Lithium Americas (NYSE:LAC) (TSE:LAC), a North American lithium company, could be sitting on the world’s largest lithium reserve. The company is better positioned to cash in on the transition to vehicle electrification following its October split from Lithium Argentina.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As a “pure-play” miner with rights to the reserve and backing from General Electric (NYSE:GE), LAC offers an opportunity to gain exposure to lithium as it prepares for major construction. Despite its stock price being down 44% since coming to market, I believe LAC presents a lucrative long-term play.

A “Pure-Play” Advantage to Lithium

The Thacker Pass lithium mine, located in the McDermitt caldera, could contain up to 40 million tonnes of lithium reserves. It has been confirmed as containing the U.S.’s largest known lithium deposits. The company has become a “pure-play” company on the asset since it split off its Argentinian operation in October, focusing on domestic development.

LAC is looking to exploit the resource in two phases and has already initiated work on Phase 1, which is expected to generate production by mid-2026. After that, the company plans to commence work on Phase 2, which will increase production starting in 2030. The mine is expected to have a 40-year lifespan using LAC’s projection model.

The company estimates an average operating cost of $7,198 per tonne of lithium carbonate equivalent (LCE). This compares to the November-end lithium carbonate price of $20.0-22.5 thousand per tonne in Europe and the U.S., providing LAC with a huge opportunity for profit margins. It also allows the company to estimate an average annual EBITDA of around $1.09 billion for the project, demonstrating the potential to drive value for shareholders.

The Phase 1 capital costs for the Thacker Pass are expected to total $2.27 billion in a project with an estimated net present value (NPV) of $5.7 billion. Compared with LAC’s market cap of $1.03 billion, it implies the company is working on a project substantially larger than its current valuation and will need to expand. Upon completion of the first phase, the company hopes to increase production in Phase 2, starting in 2030.

If LAC successfully brings Thacker Pass into production by the second half of 2026 (more on that soon), it will position itself better to benefit from the growing electric vehicle (EV) batteries market. In fact, it is expected to supply 1 million EVs on an annual basis, representing a solid long-term play.

What is LAC Stock’s Upside Potential?

LAC hasn’t generated a profit yet because it’s still in the construction phase at Thacker Pass. However, LAC believes it has enough funding to start production in late 2026. Wall Street analysts seem confident about the company’s ability to come into production per planned estimates, and I am, too.

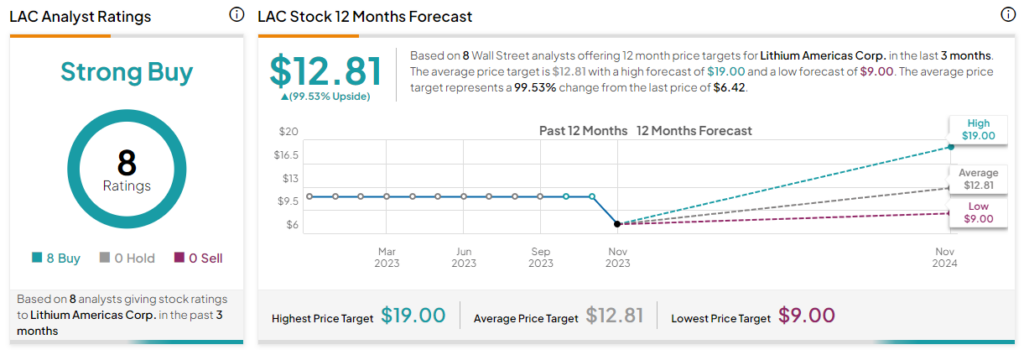

Katie Lachapelle of Canaccord Genuity initiated a Buy on October 31 with a price target of $11.47. Katie has a success rate of 60% overall, with an average return per rating of 34.4%. Interestingly, Katie’s record best rating, which provided investors with an astonishing gain of 417.6% from November 2020 to November 2021, was on Denison Mines Corp (NYSE MKT:DNN), another miner, albeit uranium-focused.

More recently, on November 13, Ben Isaacson of Scotiabank assigned a new Buy rating with a price target of $15, representing upside of 133.1%. Ben’s average return per rating stands at 11.4%, with a success rate of 52%.

Based on eight analysts covering Lithium Americas since it started trading in its current form, the 12-month average LAC stock price target represents a 99.53% upside at $12.81 per share. I agree with the bullish ratings, as Lithium America appears well-positioned to generate profits from Thacker Pass.

Is LAC Well-Positioned to Capitalize?

With transport links and infrastructure already in the works, LAC is primed to supply domestic markets with a secure source of battery-grade lithium products. However, GM (NYSE:GM) has already committed a $650 million equity investment for the project in exchange for gaining the right of the first offer (ROFO), highlighting the need to develop more lithium resources to support vehicle electrification. The second tranche of $330 million is pending Phase 1 financing from the loan program.

But GM is not alone in the battle to transition. Volkswagen (DE:VOW) has also announced ambitious electrification plans, with goals to transition its fleets to fully electric over the next few years. They will also require vast amounts of lithium-ion batteries to meet these targets. Thacker Pass may be poised to become a crucial global supply source once GM’s agreement with LAC comes to an end.

With $275.5 million in cash on hand and a strategic partnership with GE, LAC is poised to become a leading supplier of battery-grade lithium products to meet soaring demand. However, it has to develop Thacker Pass responsibly and sustainably, representing a unique opportunity to produce for the green economy right in America.

LAC has faced community protests and attempted blocks by environmental groups. If they can get the project off the ground, the mining process could start according to plan.

The Takeaway

Lithium Americas’ long-term prospects hinge on the successful exploitation and litigation of the Thacker Pass deposit. If successful, the payoff could be significant, with capital costs substantially larger than the company’s current market cap and solid margins over the long run. Given the high demand for lithium in the EV sector, the company’s “pure-play” positioning, and GE’s backing, the opportunity appears promising for investors willing to weather potential short-term volatility.