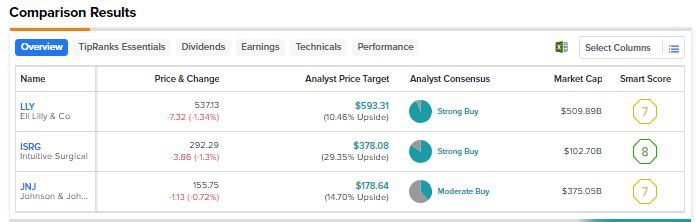

With macro pressures continuing to weigh on companies, it is better to focus on sectors that are recession-resilient and include companies that can navigate short-term pressures. The healthcare sector is one such sector in which we can find several companies that are not significantly hit by macro headwinds compared to companies in other sectors like tech. Using TipRanks’ Stock Comparison Tool, we placed Eli Lilly (NYSE:LLY), Intuitive Surgical (NASDAQ:ISRG), and Johnson & Johnson (NYSE:JNJ) against each other to pick the most attractive healthcare stock as per Wall Street analysts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Eli Lilly (NYSE:LLY)

Shares of pharmaceutical giant Eli Lilly have rallied 47% so far this year, driven by several favorable developments, optimism around the company’s weight loss drug pipeline and Alzheimer’s drug donanemab, and solid second-quarter results.

The company’s Q3 2023 revenue grew 28% to $8.3 billion, while adjusted EPS jumped 69% to $2.11. The second-quarter performance and upgraded guidance were driven by a significant rise in sales of LLY’s diabetes treatment Mounjaro to $979.9 million from $16 million in the prior-year quarter. The company’s breast cancer pill Verzenio and Type 2 diabetes drug Jardiance also performed well.

Is Eli Lilly a Good Stock to Buy Now?

Earlier this month, J.P.Morgan analyst Chris Schott raised his projections for weight loss drugs and expects the drug category known as GLP-1 agonists to generate more than $100 billion in annual sales by 2030 in a duopoly controlled by Eli Lilly and Novo Nordisk (NVO).

With Eli Lilly anticipated to be granted FDA approval this year to offer Mounjaro for weight loss, the stock is one of Schott’s favorites among GLP-1 developers, with a Buy rating and a price target of $600. The analyst said that he sees a significant upside to Street estimates, supported by multiple catalysts, including a potential FDA approval of LLY’s Alzheimer’s therapy donanemab. He projects LLY’s GLP-1 drug class to deliver revenue of $23 billion and $34 billion in 2025 and 2027, respectively, up from $8 billion in 2022, and then reach $50 billion in 2030.

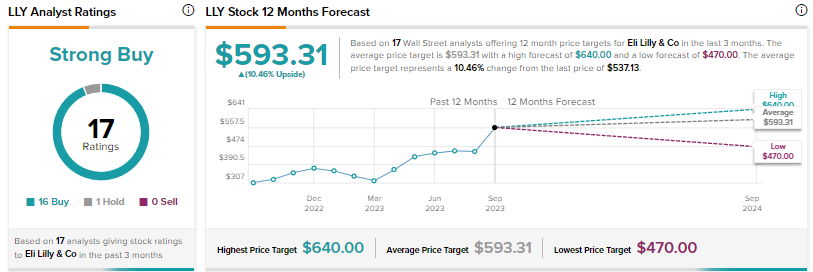

Wall Street’s Strong Buy consensus rating on Eli Lilly stock is based on 16 Buys and one Hold. The average price target of $593.31 implies 10.5% upside potential.

Intuitive Surgical (NASDAQ:ISRG)

Medtech company Intuitive Surgical is a leader in robotic-assisted, minimally invasive surgery, thanks to its da Vinci surgical system. While the company reported mixed second-quarter results amid macro pressures, its long-term growth potential looks attractive.

The company’s da Vinci surgical system had an installed base of 8,042 systems at the end of the second quarter, reflecting a 13% year-over-year growth. Moreover, da Vinci procedures grew about 22% in Q2 2023.

