Riding the wave of positive economic developments in 2023, investors have significantly increased their exposure to the stock market this year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The evidence is in the data, as pointed out by Goldman Sachs’ Chief US Equity Strategist, David Kostin. The investment firm’s US Equity Sentiment Indicator rebounded from -1.8 in December to +1.5 in July. However, during August, the bears have been trying to regain a foothold, and over the past week, that metric has fallen to +0.8.

Now, Kostin says that a common question asked by investors is whether the current “level of equity length will limit upside for stocks.”

And here, Kostin has a reassuring answer for those worried about what’s coming next. “We find that US investors have room to further increase their exposure to equities,” he said. “Should the US economy continue on its path to a soft landing, we believe the recent decrease in equity length will be short-lived.”

Running with this positive sentiment, the analysts at Goldman have pinpointed two names that they see as poised to deliver the goods as the stock market regains momentum. We ran this pair of Goldman-recommended names through the TipRanks database to find out what the rest of the Street has to say about them. It turns out that both are rated as Strong Buys by the analyst consensus. Let’s find out why.

Revance Therapeutics (RVNC)

The first Goldman Sachs-backed company we’ll look at is Revance Therapeutics, a biotech company that specializes in developing innovative treatments for various medical and aesthetic conditions.

Revance has been making strides in the aesthetic drug market, a segment that pharmaceutical colossus Abbvie has dominated for the last couple of decades with its anti-wrinkle treatment Botox. And it appears that Revance is ready for the challenge.

Achieving the ultimate goal every biotech company aims for, last September, the FDA gave the green light for its neuromuscular blocker Daxxify, approving the therapy for injection to temporarily improve moderate to severe frown lines. The approval was followed by the launch of Daxxify. In Q2, the treatment generated revenue of $22.6 million, marking a sequential increase of 47.1% over Q1 – the period when Daxxify was introduced to the market.

More recently, the FDA granted a label expansion for the product. Earlier this month, based on the positive results from the Phase 3 ASPEN study, the FDA approved Daxxify for the treatment of Cervical Dystonia, a condition characterized by involuntary contractions of neck muscles. This marked Daxxify’s first approval for a therapeutic indication.

This potential across various applications is the bedrock of Goldman analyst Chris Shibutani’s bullish thesis for Revance.

“We remain constructive on the outlook for Daxxify’s commercial opportunity in therapeutic indications as we believe a longer-lasting neurotoxin could be of interest for many patients, particularly for those who regularly seek symptom relief with neurotoxins but see loss of treatment effect before 12 weeks (Botox’s label recommends to not dose more than once every 3 months)… We model ~$140mn in peak sales and market penetration of ~25% for the indication,” the 5-star analyst noted.

These comments underpin Shibutani’s Buy rating, while his $38 price target implies shares will deliver returns of ~121% in the year ahead. (To watch Shibutani’s track record, click here)

Overall, 8 analysts have recently waded in with RVNC reviews and they break down into 6 Buys and 2 Holds, all coalescing to a Strong Buy consensus rating. It’s not as if Shibutani’s optimistic outlook stands out here; going by the $36.13 average target, the shares will see upside of ~110% over the coming months. (See RVNC stock forecast)

Monday.com (MNDY)

The next stock on Goldman Sachs’ radar is Monday.com, a company that offers an intuitive work operating system that streamlines collaboration and project management. Founded in 2012, the platform offers a visual workspace where users can create, manage, and track various tasks, projects, and workflows. Monday.com’s strength lies in the platform’s customizable nature, allowing teams to design their own unique work structures using visual boards, columns, and automation.

The platform’s user-friendly interface and adaptable framework make it suitable for a wide range of projects, from simple to complex, enabling teams to align their efforts, minimize miscommunication, and ultimately achieve goals more efficiently.

And customers appear to be increasingly taking the platform to heart with MNDY’s recent Q2 report boasting beats both on the top-and bottom-line. Revenue climbed by 42% year-over-year to $175.7 million, while beating the Street’s call by $6.41 million. At the other end of the scale, adj. EPS of $0.41 came in $0.20 ahead of the forecast.

Elsewhere in the print, the net dollar retention rate exceeded 110% while the number of paid customers with ARR (annual recurring revenue) over $50,000 saw a 63% y/y uptick to 1,892.

Even better, MNDY came good on its outlook, too. The company now sees full-year revenue hitting the range between $713 million and $717 million, up from the prior $688 million to $693 million range.

The Street liked the results, sending shares up in the aftermath, and so did Goldman Sachs analyst Kash Rangan.

“Recent results support our thesis that Monday.com is a unique work operating system product cutting across operational silos built on low-code no-code platform,” the analyst said. “The low-code no-code technology, intuitive interface, robust integrations and network effects of the platform continues to drive customer growth. Given enterprise customers are <1% penetrated into the current installed base, we believe the company’s continued momentum in enterprise adoption can potentially, 1) provide upside to our estimates, 2) improve unit economics, and 3) will drive long-term growth.”

“We see Monday.com reaching $2bn+ in revenue, a scale similar to Atlassian’s Cloud business. Given this commands the majority of TEAM’s ~$50bn market value, we see upside to MNDY,” Rangan summed up.

It’s no surprise, then, that Rangan rates MNDY a Buy, which is backed by a $250 price target. The implication for investors? Potential upside of ~51% from current levels. (To watch Rangan’s track record, click here)

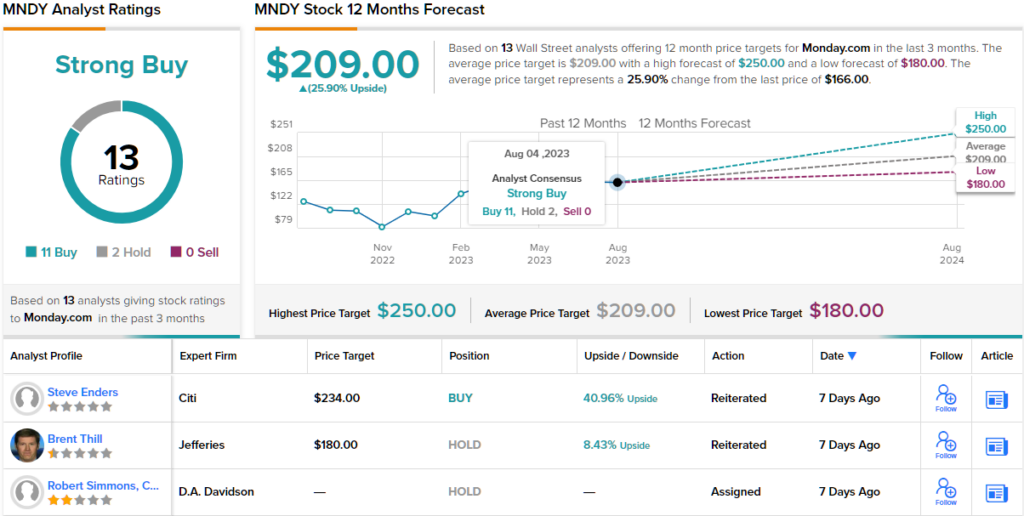

Overall, this work management software company gets plenty of support on Wall Street. With 11 Buys and 2 Holds, the word on the Street is that MNDY is a Strong Buy. The $209 average price target puts the upside potential at ~26%. (See MNDY stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.