Despite reporting unimpressive results for the fiscal first quarter, shares of Alibaba Group Holding Ltd. (NYSE:BABA) have been on the upswing lately.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

BABA stock lost up to 7.8% in the days following the release of the results. The stock rebounded and closed in the green on Wednesday. Further, it was trading almost 7% up at the time of writing, on Thursday.

In the first quarter, the Chinese E-commerce giant reported a 29% year-over-year decline in adjusted earnings per ADS to RMB11.73. Income from operations fell 19% to RMB24.943 billion, and adjusted EBITDA decreased 18% to RMB34.419 billion.

Revenues remained flat year-over-year at RMB205.555 billion. While the Cloud segment’s revenue grew 10% to RMB17.685 billion, the revenue of the China commerce segment slipped 1% to RMB141.935 billion.

TipRanks’ Website Traffic Tool Hinted at a Weak Q1 Show

Even before the results were announced, TipRanks’ Website Traffic Tool hinted at a weak quarter for Alibaba. The tool, which uses data from SEMrush Holdings (NYSE:SEMR), the world’s biggest website usage monitoring service, showed a 6% fall in BABA’s global website visits during the first quarter, compared to the fourth quarter of the last fiscal year. Website visits on the desktop decreased 3.9% quarter-over-quarter and the traffic to the company’s mobile app had declined 6.8%. Learn how Website Traffic can help you research your favorite stocks.

What Is the Price Target for BABA Stock?

BABA’s average price target of $154.09 mirrors over 55% upside potential. On TipRanks, Alibaba Group commands a Strong Buy consensus rating based on 21 Buys, one Hold, and one Sell.

Further, financial bloggers are 78% Bullish on the stock, compared to the sector average of 65%.

What Is the Future of BABA Stock?

The economic slowdown that followed the COVID-19 pandemic has hit Alibaba hard. It is cutting costs across all operations to deal with lower consumer spending in its main market, China. Alibaba Group plans to continue with its cost control and optimization strategy in the next few quarters to curtail losses.

Additionally, Leo Chiang of Deutsche Bank expects “geopolitical tensions, currency depreciation in Euro markets, and a slowdown in Southeast Asian markets” to impact the company’s international commerce revenues in the second quarter.

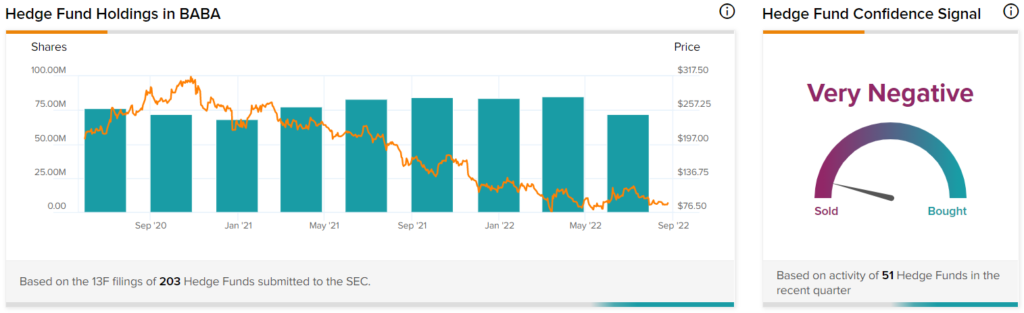

Maybe this is why hedge funds are pessimistic about the stock. TipRanks data shows that confidence in Alibaba is currently Very Negative, as the cumulative change in holdings across all 51 hedge funds that were active in the last quarter was a decrease of 12.8 million shares.

Read full Disclosure