Have the markets reached the exuberant stage? Bullish sentiment has been the order of the day for a while, and the S&P 500 currently sits at 4,455, reflecting year-to-date gains of 16%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

By now, the index has already surpassed the year-end target of 4,400 set by Raymond James’ chief investment officer, Larry Adam. This achievement serves as a bit of vindication for Adam. He went against the prevailing sentiment at the start of the year, which, if you recall, was decidedly bearish due to the downbeat environment of 2022. Despite that, Adam maintained a positive outlook. Now, as everyone jumps back on the bull bandwagon and relative strength indicators enter ‘overbought territory,’ Adam believes it’s time to play the contrarian once again.

“These technical indicators, combined with other Wall Street firms rushing to lift their year-end S&P 500 price targets in recent weeks, indicated that much of the good news had been priced in – suggesting the market had entered into a more vulnerable position, susceptible to disappointment,” he explained.

Don’t get too alarmed, though, because Adam’s caution is reserved purely for the near-term. “Longer term,” he goes on to say, “we remain optimistic and expect the S&P 500 will grind higher over the next twelve months to at least 4,600 as macro tailwinds (i.e., the Fed concludes its tightening cycle, declining interest rates, resilient margins, and record cash on the sidelines) provide a more supportive backdrop for equities.”

Meanwhile, Raymond James analysts have been busy pointing out to investors the stocks primed to push ahead over the coming year, and they have tagged two names they see as ‘Strong Buys.’ We ran these tickers through the TipRanks database to find out what the rest of Wall Street’s analyst corps think about them. Let’s check the details.

EngageSmart, Inc. (ESMT)

We’ll start with EngageSmart, a company specializing in providing customized customer engagement software and integrated payment solutions. With a customer base of over 3,000 enterprises and 108,000 health and wellness professionals, EngageSmart caters to various industries with tailored software-as-a-service (SaaS) solutions. Originally established as Invoice Cloud in 2009, the company underwent rebranding in 2020 and became EngageSmart. The firm’s primary focus lies in serving large and untapped markets that increasingly rely on software and payment technologies, particularly within non-cyclical sectors.

EngageSmart operates through two distinct segments: SMB Solutions, which offers comprehensive practice management solutions for the health and wellness industry, and Enterprise Solutions, which provides vertical engagement services for electronic bill payment and integrated payments across sectors such as government, utilities, financial services, healthcare, and charitable giving.

EngageSmart has been a public entity for less than 2 years, but throughout the period, revenue has consistently improved on a sequential basis. The most recent report, for 1Q23, was no different. Revenue climbed by 31.2% from the same period a year ago, to $88.4 million, while also improving on the $83.9 million generated in the prior quarter. Additionally, the figure came in $1.73 million above consensus. At the bottom-line, EPS of $0.02 met the analysts’ forecast. Total customers grew by 23% to reach 108,200 compared to 87,800 thousand as of the end of 1Q22.

EngageSmart’s prospects have attracted the attention of Raymond James analyst John Davis, who lays out a strong bull-case.

“We believe EngageSmart has a clear growth roadmap for several years, thanks to the convergence of software and payments within its core verticals,” Davis opined. “More importantly, the company has a significant first-mover advantage in both SMB and Enterprise, putting it in a position to continue to capture share from legacy players/processes. More importantly, we believe there is a convincing bull case given tailwinds in both SMB (pricing + new specialties) and Enterprise (bill pay 2.0) that could result in material upside to numbers (high 120s NRR + mid-teens new wins).”

These comments underpin Davis’ Strong Buy rating while his $25 price target makes room for 12-month returns of 35%. (To watch Davis’ track record, click here)

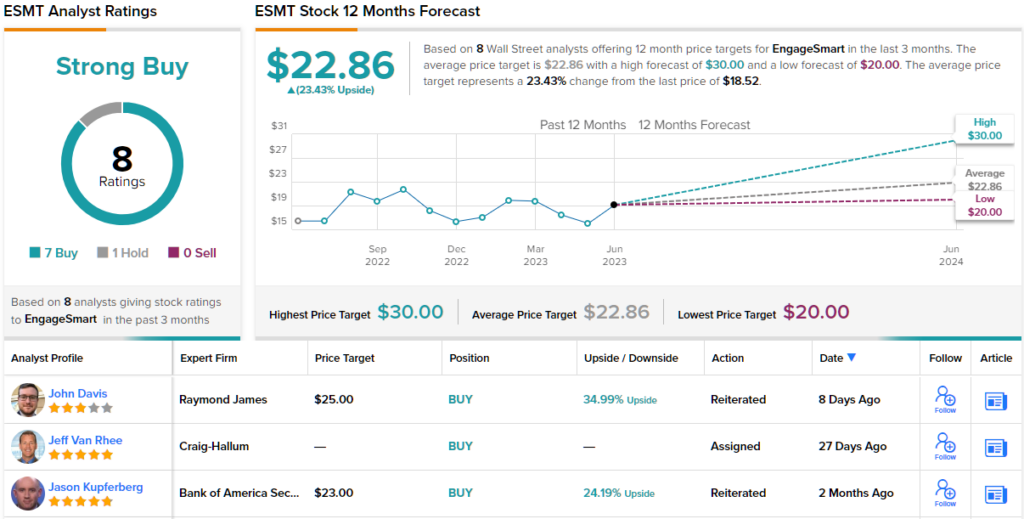

Let’s turn our attention now to the rest of the Street, where based on 7 Buys and 1 Hold, ESMT currently carries a Strong Buy consensus rating. With an average price target of $22.86, the analysts project a 23% upside over the coming months. (See ESMT stock forecast)

The Allstate Corporation (ALL)

Let’s now pivot from software to one of the largest publicly held personal lines insurers in the U.S. Allstate is a well-established and prominent insurance firm with a history dating back to 1931. Over the years, it has grown to become one of the country’s largest and most recognized insurers. Allstate offers a comprehensive range of insurance products and services, including auto, home, renters, life, and business insurance, catering to the diverse needs of individuals and businesses.

It is a substantial operation with 54,700 employees, a market cap of $29 billion, and revenues of $51 billion in 2022. Judging by the first-quarter performance this year, the company is on track to surpass that figure. The Q1 top-line revenue stood at $13.79 billion, representing an 11.8% year-over-year increase, which exceeded the consensus estimate by $110 million. However, the company did not fare as well on the other end of the spectrum; adj. EPS of -$1.30 fell some way short of the -$1.01 expected by the analysts.

The quarter’s performance reflects the company focusing in recent years on growth at the expense of profitability. Another recent focus has been on investing in technology and digital know-how to improve operations and cater to the changing demands of its clientele; the company has developed a range of digital tools and platforms.

This is a point picked up by Raymond James’ Charles Peters, who highlights the progress being made here. The 5-star analyst writes, “Allstate is at the forefront of and committed to the digital transformation of insurance. The company is pursuing a concept of an integrated digital enterprise. Within this context, Allstate highlights its QuickFoto claim app, where ~75% of the company’s drivable claims are being settled in one day. Allstate is also positioned to harvest meaningful pricing advantages and report significantly lower rates of accident frequency through the rollout of its Drivewise app.”

To this end, Peters rates Allstate shares a Strong Buy, while his $155 price target suggests upside of 40% in the year ahead. (To watch Peters’ track record, click here)

Elsewhere on the Street, the stock claims an additional 6 Buys, 5 Holds and 1 Sell, all coalescing to a Moderate Buy consensus rating. Going by the $131.08 average target, a year from now, investors will be sitting on returns of ~19%. (See Allstate stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.