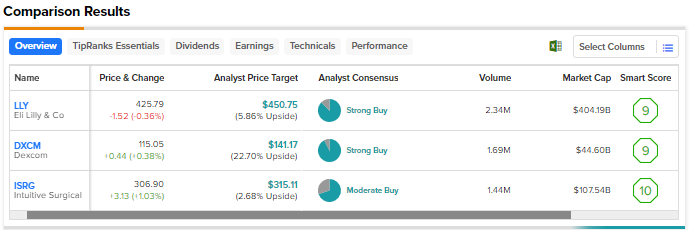

Healthcare stocks are generally more resilient in an uncertain macro backdrop, given the essential nature of products and services offered by the companies in this space. Using TipRanks’ Stock Comparison Tool, we measured Eli Lilly (NYSE:LLY), Dexcom (NASDAQ:DXCM), and Intuitive Surgical (NASDAQ:ISRG) against one another to figure out which one is Wall Street’s top healthcare stock pick.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Eli Lilly (NYSE:LLY)

Despite a weak earnings report, Eli Lilly has been in the news due to the favorable update about its obesity drug Tirzepatide. In May 2022,the U.S. Food and Drug Administration (FDA) approved Tirzepatide under the brand name Mounjaro to treat Type-2 diabetes. Mounjaro generated $568.5 million in sales in Q1 2023. The drug is expected to generate billions of dollars if it wins approval for obesity as well.

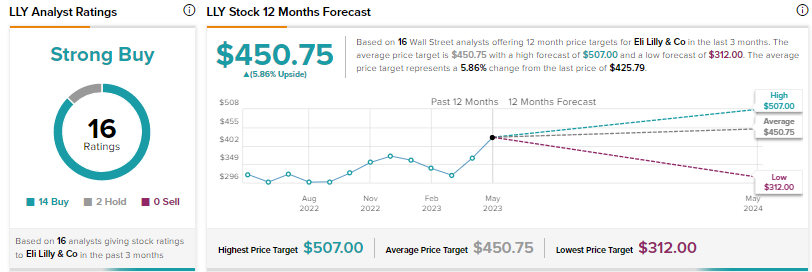

Is Eli Lilly Stock a Good Buy?

Last week, Bank of America analyst Geoff Meacham reiterated a Buy rating on Eli Lilly and raised his price target to $500 from $450 following a proprietary consumer analysis that examined the growing hype around new obesity medications based on the responses of 1,100 U.S. consumers.

The study found that more than 55% of consumers heard about these treatments on some form of social media, suggesting the need for targeted advertising. Meacham noted that Lilly launched the first direct-to-consumer campaign for Mounjaro in Type-2 Diabetes in Q1. He expects increased interest in the drug as patients become familiar with its benefits.

The analyst does not expect the obesity market to be a “zero-sum game,” and anticipates several big players like Eli Lilly, Novo Nordisk (NVO), and Pfizer (PFE) to see more “rapid improvements to reimbursement and competitive pricing pressure, which should lead to faster uptake.”

Meacham boosted the revenue forecasts for Mounjaro in Type-2 diabetes by an average 19% for 2023-2030. He also raised the forecasts for the Tirzepatide drug in obesity by an average 40% for 2023-2030.

Wall Street’s Strong Buy consensus rating on Eli Lilly is based on 14 Buys and two Holds. Following the 16.4% year-to-date rise in LLY stock, the average price target of $450.75 implies nearly 6% upside.

Dexcom (NASDAQ:DXCM)

Dexcom is one of the leading makers of continuous glucose monitoring (CGM) devices. Last month, the company raised its full-year revenue guidance to reflect an upbeat Q1 performance and demand for the recently launched Dexcom G7 in the U.S.

The company expects its 2023 revenue to grow in the range of $3.400 to 3.515 billion, reflecting 17% to 21% growth.

Is Dexcom a Buy, Hold, or Sell?

On May 24, BTIG analyst Marie Thibault reiterated a Buy rating on DXCM stock with a price target of $134 as part of her analysis of the Q1 earnings season for the medical technology space. Thibault noted that Dexcom reported a strong quarter and management’s commentary was upbeat on the early U.S. G7 launch, the interest in basal-only (a long-acting insulin injected once or twice daily) CGM, and the adoption of the Dexcom ONE CGMs.

The analyst highlighted that new patient additions reached an all-time record in Q1 and commercial plans are covering G7 at a faster pace than initially anticipated. Thibault was “particularly encouraged” to know that doctors new to Dexcom are already prescribing G7, payor coverage is being secured quickly, and all major pharmacy benefit managers (PBMs) would be covering G7 by the end of Q2.

Thibault thinks that the increase in 2023 revenue guidance was conservative, making it a prudent move that leaves room for “large beats and raises” in upcoming quarters. Thibault expects Dexcom to maintain its leadership position among new Type 1 patients starting on CGM, given its equation with endocrinologists.

Wall Street’s Strong Buy consensus rating on Dexcom is based on 12 Buys and one Hold. The average price target of $141.17 suggests upside of nearly 23%. Shares have risen 2% since the start of 2023.

Intuitive Surgical (NASDAQ:ISRG)

Intuitive Surgical is a dominant player in the robotics-assisted surgical systems market. The company’s da Vinci systems have gained strong acceptance over the past few years in the medical world and are used in performing robotic-assisted minimally invasive surgeries.

As of the end of Q1 2023, the company’s da Vinci Surgical System installed base grew 12% year-over-year to 7,779 systems. Higher da Vinci procedure volumes drove a 14% rise in the company’s Q1 revenue to $1.7 billion. Adjusted earnings per share (EPS) grew 9% to $1.23.

The company is optimistic about the road ahead, backed by its leading position in the robotics-assisted surgeries space, the launch of new platforms, and approval of its devices in additional surgical indications.

What is the Price Target for ISRG Stock?

On May 18, Truist analyst Richard Newitter increased the price target on Intuitive Surgical stock to $347 from $325 and maintained a Buy rating following Q1 earnings. Newitter believes that ISRG offers long-term double-digit revenue and earnings growth prospects. The analyst also highlighted the company’s new product cycle potential and market leadership within the underpenetrated robotics addressable market.

With 14 Buys and six Holds, Intuitive Surgical scores a Moderate Buy consensus rating. The average price target of $315.11 suggests 2.7% upside. Shares have advanced 16% year-to-date.

Conclusion

Wall Street is more bullish on Eli Lilly and Dexcom than Intuitive Surgical. Analysts see higher upside potential in Dexcom, keeping in view the solid demand for CGMs in the diabetes space. As per TipRanks’ Smart Score System, Dexcom earns a nine out of 10, which indicates that the stock has the ability to outperform the broader market over the long term.

Dexcom stock (DXCM) is the top healthcare stock pick.