Cheniere Energy (LNG) and Schlumberger (SLB) are two energy giants strategically positioned to capitalize on the surging global demand for liquefied natural gas (LNG) and the robust drilling activity in the prolific Permian Basin.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to the International Energy Agency, global LNG supply capacity is expected to rise to 666.5 MTPA (million tonnes per annum) by 2028, highlighting the importance of companies like Cheniere in meeting this demand. Meanwhile, Schlumberger’s innovative technologies and strategic partnerships are driving growth in the oilfield services sector, particularly in the Permian Basin. For these reasons, I am bullish on both Cheniere Energy and Schlumberger.

Cheniere’s strong market position and ongoing expansion projects make it look like a solid investment, while Schlumberger’s innovative technologies and strategic acquisitions position it well to capitalize on the growing Energy sector.

Let’s dive into why these companies are worthy of consideration.

Cheniere Energy (NYSE:LNG)

Cheniere Energy is a major player in the liquefied natural gas (LNG) industry. It focuses on developing, constructing, and operating LNG terminals and related infrastructure in the United States. As the largest LNG exporter in the United States, Cheniere is well-positioned to capitalize on the growing global demand for natural gas.

The company’s stock has shown resilience, hitting an all-time high just a few days ago.

With a market cap of $40.5 billion, Cheniere Energy is trading at a forward P/E ratio of 19x, which is higher than the sector median of 11.80x. Given Cheniere’s dominant role in U.S. LNG exports and its robust cash flow generation, this valuation can be justified by the company’s long-term growth potential and strategic importance in the global energy landscape

Despite a 42% decline in revenues compared to Q1 2023, the company reported $4.3 billion in revenues and $502 million in net income. It also has a solid liquidity position, with over $12 billion available. This gives the company plenty of room for expansion and debt management.

Now, Cheniere isn’t just sitting on this cash. The company rewards shareholders with a quarterly dividend of $0.43 per share and has boosted its share repurchase program by $4 billion through 2027. That’s a decisive vote of confidence from management.

Looking ahead, Cheniere remains confident in achieving its full-year 2024 financial guidance, with projected consolidated adjusted EBITDA between $5.5 billion and $6.0 billion and distributable cash flow between $2.9 billion and $3.4 billion.

Global gas demand is projected to surge by over 50% by 2040, mainly driven by Asia’s increasing LNG appetite. With projects like the expansion of Sabine Pass and the Corpus Christi Stage 3 expansion (62% complete as of May 2024), Cheniere is gearing up to meet this demand.

Interestingly, the growing power demands of data centers also contribute to the increase in LNG demand. As data centers consume more electricity, the need for reliable, lower-carbon power generation sources like natural gas grows. U.S. data centers are expected to triple their electricity consumption by 2030, and Cheniere’s LNG exports could play a crucial role in meeting this demand.

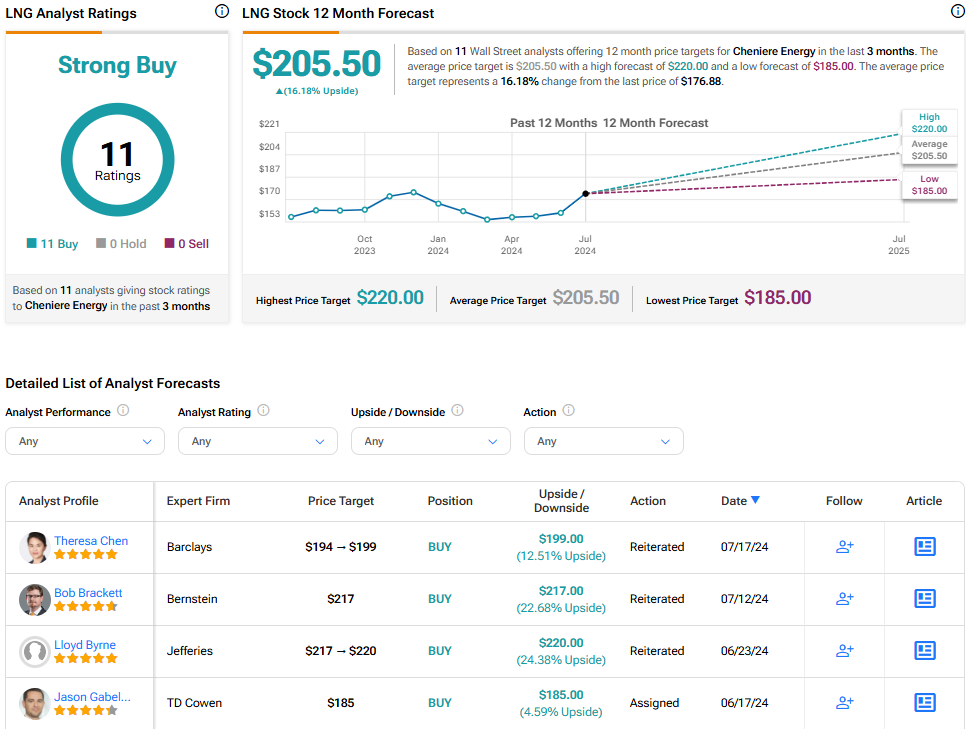

Is Cheniere Energy Stock a Buy, According to Analysts?

