On the heels of cooling inflation, the Federal Reserve announced Wednesday an increase in interest rates, as widely anticipated. The key rate has gone up by 25 basis points, bringing it to a range of 5% to 5.25%, which is the highest in 16 years.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While Fed Chair Jerome Powell indicated a pause to the rate hikes might be on the menu in June, the probability for any rate cuts seems unlikely for now, at least until inflation starts showing signs it really is on the backfoot.

Although this measure may alleviate inflation in the long run, it could slow down the economy in the short term. As a result, investors should consider repositioning their portfolios to protect against the negative consequences of a high-interest rate environment. At least that’s the opinion of Matt Orton, Chief Market Strategist at Raymond James.

“The biggest risk I’ve been talking about with clients regarding U.S. equities is the Fed, and it’s this disconnect that the market has between where it’s pricing rate cuts and where the Fed is likely to go… When you look at the trade and the technology so far this year, and particularly the mega-caps that contributed about 80% of the market gains to the S&P 500, a lot of that is predicated on rate cuts, so to me, it makes sense to be defensive,” Orton opined.

If we’re talking defensive, then dividend stocks are the place to be, especially ones offering high yields. Raymond James analyst James Weston has gotten the game started here, having pinpointed an opportunity in two such names, including one with 8% yield.

We ran the pair through the TipRanks database to get a fuller picture as to their prospects. Here are the details.

Hess Midstream Partners (HESM)

We’ll start with Hess Midstream, an energy company that came into its own in 2017 as a spin-off from Hess Oil, to take over the parent firm’s pipeline operations. Hess Midstream now owns and operates a profitable network of transport assets for hydrocarbon-industry liquids in the Williston Basin on the Montana-Dakota border. Specifically, the company’s network moves oil, gas, and produced water in the Bakken and Three Forks shale plays.

Sprawling across three US states and Canada’s Saskatchewan province, the Williston Basin became famous in the last decade as one of North America’s richest oil and gas production basins. Hess is an important player in this geographical area; last year, the firm reached a total net processing capacity of 500 million cubic feet per day (MMcf/d). Hess’s assets include facilities for oil and gas gathering, gas plants, and transportation terminals.

The midstream sector moves crude oil and natural gas from the well heads to the storage farms and refineries, and Hess is consistently profitable at this activity. In the recently reported Q1 statement, Hess delivered net income attributable to partners of $20.7 million, or 47 cents per share, although that EPS figure was 2 cents lower than the year-ago quarter and missed Street expectations.

The revenue haul reached $305 million, while down 2.4% year-over-year, it marked the seventh consecutive quarter of $300 million-plus revenue. On a negative note, the revenue number missed the forecast by $7.5 million.

Looking at cash flow, Hess generated $198.7 million in net cash from operations, a number that should interest dividend investors as it supports the distribution payments. Hess, in its April 26 Q1 release, declared a quarterly cash dividend of 58.51 cents per common share, bumping the payment up 2.7% from the previous quarter. At the current rate, the dividend annualizes to $2.34 per common share, and gives a strong yield of 8.11%.

This stock has caught the eye of Raymond James’ James Weston, who believes the shares’ current price offers a good entry point. He writes of HESM, “Through the help of private equity, Hess Midstream was spun-out of Hess Corporation several years ago. Since then, its uniquely midstream-friendly contracting has protected the company from energy sector volatility and allowed for modest growth and maturation. With the HES Bakken development plan reaching an inflection point, HESM possesses a differentiated combination of operating leverage and contractual downside support in 2023+.”

“Given its defensive characteristics and other favorable attributes, in the context of ‘quality’ midstream names historically trading at ~10x forward EV/EBITDA, one could make a solid case that HESM is under-valued,” Weston further said.

Looking forward, Weston quantifies his stance with an Outperform (i.e. Buy) rating, and a $35 price target that suggests a 23% upside on the one-year time horizon. Based on the current dividend yield and the expected price appreciation, the stock has ~31% potential total return profile. (To watch Weston’s track record, click here)

Overall, the 5 recent analyst reviews of HESM shares include 4 to Buy against a single Hold, giving the stock its Strong Buy consensus rating. The stock is priced at $28.42, and the $34.80 average price target implies ~22% potential gain for the next 12 months. (See HESM stock forecast)

DT Midstream (DTM)

The second stock we’re looking at, DTM, is another spin-off, this time from a utility company. DTE Energy is a major gas and electric supplier in Michigan, and DT Midstream was spun off from the parent in the summer of 2021 to manage DTE’s natural gas gathering and transport activities.