Interestingly, a significant portion of Intuitive Surgical’s revenue is recurring and comes from the sale of instruments and accessories, service revenue, and operating lease revenue. Also, instruments and accessories revenue has increased at a faster rate than systems revenue over time. Last year, recurring revenue accounted for 79% of ISRG’s overall revenue. The increased adoption of robotic procedures is expected to boost the company’s recurring revenue and drive further growth.

What is the Prediction for Intuitive Surgical?

ISRG stock is up 10% year-to-date but down over 18% from its 52-week high.

On September 25, Citigroup analyst Scott Chronert recommended a list of 20 growth stocks, including ISRG, which he feels are worth considering as the market corrects. The analyst suggests adding names that are down at least 10% from recent highs but have a “stable fundamental outlook and /reasonable implicit medium-term free cash flow growth expectations.”

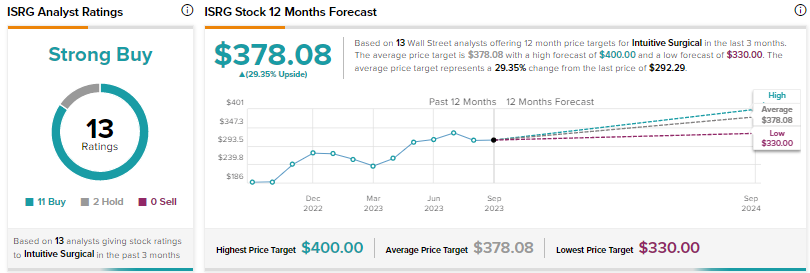

With 11 Buys and two Holds, ISRG stock earns Wall Street’s Strong Buy consensus rating. The average price target of $378.08 implies 29.4% upside.

Johnson & Johnson (NYSE:JNJ)

Shares of healthcare behemoth Johnson & Johnson are down about 12% so far in 2023, as solid Q2 2023 performance and improved outlook failed to address investors’ concerns over the baby talc powder controversy.

Meanwhile, the company recently completed the spin-off of its consumer business into a separate company called Kenvue (KVUE). The rationale behind JNJ’s decision to spin off its consumer division was to increase its focus and direct resources to its pharmaceutical and medtech divisions.

JNJ aims to generate $57 billion in annual sales from its pharmaceutical business by 2025. While in the past, the company has strengthened its portfolio through strategic acquisitions, including that of heart pump maker Abiomed for $16.6 billion, it expects most of its growth over the next five years to come from its existing portfolio and research and development efforts.

Is JNJ Stock a Buy or Sell?

Earlier this month, Barclays analyst Matt Miksic lowered the price target for JNJ stock to $158 from $175 and reiterated a hold rating. The analyst updated his model to exclude the consumer business from the Q3 results. His new estimates are in line with the company’s revised guidance.

Following the separation of the consumer business, the company now expects 2023 sales growth in the range of 7% to 8% and adjusted EPS growth of 12% to 13%.

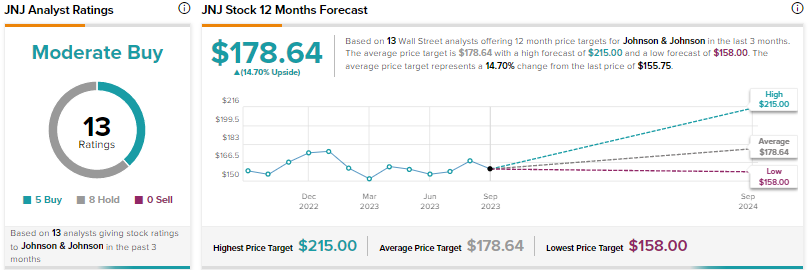

Wall Street has a Moderate Buy consensus rating on JNJ based on five Buys and eight Holds. The average price target of $178.64 suggests 15% upside potential. It is worth noting that JNJ is a dividend king and has raised its dividend for 61 consecutive years. JNJ offers a dividend yield of 3.1%.

Conclusion

Wall Street analysts are very bullish about Intuitive Surgical and are cautiously optimistic about Eli Lilly and Johnson & Johnson. They see the pullback in ISRG stock as a good opportunity to buy the stock and gain from the company’s long-term prospects. Intuitive’s dominant position in the robotic-assisted surgery market and the growing demand for its da Vinci systems make it an attractive pick.