Lam Research is a company that designs, manufactures, and supplies wafer fabrication equipment and related services to the semiconductor industry.

Based in the U.S., the firm offers products such as plasma tech, thin film deposition, wafer cleaning, and photoresist strip, which are used in the active components and wiring of semiconductor devices. It also produces and supplies back-end wafer-level packaging (WLP) equipment for the manufacturing industries.

I am neutral on Lam Research Corp. (LRCX), as its competitive positioning, substantial growth momentum, and profitability are offset by its elevated valuation.

The company was founded in 1980, with its headquarters in California’s Silicon Valley. Since then, it has expanded its offerings to countries in Asia and Europe. It has also started operations in Korea and Austria.

Strengths

Lam Research Corporation has a significant number of clients around the world. Some of its more high profile clients include Kioxia, Intel (INTC), Samsung Electronics, Micron Technology (MU), Yangtze Memory Technologies, SK Hynix, and TSMC (TSM). Applications for Lam’s products include computer, military, aerospace, and communications enterprises. The company has a strong market presence with its operating efficiency constantly evolving and improving.

Additionally, since its merger with Novellus Systems, it has also built up a stronger portfolio and liquidity position. The research and development and new product innovations has provided Lam Research Corporation with vast opportunities to scale and grow in its industry.

Recent Results

LRCX earned revenue of $4.3 billion during the quarter that ended in September, 2021. The income as a percentage of revenue was 31.9% and the gross margin was 45.9%. Its earnings per share totaled $8.27. The revenue grew by a total of 4% from the last quarter, where the company enjoyed a revenue of approximately $4.1 billion. The firm’s operating income as a percentage of revenue grew by 20 bps and the diluted EPS increased by 4%.

The company also repurchased $1.2 billion worth of shares, which resulted in a decrease in restricted cash and investment, short-term investments, and cash & cash equivalents. In the same quarter of the previous year, the company generated $3.1 billion revenue.

Valuation Metrics

LRCX stock looks overvalued at the moment, as its enterprise value to EBITDA ratio is 16.05 times compared to its historical average of 11.11 times. Also, its price to normalized earnings ratio is 19.58 times compared to its historical average of 15.19 times.

Wall Street’s Take

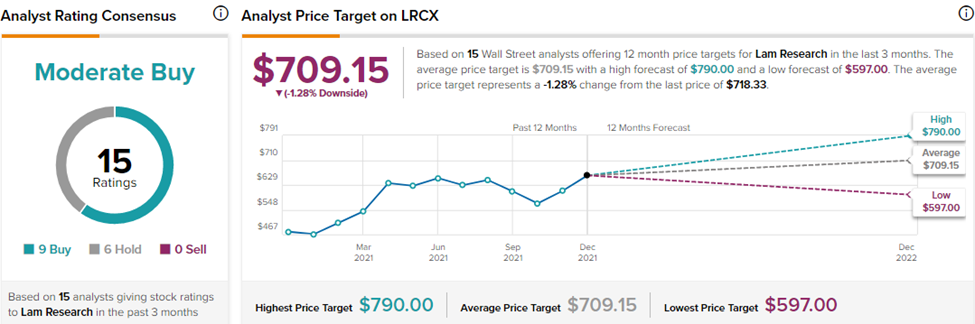

According to Wall Street analysts and calculated by TipRanks, LRCX maintains an analyst rating consensus of Moderate Buy, based on 9 Buy and 6 Hold ratings over the the past three months. Additionally, the average price target of $709.15 puts the current 12-month downside potential at 1.28%.

Summary and Conclusions

Lam Research plays a leading and crucial role in the semiconductor industry. Given the ongoing supply chain issues confronting the global economy, Lam Research has seen strong growth and substantial profitability recently. However, the stock price looks a bit extended here as its valuation multiples are well above historical averages and its average analyst price target indicates little to no upside for the stock price over the next year.

That said, the company is strongly positioned in an increasingly indispensable industry. As a result, it is a tough company to bet against. Nevertheless, given the stretched valuation, investors might want to wait for a pullback before adding shares.

Disclosure: At the time of publication, Samuel Smith did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates Read full disclaimer >