Microsoft (NASDAQ:MSFT) has just started taking its Envision conference on a world tour. Stopping off in various global locations over the next few months, at the in-person event, the tech giant is showing organizations the different ways it can apply AI to their day-to-day operations and make the most of the opportunities presented by the game-changing tech.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

After attending the maiden New York event, Goldman Sachs analyst Kash Rangan came away impressed with what Microsoft has to offer and all that’s in the pipeline.

“We leave increasingly confident that Microsoft is making progress on its rich product roadmap, with Microsoft 365 Copilot (the AI assistant feature for Microsoft 365 applications) and Fabric (an analytics solution) expected to go live by the end of year,” said the 5-star analyst. “Our conversations suggested a healthy demand pipeline, with thousands of customers on the waitlist for M365 Copilot (despite a beta of ~600 customers), and the rollout of Fabric’s private beta to 22K customers (the largest preview for the company).”

Microsoft is witnessing a 35% increase in developer productivity with the implementation of GitHub Copilot among its developer base, and it anticipates $100 million in cost savings through enhanced efficiency via the use of Azure AI Studio. These have instilled in Rangan greater confidence that its backlog can “convert to paying users” as companies are naturally keen on solutions that promise high returns on investment and swift time-to-value. Microsoft’s ability to bring these features to the market quickly leads Rangan to anticipate a surge in adoption once they become available in early CY24. Although Microsoft intends to monetize most of these services individually, Rangan emphasizes that Sales Copilot and other AI-driven services oriented towards customer relationship management (CRM) are likely to experience widespread customer adoption before Microsoft capitalizes on additional revenue opportunities.

With Rangan seeing the TAM (total addressable market) of Generative AI at “well over” $135 billion and representing a revenue opportunity that can eclipse $10 billion, he recognizes Microsoft as “one of the most compelling investment opportunities in the technology industry and across sectors.”

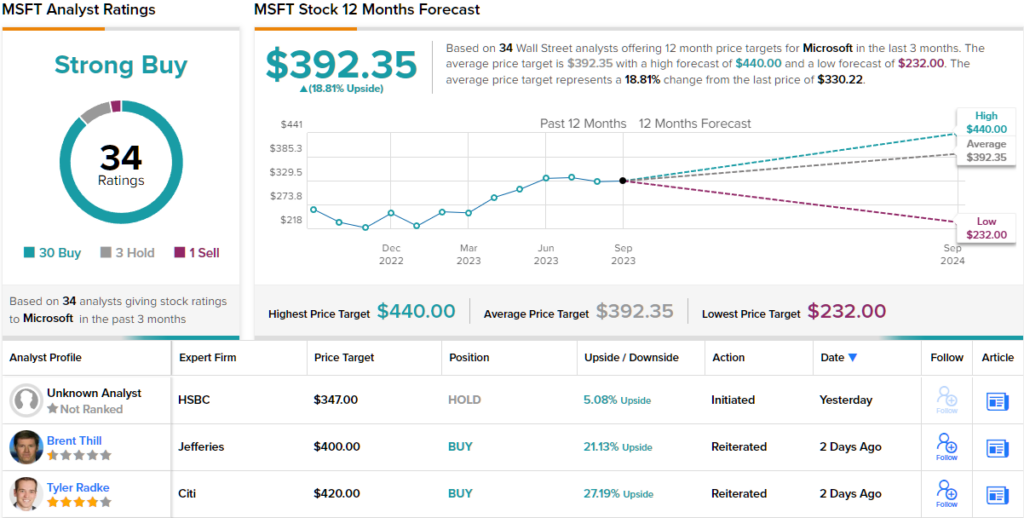

It’s hardly surprising to learn, then, that Rangan rates MSFT shares a Buy alongside a $400 price target. The implication for investors? Upside of 19% from current levels. (To watch Rangan’s track record, click here)

Overall, of the 34 analyst reviews submitted during the past 3 months, 30 are positive on MSFT, 3 remain on the sidelines while only one takes a bearish stance, the result of which is a Strong Buy consensus rating. The average target currently stands at $392.35, offering returns of ~19% for the coming year. (See Microsoft stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.