According to the latest analyst ratings, Cheniere Energy stock has a Strong Buy rating with 11 unanimous Buy ratings. The average LNG stock price target of $205.50 implies upside potential of around 16.2%.

Schlumberger (NYSE:SLB)

Schlumberger Limited is a global leader in oilfield services, providing innovative energy industry solutions. It focuses on reservoir characterization, drilling, production, and digital technologies. With the Permian Basin experiencing a surge in production, Schlumberger is well-positioned to leverage this growth.

While SLB stock has seen a slight year-to-date decline of approximately 4%, its operational performance tells a different story.

In Q1 2024, the company reported total revenue of $8.71 billion, up 13% year-over-year. This growth was largely driven by international markets, which saw an impressive 18% increase, while North America experienced a 6% decline. However, that’s not stopping SLB from being bullish on the Permian Basin.

Production from this basin is set to hit a record 6.4 million barrels per day by the end of 2024, up from 6.1 million barrels per day at the end of 2023. This growth is largely due to increased drilling efficiencies and the stable number of rigs operating in the region.

The company’s CEO, Olivier Le Peuch, highlighted that the oil and gas industry is benefiting from strong market fundamentals and a growing demand outlook. This is driving a solid baseline of activity, especially in international and offshore markets – right where SLB shines.

Looking at SLB’s valuation, it’s trading at a forward P/E ratio of 14.2x, slightly above the sector median of 12.18x. While this might suggest a premium valuation, it’s vital to consider Schlumberger’s industry-leading position and potential for growth in the recovering oil services industry. The company’s strong market presence and technological edge justify this valuation. Additionally, SLB offers a dividend yield of 2.26%, with a quarterly dividend of $0.275 per share, reflecting a commitment to returning value to shareholders.

Looking ahead, SLB remains optimistic about its growth prospects, both in the Permian and globally. The company stuck to its 2024 financial guidance, which shows that it’s confident in the current cycle’s strength and longevity.

A significant catalyst for SLB is the planned acquisition of ChampionX, valued at approximately $7.8 billion. This acquisition is expected to enhance SLB’s production and intervention solutions portfolio, particularly in the artificial lift domain, and generate $400 million in annual pretax savings within three years post-closing.

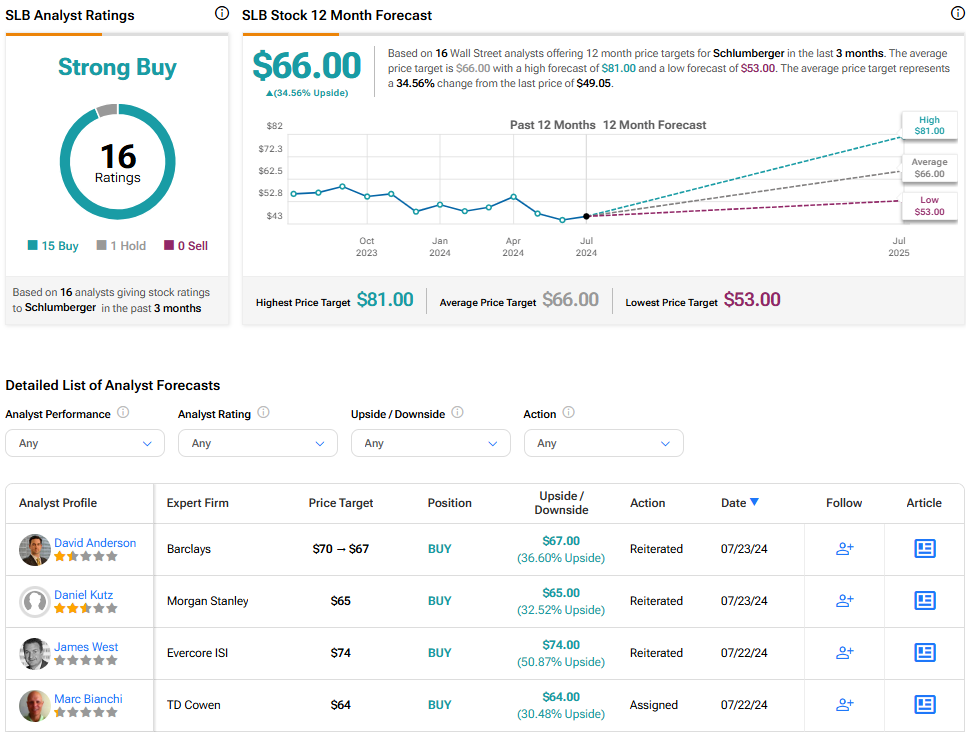

Is Schlumberger Stock a Buy, According to Analysts?

According to the latest analyst ratings, Schlumberger stock has a Strong Buy consensus rating. Out of 16 analysts covering the stock, 15 rate it a Buy, and one rates it as a Hold. The average SLB stock price target of $66.00 implies upside potential of around 34.6%.

The Bottom Line

Cheniere Energy and Schlumberger are two top energy stocks that investors should seriously consider adding to their portfolios. I’m confident in my bullish stance on both stocks. The numbers don’t lie – these companies deliver strong results and have clear paths for future growth. If you’re looking for energy stocks with the potential to outperform, Cheniere Energy and Schlumberger should be on your radar.