Not so long ago, those keeping a tab on the trends of the 21st century had touted data as ‘the new oil.’ But now, Elon Musk has presented an alternative perspective, stating that lithium batteries should be considered as ‘the new oil.’

In fact, taking the analogy to its logical conclusion, on Monday, Musk was in oil-rich Texas to break ground on a lithium refinery Tesla intends to construct in Corpus Christi. The EV leader plans on splashing out $375 million on the facility so it can produce more domestic battery-grade lithium than the rest of North America is currently capable of.

Given lithium is a key component of the batteries that power Tesla’s cars and EVs are set to gain widespread adoption over the coming years, Tesla is obviously the first investment case that comes to mind here. But there are other smaller companies hoping to ride the lithium trend, and this obviously opens up opportunities for those looking to get ahead of the game.

With this in mind, we dipped into the TipRanks database and got the lowdown on two lithium battery stocks, priced below $10, that some Wall Street analysts see as potential winners in this expanding field. Let’s find out why.

Microvast Holdings (MVST)

We’ll start with Microvast Holdings, a leader in lithium-ion battery tech. The company’s advanced battery solutions are designed to power a wide range of electric vehicles, from small passenger cars to heavy-duty trucks and buses. Additionally, the company offers a comprehensive suite of services to support its customers, including battery system design and integration, testing and validation, and after-sales support. The firm also has a global reach, with manufacturing operations in China, as well as facilities in Germany and the U.S.

The company will report Q1 earnings today after the close, but we can hark back to the Q4 and full-year 2022 report to get a picture of Microvast’s operations. In the quarter, revenue fell by 3% year-over-year to $64.8 million, although it should be noted that for the full-year, revenue reached $204.5 million, a 35% improvement on the $152 million generated in 2021. In Q4, the company delivered a non-GAAP adjusted net loss of $15.9 million, also bettering the loss of $33.4 million in the same period a year ago.

Nevertheless, loss making firms have been out of favor in the high inflation and rising interest rate environment and that has been reflected in the stock’s poor performance; the shares have shed 66% over the past year. However, they are now at such a low level that H.C. Wainwright analyst Amit Dayal believes they present a “compelling entry point.”

In the year ahead, the 5-star analyst thinks the stock should outperform its peers. This forecast is supported by: “(1) accelerating sales that should push margins to improve from 4.4% currently to 18.4% during the next two years; (2) a healthy balance sheet with $327.7M in cash that should be sufficient to cover planned capacity expansion and growth investment needs over the next 12-18 months; (3) capacity expansion plan in the U.S. and China, when fully utilized is expected to translate into an additional revenue potential of $1B; (4) solid manufacturing and distribution presence established in the U.S., allowing the company to benefit from grants and incentives stipulated under the IRA; (5) a relatively unique business model that allows for flexibility in meeting supply chain challenges better than some of its competitors; (6) a very healthy backlog of $410.5M…; and (7) significant industry runway with multi-billion addressable opportunities associated with the electrification trend.”

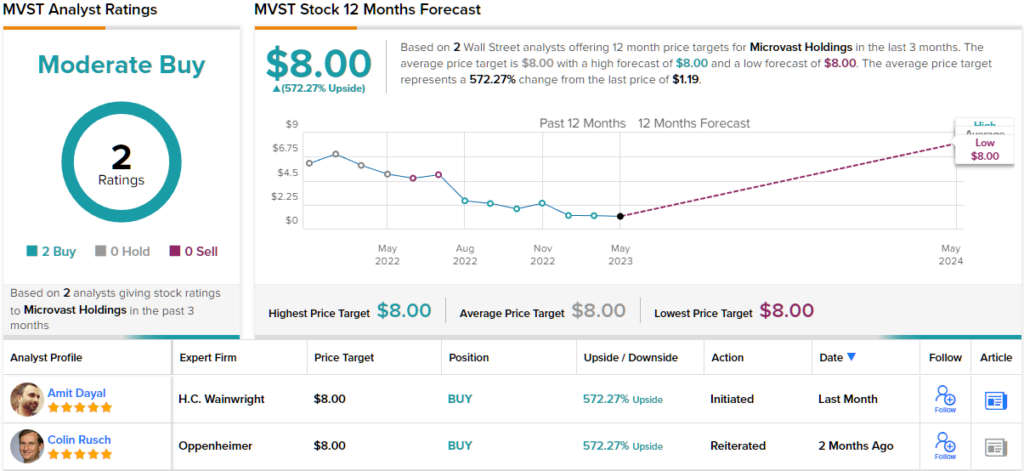

That’s a long list that forms the basis of Dayal’s Buy rating on MVST. With shares trading at $1.19, the top analyst gives the stock an $8 price target, implying a huge 572%. (To watch Dayal’s track record, click here)

