Lucid Group’s (NASDAQ:LCID) outlook for the year was cut twice this summer, but it looks like it’s finally managed to get its act together with its third-quarter production figures. Lucid Air’s production ramp is on track, and the company announced it would increase its output in Arizona. With its stock down in the doldrums, it’s an ideal time to load up on the luxury EV maker before the bull run begins.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Lucid Air can travel a whopping 520 miles on a single charge, which is roughly 100 miles better than Tesla’s Model S. Its development has been led by Tesla’s former Chief Vehicle Engineer, Peter Rawlinson, who also designs EVs at BMW Group factories in Germany. Lucid’s top-of-the-line luxury car is more expensive than Tesla’s most luxurious model.

Lucid’s bold claims about shipping 20,000 vehicles in 2022 were premature. The company reduced this forecast to just 12,000-14,000 this February, citing “extraordinary supply chain and logistics challenges.” It then lowered it again to a range of 6000-7000 in August. The EV sector in general had been reeling under the weight of supply-chain bottlenecks.

However, with its solid performance during the third quarter, investors can breathe a sigh of relief and expect a significantly better outlook ahead. Moreover, LCID stock is trading at a hefty bargain and presents an excellent entry point for long-term investors.

Lucid Provided an Encouraging Update

Lucid produced 2,282 EVs over the past three months at its manufacturing plant in Arizona, exceeding the first half of this year’s production by 62%. Moreover, Lucid Air deliveries more than doubled in the quarter, with it delivering 1,398 EVs, which equates to a 61% share of total production. In contrast to this remarkable stat, it delivered just 679 units in the previous quarter. It’s impressive how Lucid doubled its production and deliveries in the quarter.

As we head into the fourth quarter, it will be interesting if these numbers can continue at the same pace, potentially sparking a rally in its stock.

It’s also worth mentioning that Lucid ended its second quarter with 37,000 vehicle reservations, equating to over $3.5 billion in sales. With the company set to report its third-quarter earnings soon, it would be reasonable to assume that Lucid’s reservation book has grown to over 40,000.

Lucid’s Supply Chain Issues Have Improved, but Risks Remain

Lucid’s supply chain risks have eased out considerably, and the company has enough money to finance its current product line-up with a whopping $4.3 billion in its cash till. Although it will take longer than initial expectations for its production to ramp up, this major risk associated with the company appears to be improving. Nonetheless, risks still remain, and Lucid still needs to prove that it can actually hit its production targets. Until then, the stock is unlikely to experience an upside revaluation.

In addition, when using TipRanks’ risk analysis tool, it’s clear that the company has more risk disclosures than the average S&P 500 company. Indeed, Lucid disclosed 88 risks compared to the average of 31. The main risk category was Finance & Corporate, with 31 risks disclosed in the second quarter.

Wall Street’s Take

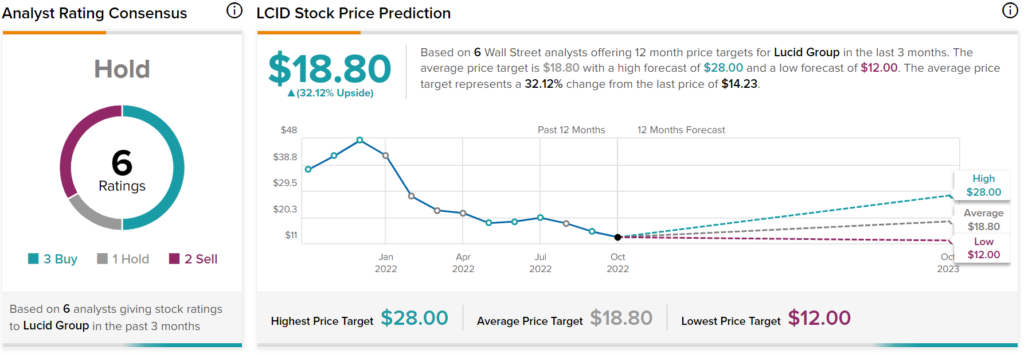

Turning to Wall Street, LCID stock has a Hold consensus rating. Out of 6 total analyst ratings, three Buys, one Hold, and two Sells were assigned over the past three months. The average LCID stock price target is $18.80, implying 32.12% upside potential. Analyst price targets range from a low of $12 per share to a high of $28 per share.

Conclusion: LCID Stock Appears to be on the Right Track

Lucid’s production update for the third quarter was much more reassuring than previous ones, which bodes well for its stock. It saw a superb increase in production, with manufacturing volume exceeding the total for the first half by 62%. Recent positive developments indicate that Lucid is on track to reach its targets this year without disappointing stockholders.

The most difficult challenge for the business is scaling manufacturing, and there’s still much uncertainty about how this will be done. Nevertheless, its progress of late has been remarkable. With rising reservations, its business is booming, starting with its incredible product. The company has an ambitious plan for success that its strong team of professionals will continue to execute.