Persistent macro uncertainty could make it difficult for investors to pick stocks that are well-positioned to outperform the broader market. In this scenario, it will be useful to look at well-established large-cap stocks (stocks having a market capitalization of more than $10 billion) that have the capability to navigate challenging macro conditions. We used TipRanks’ Stock Comparison Tool to place Coca-Cola (NYSE:KO), Energy Transfer (NYSE:ET), and Starbucks (NASDAQ:SBUX) against each other to pick the large-cap stock that could offer the best returns as per Wall Street analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Coca-Cola (NYSE:KO)

Beverage giant Coca-Cola has an extensive portfolio of brands, including Coca-Cola, Sprite, Fanta, Dasani, and BodyArmor. The company has been rapidly growing its non-soda and low or no-sugar offerings, keeping in view the growing aversion for sugary soda beverages.

Coca-Cola’s Q4 2022 revenue increased 7% to $10.1 billion, thanks to higher pricing and a favorable product mix. The company’s dominant position and its pricing power are helping it in navigating a high cost backdrop. However, Q4 2022 adjusted EPS was flat year-over-year at $0.45, as currency headwinds offset the impact of higher revenue and improved operating margin.

While Coca-Cola’s free cash flow declined 15% to $9.5 billion in 2022 due to inventory buildup and higher-than-expected tax payments, the company assured investors that its underlying cash flow generation remains strong. In February, Coca-Cola announced a 4.6% rise in its quarterly dividend per share to $0.46. This marks the 61st consecutive annual hike for the dividend king (a company that has increased its dividends for 50 straight years). Coca-Cola’s dividend yield stands at 2.9%.

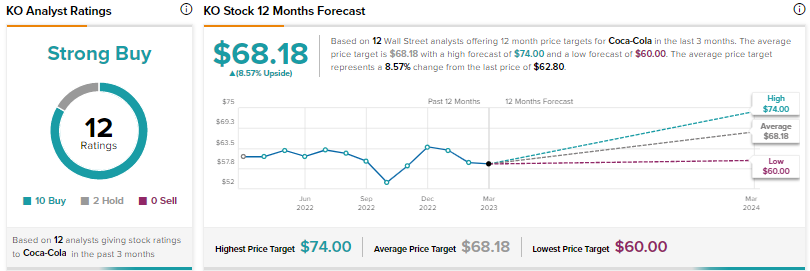

Is Coca-Cola Stock a Buy or Sell?

Recently, Deutsche Bank analyst Stephen Powers lowered his price target for Coca-Cola stock to $60 from $63 and reiterated a Hold rating. Powers sees growing macroeconomic risks for the consumer staples sector.

Meanwhile, Wall Street has a Strong Buy consensus rating on Coca-Cola based on 10 Buys and two Holds. The average price target of $68.18 suggests 8.6% upside potential. Shares are down 1.3% since the start of this year.

Energy Transfer (NYSE:ET)

Energy Transfer is a diversified midstream energy company in North America, with about 120,000 miles of pipelines in 41 states. The master limited partnership’s Q4 2022 revenue increased 10% to $20.5 billion, while EPS increased 17.2% to $0.34. However, both the metrics fell short of analysts’ estimates.

Adjusted distributable cash flow attributable to partners increased 19.4% to $1.91 billion in the quarter. Energy Transfer hiked its Q4 distribution (dividend) per unit by 15% to $0.305 ($1.22 on an annualized basis). With that hike, Energy Transfer offers an impressive dividend yield of 9.8%.

Meanwhile, Energy Transfer continues to strengthen its business with strategic acquisitions. Recently, it announced an agreement to acquire Lotus Midstream Operations for about $1.45 billion. The acquisition is expected to enhance Energy Transfer’s footprint in the Permian Basin and provide enhanced connectivity for its crude oil transportation and storage businesses. The deal, which is expected to be completed in Q2 2023, is anticipated to be immediately accretive to Energy Transfer’s free cash flow and distributable cash flow per unit.

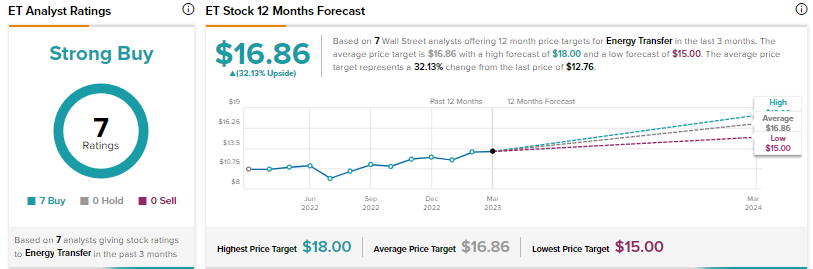

Is Energy Transfer a Good Stock to Buy Now?

Recently, Bernstein analyst Jean Ann Salisbury increased his price target for Energy Transfer to $17 from $16 and reaffirmed a Buy rating.

Other Wall Street analysts are also bullish on Energy Transfer, with a Strong Buy consensus rating based on seven unanimous Buys. At $16.86, the average ET stock price target implies 32.1% upside. Shares have risen more than 7% year-to-date.

Starbucks (NASDAQ:SBUX)

Leading coffee chain Starbucks’ revenue grew 8.2% to $8.7 billion in the first quarter of Fiscal 2023 (ended January 1, 2023), while adjusted EPS increased 4% to $0.75. However, Q1 results fell short of expectations due to weak performance in China, the company’s second-largest market, due to the disruptions caused by COVID-19 resurgence.

Nevertheless, the company is optimistic that China business will recover in the second half of Fiscal 2023. Meanwhile, Starbucks continues to expand its footprint and add high-return drive-thru locations. The company opened 459 net new stores in Q1 2023, ending the period with 36,170 stores worldwide.

What is the Target Price for SBUX Stock?

Recently, Starbucks’ founder and former CEO Howard Schultz testified in a Senate hearing about the company’s labor practices and allegations of union busting. Cowen analyst Andrew Charles called it a non-event for investors.

Charles opined that the importance of unionization in case of Starbucks is declining, given that only close to 300 stores out of 9,300 company-operated stores in the U.S. have voted to unionize. The analyst noted that the pace of unionization is also slowing. Charles reiterated a Buy rating on Starbucks, with a price target of $116.

Wall Street’s Moderate Buy consensus rating for Starbucks stock is based on 11 Buys and 12 Holds. The average price target of $114.80 suggests 9.4% upside. Shares have risen about 6% so far in 2023. Starbucks offers a dividend yield of 2%.

Conclusion

The large cap names discussed above are well-established companies with strong fundamentals. Currently, Wall Street sees higher upside potential in Energy Transfer compared to Coca-Cola and Starbucks. Moreover, Energy Transfer’s stellar dividend yield makes it a better pick than the other two large caps.

As per TipRanks’ Smart Score System, Energy Transfer scores a Perfect 10, implying that the stock could outperform the broader market over the long run.