The second half of the year is now well underway and comes off the back of a surprisingly strong first 6 months for the stock market. The first part was defined by a banking meltdown followed by a debt ceiling crisis that was narrowly averted. All the while, talk of an imminent recession buzzed in the background.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Yet, despite these concerns, the markets rallied. As inflation continued to show signs of being on the backfoot, many economic experts began touting the idea that if a recession does come into play, it will be a relatively tame one.

Although August has experienced some market weakness, if history is anything to go by, J.P. Morgan’s U.S. Head of Investment Strategy Jacob Manoukian thinks that the rest of the year looks highly promising.

“A strong first half of the year typically begets a strong second half,” Manoukian recently said. “Since 1950, when the S&P 500 has been up over 10% in the first half of the year, the median gain for the index in the second half of the year has been another 10%. Second-half returns after a strong first half have been even better when the prior year was negative.”

So, with that positive outlook in tow, the question is, which equities should investors be loading up on at present? The JPMorgan analysts have been busy seeking out those names and have homed in on two they think make good additions to a portfolio in this environment. And they are not alone, according to TipRanks’ database, both are also rated as ‘Strong Buy’s by the analyst consensus. Let’s see why they are drawing plaudits across the board.

Procore Technologies (PCOR)

It’s no secret, the year’s rally has been driven by the tech sector, and that’s where our first JPMorgan-backed name resides. Procore Technologies is a software company with a unique selling point. It focuses on the construction industry, offering construction management software that revolutionizes the way construction professionals collaborate, communicate, and manage projects.

Procore’s comprehensive platform offers a wide range of tools and features, including project management, document control, financial management, quality and safety management, and resource planning, all integrated into a single cloud-based solution.

The construction industry is a latecomer to the digital revolution and ripe for disruption. Procore has taken advantage of this and has increased its revenue consistently over the past few years. That was the case again in the recently reported Q2 print.

The company generated revenue of $228.5 million, representing a 32.7% year-over-year uptick and beating the forecast by $10.52 million. Adj. EPS of $0.02 came in well above the -$0.09 expected by the analysts. As for the outlook, Q3 revenue is expected to hit the range between $232 million and $234 million, above consensus at $231.79 million, amounting to a y/y increase between 24% to 26%.

JPMorgan analyst Alexei Gogolev thinks there is plenty to admire here. He writes, “We continue to like Procore as it falls into a cohort within our vertical software coverage, which is able to stay relatively insulated from weaknesses in the underlying market they serve… Procore is well-positioned because it is automating among the least digitalized industries in the global economy. On the periphery, opportunities — such as emphasizing payments and insurance solutions — are set to offer competitive services which are to become additional products to cross-sell and up-sell to clients…”

“With nearly c.50% of sales spent on Sales and Marketing, Procore remains vehement that there is more market to seize and hence appears disinterested from turning EBIT positive in the near term,” Gogolev further said.

These comments underpin Gogolev’s Overweight (i.e. Buy) rating while his $85 price target implies one-year share appreciation of 27%. (To watch Gogolev’s track record, click here)

Overall, the Strong Buy consensus rating shows that Wall Street generally agrees with the JPMorgan take here. PCOR has 12 analyst reviews on file, including 11 Buys and 1 Hold. At $82.45, the average suggests shares will climb 23% higher over the coming months. (See PCOR stock forecast)

Scorpio Tankers (STNG)

Let’s now turn from construction software to the marine transportation business. Scorpio Tankers is a leading shipping company that specializes in transporting refined petroleum products and bulk commodities. The Monaco-based firm is a significant player in the global shipping industry with a fleet comprising modern vessels, including eco-friendly carriers designed to meet environmental standards. The company serves a clientele mix of oil majors, traders, and government entities across the globe, and through strategic fleet expansion and technological advancements, has managed to stay competitive and offer reliable shipping solutions.

Volatility is a hallmark of the global oil shipping industry, with frequent rate and revenue fluctuations due to shifts in oil supply and demand, geopolitical events, and economic circumstances. These issues affected the performance of the company in Q2.

Revenue fell by 18.7% year-over-year to $329 million, at the same time missing the consensus estimate by $14.83 million. And while the company has shown the ability to navigate a complex landscape and generate profits, adj. EPS of $2.41 fell shy of Street expectations by $0.08.

However, despite the misses, investors reacted positively to the results. This is not much of a surprise to JPMorgan analyst Sam Bland, who, going by management’s commentary, thinks the outlook appears favorable to Scorpio.

“Seasonally August is typically a weak month. However, we note signals that rates are beginning to improve, with STNG now indicating the LR2 rates are above $40,000 / day, and MRs above $30,000. To some extent, this improvement seems to be sentiment-driven, around improved macro outlook views, as opposed to any actual demand / supply improvement,” Bland explained. “These rates compare to an average booked in Q3 to date of $27,000. While it may not be linear, we expect a general upwards movement in rates over the coming months, driven by seasonality and expected increases in demand. Supply / demand appears likely to improve further in 2024, and possibly also in 2025.”

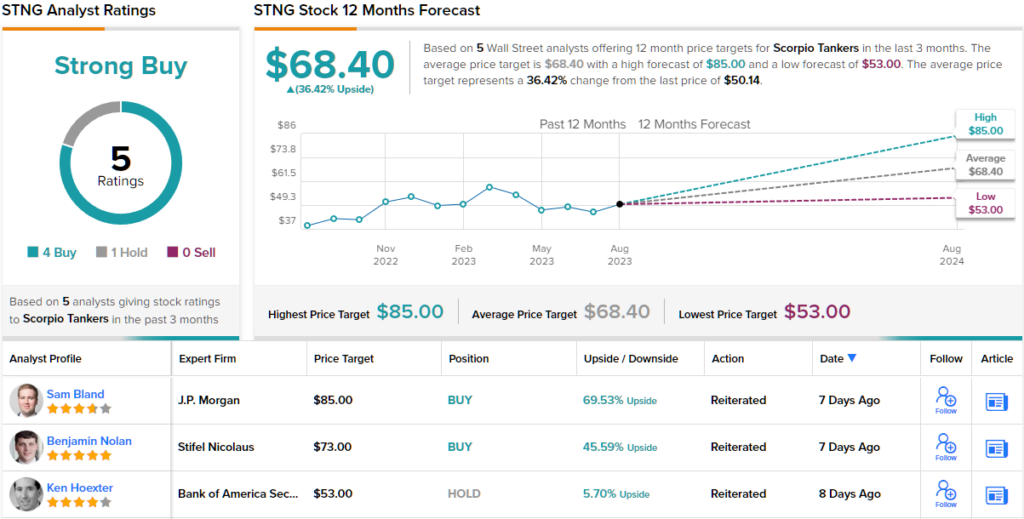

Accordingly, Bland has an Overweight (i.e., Buy) rating on Scorpio Tankers shares to go alongside an $85 price target. The implication for investors? Upside of 69% from current levels. (To watch Bland’s track record, click here)

Overall, 3 other analysts join Bland in the bull camp and the addition of one fencesitter can’t detract from a Strong Buy consensus rating. The forecast calls for 12-month returns of 36%, considering the average target stands at $68.40. (See STNG stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.