The main piece of this week involved the debt ceiling deal reached by the White House and House Speaker Kevin McCarthy. The deal has passed the House and now awaits approval in the Senate for the US to avoid a default.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The chances of it passing are good, says Raymond James CIO Larry Adam, who is “generally optimistic about the passage of the deal,” while also noting that the “reduction in uncertainty will be a net positive for the equity market.”

In any case, Adam notes that through the whole debt ceiling talks, the S&P 500 has been “fairly resilient” with the index currently at the highest level since last August. Adam puts the lack of market panic down to the fact investors have gotten used to “brinkmanship and last-minute deals emanating from Washington.”

“More important,” Adam goes on to add, “as the drama hopefully fades, focus will turn to fundamental factors such as economic growth, inflation, the Federal Reserve and earnings. And the reality is, these factors are turning more positive for the equity market over the near to medium term.”

That’s obviously heartening news for investors. Meanwhile, against this backdrop, Raymond James analysts have been busy pointing out the names they see as Strong Buys in the current environment, recommending investors load up on what they believe are promising equities.

Zura Bio (ZURA)

The first stock we’ll look at is Zura Bio, a clinical-stage biopharmaceutical researcher and developer, focused on the field of immunology. The company is currently investigating a portfolio of three drug candidates, the leading candidate ZB-106, and two others, ZB-168 and torudokimab. These assets take different paths toward combatting auto-immune disorders, and Zura is moving each of them through the early stages of the clinical trial process.

In the clinic, ZB-106 (formerly known as tibulizumab) has completed Phase 1b studies in Rheumatoid Arthritis and Sjogren’s Syndrome and has broad potential as a treatment for autoimmune disorders; it is a tetravalent, bispecific antibody, and shows dual antagonist activity against both IL-17A and BAFF (B-cell activating factor). Zura holds an exclusive worldwide license for the further development and commercialization of ZB-106. The company intends to initiate a Phase 2 study of the drug in Systemic Sclerosis in 2024, followed by a study in Hidradenitis Suppurativa.

The company’s other drug candidates are torudokimab and ZB-168. Torudokimab, a fully human, high affinity monoclonal antibody, shows neutralization activity against IL33, a validated drug target in the treatment of asthma as well as chronic obstructive pulmonary disease (COPD). Torudokimab is not currently undergoing a clinical trial, but has been proven to be well tolerated in previous Phase 1 and 2 studies.

The last drug candidate, ZB-168, has passed early clinical studies, but does not have a trial ongoing. The drug is another fully human monoclonal antibody, and it acts against IL7Rα, with potent inhibition activity against both IL7 and TSLP pathways. The drug candidate has shown an impact on key T-cell subpopulations, and can potentially be used against multiple T-cell mediated conditions.

In March of this year, Zura took a crucial step to raise funds for its pipeline programs. The company announced the closing of its business combination with JATT Acquisition Corporation. The transaction was approved on March 16 by JATT’s shareholders, and the combined entity began trading on the NASDAQ under the ZURA ticker on March 21. Zura realized approximately $65 million in gross cash proceeds from the deal.

About one month later, at the end of April, Zura announced two developments. The first was its obtaining a license from Eli Lilly for the development of ZB-106, now its leading drug candidate. The second was an $80 million private placement financing transaction, providing capital for the ZB-106 program.

All of this has caught the eye of Raymond James analyst Steven Seedhouse who wrote: “Zura bio has assembled an impressive team (key members with history of success in I&I at Arena Pharmaceuticals) and impressive pipeline, led by ZB-106 (dual IL-17A/BAFF inhibitor) in SSc and HS. Our bottom-up fundamental analysis of each asset supports our constructive thesis, whereas a top-down valuation comp approach using competitor IL-17 mono-inhibitor drugs provides an even more striking relative valuation argument.”