Microvast seems to have slipped under most analysts’ radar; the stock’s Moderate Buy consensus is based on just two recent ratings – but both are Buys. Currently, Microvast shares trade at $1.14, while the average price target is $8, practically the same as Dayal’s (See MVST stock forecast)

Li-Cycle Holdings (LICY)

Moving on to the next player in the lithium battery space, we have Li-Cycle Holdings, a specialist in advanced lithium-ion battery resource recovery. Essentially, the firm recycles lithium-ion batteries, reintroducing the materials back into the supply chain, and the proprietary tech is designed to recover up to 95% of the materials used in the battery manufacturing process, including lithium, cobalt, nickel, and other valuable metals. Li-Cycle has also secured several partnerships with other companies, including Kion, Glencore and Renewance.

On the financial front, to bring the reporting calendar in line with peers, Li-Cycle changed its financial year-end from October 31st to December 31st, hence its most recent report contains the two-month period of November-December 2022. During that time, the company generated revenue of $5.9 million, amounting to a 53.6% year-over-year increase, although the adjusted EBITDA loss widened from $8.5 million in the same period a year ago to $17.8 million.

More recently, the company was a winner of the Bloomberg New Energy Finance (BNEF) Pioneers Award for 2023, rewarded in the ‘Sustainable Metals and Materials for an Electrified Future’ category for its patented Spoke & Hub tech.

And talking of the future, Piper Sandler analyst Alexander Potter’s bullish thesis for Li-Cycle rests on the essential service the company provides.

“The transportation and energy markets are evolving in unpredictable ways, but most prognosticators agree: no matter what happens, battery recycling will be crucial,” the 5-star analyst said. “LICY still strikes us as an investable option in this segment; the company has a multi-year headstart, as well as a growing list of strategic partners (including KION, a German multi-national that manufacturers 1.7M forklifts per year). Perhaps most importantly, a $375M loan from the Department of Energy helps de-risk Li-Cycle’s balance sheet, so unlike many asset-intensive peers in the battery supply chain, LICY should have no problem funding its expansion.”

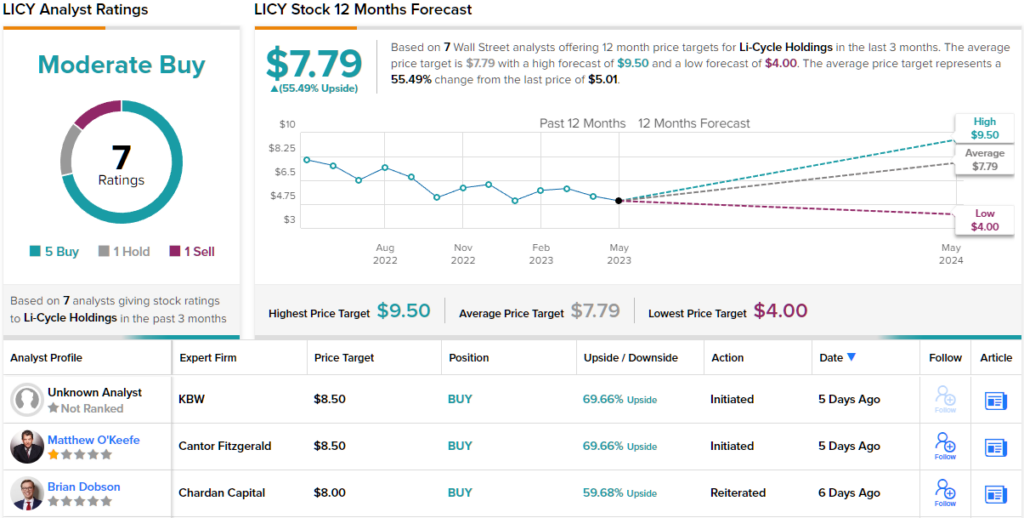

Given all of the above, Potter has high hopes. Along with an Overweight (i.e., Buy) rating, he keeps a $10 price target on the stock. This target puts the upside potential at 95% (To watch Potter’s track record, click here)

All in all, 7 analysts have waded in with LICY reviews and these break down into 5 Buys and 1 Hold and Sell, each, for a Moderate Buy consensus rating. LICY shares are trading for $5.05, and the $7.79 average price target suggests room for ~55% growth this year. (See LICY stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.