decentralized power grid, with rooftop solar playing a key role, carries economic advantages and also supports energy resilience, a facet of climate adaptation. Sunnova is one of the top-tier players in the residential segment of the U.S. PV market. Current penetration is only 4%. – compared to Germany in the mid-teens and Australia near 25% – and battery adoption is even earlier-stage. The long-term growth story needs to be balanced with the company’s reliance on vast amounts of external capital: securitizations and tax equity funds.”

The anticipated growth prospects merit a Strong Buy rating, and Molchanov’s $30 price target implies ~70% gain on the one-year horizon.

All in all, this solar player has attracted attention from no fewer than 11 Wall Street analysts, whose reviews break down to 9 Buy and 2 Holds – for a Strong Buy consensus rating. The shares have an average price target of $30.60, suggesting a potential one-year gain of ~74%. (See NOVA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.