In the year of AI, you could say Nvidia (NASDAQ:NVDA) has been the poster boy for its success. Demand for the semi giant’s AI chips has soared and backed with estimate trouncing beat-and-raises, so has the share price; to wit, NVDA shares are up by 194% year-to-date.

That figure would have been even higher if a recent pullback had not taken place. The stock has retreated by 13% from its recent highs as concerns around continued data center spending have emerged.

Most recently, investors have been worried about reports that Microsoft intends to cut back spend and thus lower its orders for Nvidia’s H100 AI chips. That has added further fuel to the fire as Nvidia’s financial filings displayed an oversized exposure to a lone cloud customer – most probably Microsoft – in the latest quarter, while Microsoft has also commented they are at ease with their Nvidia hardware availability.

However, these concerns are overblown, says Morgan Stanley analyst Joseph Moore, and have now created “another buying opportunity for NVDA stock.”

“We can’t speak to specific budgets for next year for any one customer,” the 5-star analyst said. “But our checks show demand well above supply for H100 in several regions with several customers. Supply chain reports have Microsoft pushing for more product than they are currently getting, at least tactically, so we are very comfortable there isn’t a near term air pocket with that customer.”

That issue aside, Moore also thinks the stock’s pullback is down to “multiple compression” seen across tech growth names, and that creates an all-together, less stock-specific issue. However, given the strength of Nivida’s earnings and its recent weakness, Moore makes the case it trades “at a discount to other AI centric names.”

“The bottom line is that numbers are likely to continue to be strong,” Moore summed up, “and to the extent that investors are concerned about near term demand that’s a good thing, as it is a negative thesis that the company can quickly disprove.”

Thus, Nvidia remains Moore’s “top pick in semis,” worthy of an Overweight (i.e. Buy) rating and $630 price target. The figure suggests shares will gain another 50% over the next year. (To watch Moore’s track record, click here)

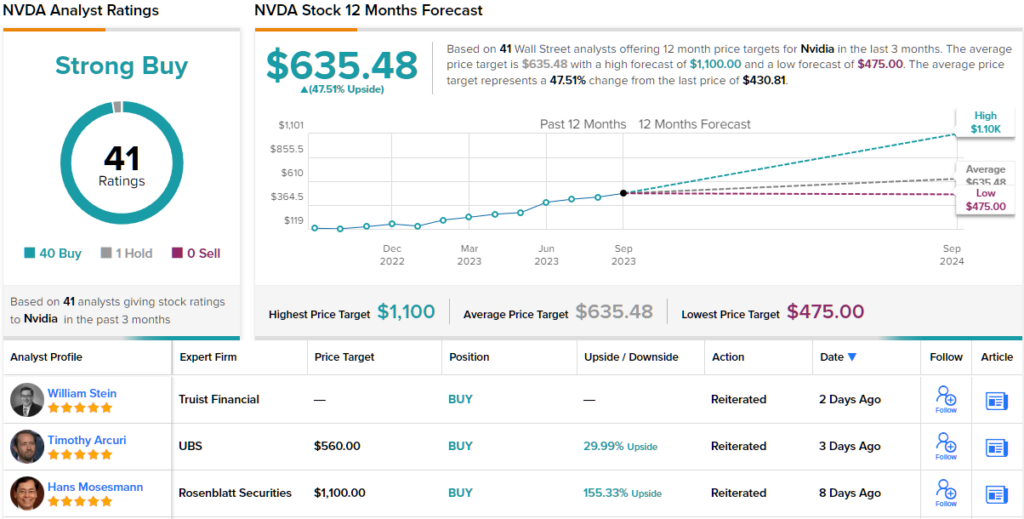

Looking at the consensus breakdown, one analyst remains on the sidelines for now, but all 40 other recent analyst reviews are positive, naturally making the consensus rating a Strong Buy. The average target is even slightly higher than Moore’s objective; at $635.48, it makes room for 12-month returns of 52%. (See Nvidia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.