Despite missing targets in its recent Q3 report and expecting to invest heavily next year while still facing ongoing Covid related snags, Li Auto (LI) believes it can turn a profit next year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

With this in mind, assessing the Chinese EV maker’s prospects, Morgan Stanley’s Tim Hsiao thinks the “time is ripe for a turnaround.”

“While Covid disruptions will continue to affect supply chains,” Hsiao explained, “Li Auto is poised to tackle the headwinds and is confident in the demand for its EREV lineup, which will remain the sales mainstay in 2023.”

Talking of which, the company’s EREV lineup – the L9, L8, and L7 – is set to act as the “key volume driver in 2023,” and should help the company reach its goal of Rmb100 billion in sales.

“Based on the company’s initial assessment,” says Hsiao, “the average monthly deliveries of L9 and L8 could reach 8-11k and 10-14k units, respectively.” Starting early next year, The L7 should also begin contributing.

One of Q3’s disappointing metrics was those of gross margins, which came in at 12.7%. This compared badly to both the 23.3% margin seen in the same period last year and the 21.5% delivered in 2Q22. The “significant contraction” was due a one-off event, namely, the “inventory provision and losses on purchase commitments” relating to the accelerated phase-out of the Li ONE.

Although Hsiao thinks that in order to procure component supply, overall manufacturing costs could rise towards the end of the year, the analyst believes “favorable scale benefit should still back Li Auto’s GpM (gross profit margins) trajectory,” which should rebound to to a more normal level of around 20% in Q4. Additionally, due to increasing scale, looking forward to next year and boosted by EREV models, , Hsiao expects Li Auto’s GpM to stay at 20%+.

All in all, Hsiao sticks with an Overweight (i.e., Buy) rating along with a $23 price target. While Hsiao thinks a turnaround is in play, the target only makes room for modest growth of ~11% for the year ahead. (To watch Hsiao’s track record, click here)

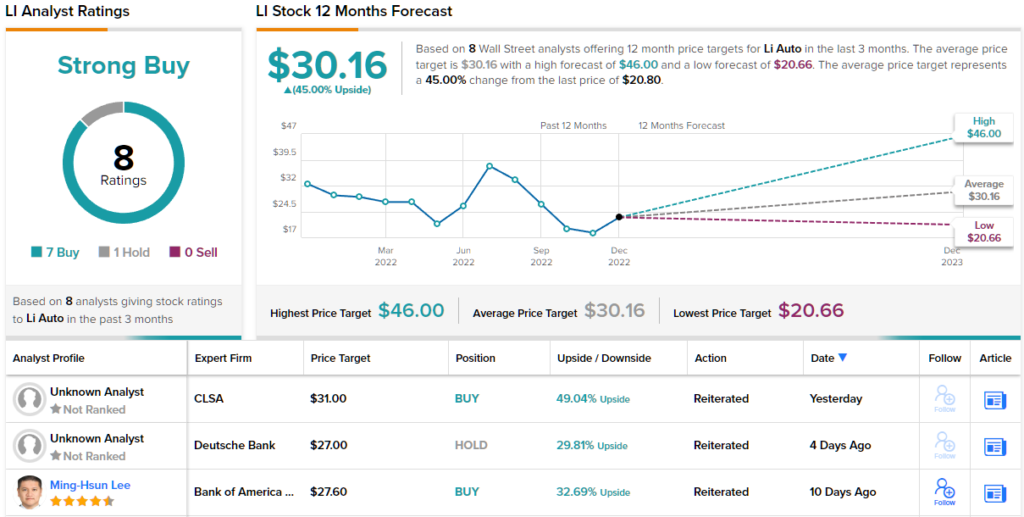

Most analysts, however, think there’s more upside than that in the cards. The Street’s average target stands at $30.16, suggesting one-year gains of 45%. The stock’s 8 recent analyst reviews include 7 Buys and 1 Hold, for a Strong Buy consensus indicative of a bullish outlook. (See Li Auto stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.