It’s not shaping up to be a great season for retail, as Kohl’s (KSS) discovered after releasing its latest earnings report. While the summer usually isn’t a great time for retail, it’s turning particularly brutal now. Many of Kohl’s problems seem to stem from another cut to its full-year forecasts. The company currently expects net sales for Fiscal Year 2022 to be down between 5% and 6% compared to 2021.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Previously, Kohl’s looked for net sales to be either flat or up around 1%. Additionally, the company slashed adjusted earnings guidance by more than half. Previous projections called for annual earnings between $6.45 and $6.85. Now, that number is down to between $2.80 and $3.20.

The last 12 months for Kohl’s shares have been strikingly volatile. This time last year, Kohl’s was challenging $54 per share. Shares then slumped, rallied, slumped father, rallied further, slumped yet again, and then rallied to push for the 52-week high of $63.02.

However, May’s arrival sent the company on a downward spiral that ultimately ended with the company down to its 52-week low of $26.07. It’s rallied once more since, back to about $32 with today’s trading.

It’s not a good look overall, and the immediate future doesn’t look much better. Thus, I’m pulling back to bearish. Back in January, when buyout talks were flying fast and furious, I was bullish.

Eight months of steadily-mounting inflation and a worsening economic outlook, however, will now likely leave Kohl’s on the back foot, struggling to recover and stay afloat in an environment ill-suited to its survival.

Investor Sentiment is Still Positive for KSS Stock

Things may not look great for Kohl’s right now, but investor sentiment metrics seem surprisingly upbeat about this company’s future. Currently, Kohl’s has a Smart Score of 8 out of 10 on TipRanks. That’s the lowest level of “outperform,” which suggests that Kohl’s has a better chance than many stocks of doing better than the broader market. In addition, the mood among Kohl’s insiders seems fairly upbeat. Or at least, it was until recently. There has been no insider trading at Kohl’s at all since May.

In fact, there have only been a couple of informative trades made at all in the last several months, but looking at the raw numbers, it’s clear insiders have great expectations for Kohl’s stock going forward.

Buy transactions outpaced sell transactions among Kohl’s insiders by a huge margin. Over the last 12 months, there have been 101 buy transactions staged but only 39 sell transactions.

Kohl’s Stock is being Weighed Down by Macroeconomic Conditions

On a certain level, we knew something like this was coming. The inflation numbers facing consumers are hitting like a bus. Shoppers frantically trying to find reasonable prices for food and fuel are having a much harder time dropping cash on apparel and housewares. That, in turn, has led Kohl’s to step up promotional activity, which is a recipe for bad news. Kohl’s is cutting prices on merchandise going into an inflationary environment.

That means it’s going to have reduced income. Costs for Kohl’s are going up, and revenue is coming down. Those are the exact opposite directions that investors want to see.

However, there are some signs that Kohl’s may be able to make a comeback. Not long after the company ended its negotiations with Franchise Group (FRG) for a potential buyout, it launched one major new program: Discover @ Kohl’s. Discover @ Kohl’s may actually allow Kohl’s to open up a new market segment with comparatively low risk.

The program calls for Kohl’s to offer an entire department whose offerings change every quarter. This means that Kohl’s won’t have to keep it stocked the way it would have to stock other departments, and it can take chances on new brands accordingly.

Better yet, it will have a direct pipeline to customer preferences, all from that low-cost environment. Think of Discover @ Kohl’s as the canary in the coal mine. If a brand doesn’t do well there, it can be shut down before large quantities are purchased.

Kohl’s has even made an attempt to draw in the Generation X shopper with some special deals. Kohl’s recently reached out to Levi Strauss (LEVI) to bring back Silver Tab jeans through the holiday season.

With the potential draw of old-fashioned jeans to pull in the Gen X shopper, that may keep them around long enough to see if there’s anything else on hand. It’s working effectively like a loss-leader might, though without the loss.

Is KSS Stock a Good Buy?

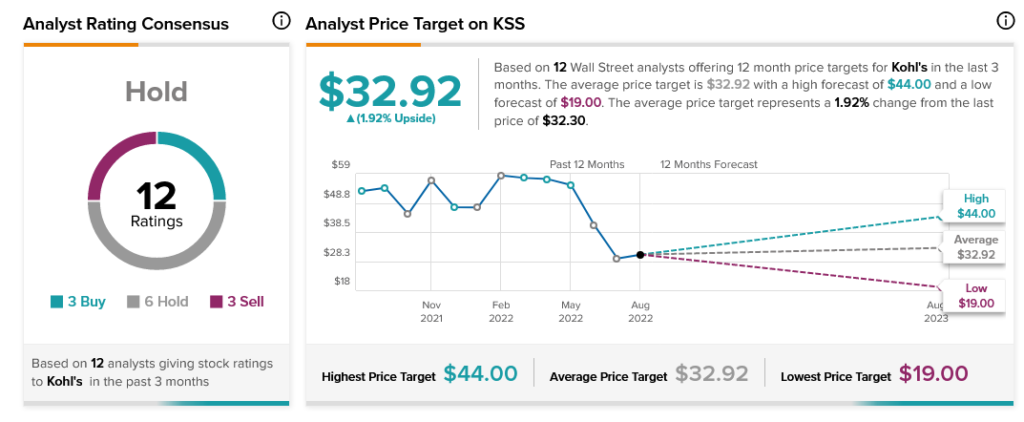

Turning to Wall Street, Kohl’s has a Hold consensus rating. That’s based on three Buys, six Holds, and three Sells assigned in the past three months. The average Kohl’s price target of $32.92 implies 1.9% upside potential. Analyst price targets range from a low of $19 per share to a high of $44 per share.

Takeaway – KSS Stock Might Have a Long Way to Fall

Things aren’t looking good for Kohl’s right now, as it caters to the middle-class shopper. That’s good, ordinarily, but right now, middle-class shoppers are pinching pennies and heading for outlets like Walmart (WMT) to do their shopping. Throw in the fact that Kohl’s is trading only slightly below its average price target, and that suggests it might have a long way to fall.

To give credit where credit is due, the company is making some noteworthy moves. These moves might help keep Kohl’s afloat through the upcoming onslaught of terrible conditions.

Nonetheless, “keeping afloat” is no investor’s goal, and that’s why I’m bearish on Kohl’s going forward. There will likely be a Kohl’s to come back to when all is said and done, but for right now, I’m more inclined to stay out.