From its headquarters in Detroit, DT Midstream controls a number of main assets, including 900 miles of interstate pipelines, 290 miles of lateral pipelines, 94 Bcf of natural gas storage facilities, and more than 1000 miles of gathering pipelines, located in some of the best dry gas production regions in the US.

In addition to the transport pipelines and storage facilities, DTM operates facilities for the compression and treatment of natural gas. The company delivers clean gas to large-scale customers across the Mid-West, Mid-Atlantic, and Texas; its customers include power plants, gas and electric utilities, energy marketers, and large industrial plants.

Since spinning off as an independent entity, DTM has been consistently profitable, as was the case in the recently released Q1 numbers. The company delivered adj. EPS of $0.84, although the figure fell short of consensus expectations for $0.93. There was better luck with the adjusted EBITDA figure; at $225 million, it just edged ahead of the $224 million forecast.

On the dividend front, the company bumped up its regular stock dividend during the first quarter, with an 8% increase in the payment, to 69 cents per common share. The dividend went out to shareholders on April 15. At its current rate, the payment annualizes to $2.76 and gives an inflation-beating yield of 6.07%.

Checking in again with Raymond James’ Weston, we find him thinking DTM’s low share price is unmerited and presents investors with an opportunity.

“DT Midstream is well positioned as a natural gas logistics pure-play, with more demand-pull integration than most peers (LEAP, NEXUS, etc.),” Weston explained. “Despite this, it is one of the worst performers YTD (down ~18%) and now trades at a slight discount to C-Corp. peers at a sub-8x 2024 EV/EBITDA – compared to a modest premium over its short history. We believe perceived consequences of lower natgas prices are overblown and like this entry point for one of the better quality midstream companies we cover – lower relative leverage, strong contracting, FCF set to inflect in 2024+, and additional commercial opportunities developing.”

Accordingly, Weston rates DTM shares as Outperform (i.e. Buy) with a $55 target price indicating room for 21% share growth in the year ahead.

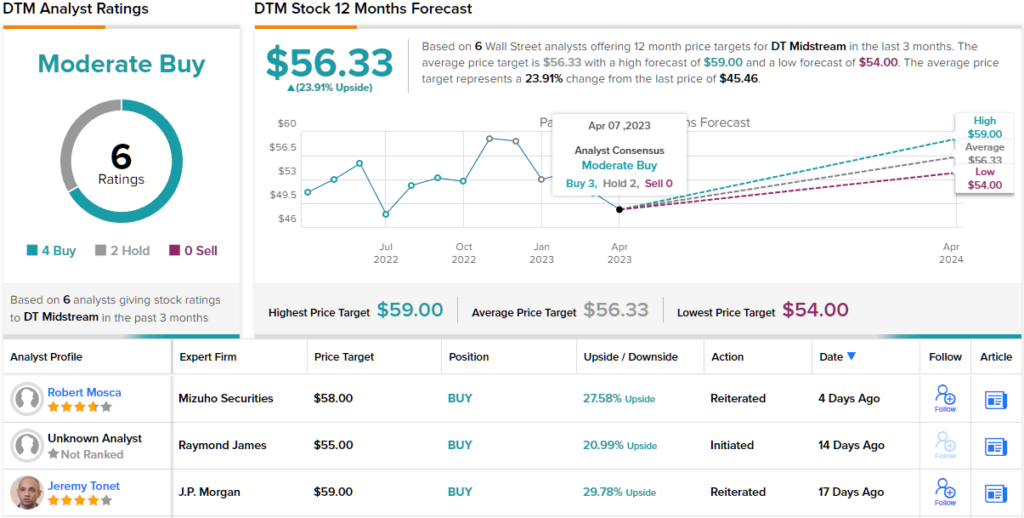

This stock gets a Moderate Buy consensus rating from the Street’s analysts, with the 6 recent reviews including 4 to Buy and 2 to Hold. The shares have a current trading price of $45.46 and a $56.33 average price target, suggesting ~24% one-year upside potential. (See DTM stock forecast)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.