Looking ahead, Seedhouse gives Zura a Strong Buy rating, along with a $20 price target that implies a robust 223% upside for the coming year. (To watch Seedhouse’s track record, click here)

Seedhouse’s is the only review currently on file for Zura, which is priced at $6.19 per share. (See ZURA stock forecast)

Alarm.com Holdings (ALRM)

As the quote roughly goes, a man’s home is his castle – but that castle still must have an effective defense. That’s where Alarm.com enters the frame. The company is a leader in the field of residential and commercial security technology, working through a wide-ranging network of vetted and authorized service providers to bring customers the best in connected security systems. The company has been in business for more than 20 years, and nowadays offers its products on the SaaS model; think Security-as-a-Service, by subscription.

Alarm’s products include packages for residential, small business, and commercial use; customers can choose the right features for their property, to get the protection they need. Features also include an operating system on the connected property, giving users remote access via an app. The company’s security control system even offers smart energy management and temperature control for the customer’s location.

Over the past year, Alarm’s quarterly revenues have consistently exceeded $200 million. The company brought in $209.7 million in 1Q23, the last reported, for a 2% year-over-year gain – and it came in $2.43 million ahead of the analysts’ expectations. At the bottom line, Alarm had an adj. EPS of 41 cents; this compared favorably to the 39-cent figure from the year-ago period and was 10 cents better than the forecasts.

In addition to its sound financial performance, Alarm also reported several important business highlights. These include a new software integration solution with the OpenEye platform; an expansion of its international product offering through the acquisition of Poland’s EBS smart communications; and an integration with Shooter Detection Systems, to provide indoor gunshot detections systems for commercial properties.

Covering this stock for Raymond James, analyst Adam Tindle thinks the company’s prospects are sound. He writes, “We see a congruent longer-term story as a SaaS provider for security-related use cases across commercial/international (recently acquired capabilities to integrate with legacy control panels)/video analytics, as well as ventures into IoT-enabled clean energy as wise investments. We see multiple levers for incremental value creation via more than $600M of cash, a solid foundational core in residential security, and a new organizational structure to accelerate new ventures.”

Backing his stance, Tindle gives ALRM a Strong Buy rating and a $65 price target, implying a 31% gain on the one-year horizon. (To watch Tindle’s track record, click here.)

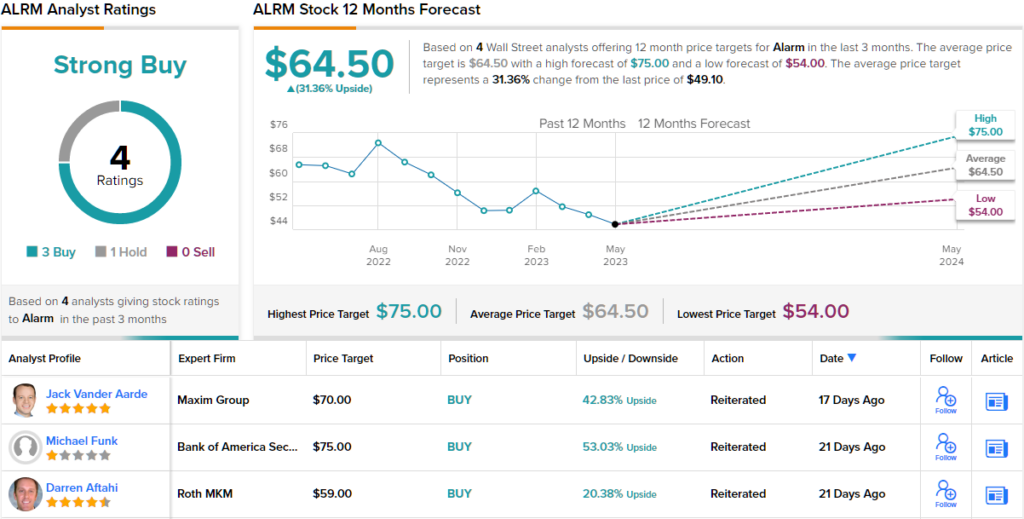

Alarm also gets a Strong Buy rating from the analyst consensus, based on 4 recent analyst reviews, including 3 Buys to 1 Hold. The stock is currently priced at $49.01, and the $64.50 average target suggests a potential upside of 31% for the next 12 months. (See ALRM stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.