For the average retail investor, the biggest question regarding the stock market today is how do I cut through the noise?

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The surest way to do that is to get expert advice. Find the best analysts out there, and watch the stocks they recommend. Wall Street’s top analysts have built their success and reputations on the quality of their calls. And fortunately for us, all of those calls are in the public domain – meaning we can parse that data to find the analyst who stands out from the crowd.

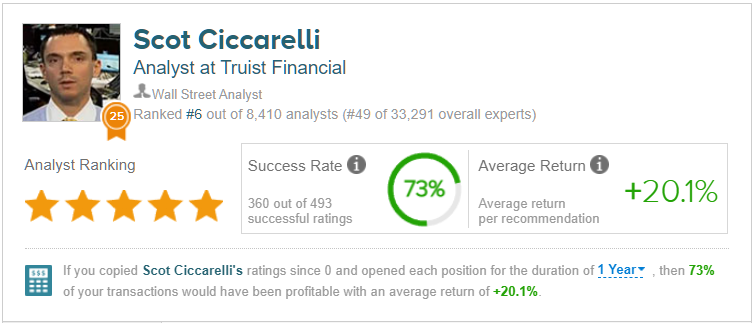

TipRanks has answered that call, compiling a comprehensive database of more than 8,400 analysts. These stock pros are rated and ranked based on the success of their stock reviews and the average return an investor would receive by following those reviews for one year.

On those criteria, analyst Scot Ciccarelli stands head-and-shoulders above most of his peers. Bolton’s success rate is 73%, and his stock picks have generated 20.1% average return. Ciccarelli is a Managing Director and Senior Equity Research Analyst at Truist Securities, which is also the #3-rated investment research firm by TipRanks.

Now that we know who to trust, let’s take a look at two of Ciccarelli’s recent stock picks. These are all Buy-rated equities with double-digit upside potential in the offing.

Tractor Supply (TSCO)

The first stock we’ll look at is Tractor Supply, a retailer in the outdoor supply sector. Tractor Supply is well-known as a supplier of tools and equipment for home, lawn, and garden, as well as equipment and gear aimed at farmers, ranchers, and professional landscapers. The company’s product lines include tools and hardware, hunting gear, outdoor apparel and footwear, outdoor power tools and mowers, and pet and livestock supplies – the list is expansive.

The long list of products and services is complemented by an extensive retail footprint. The company employs over 52,000 people in more than 2,100 stores across 49 states and has a history of expansion through mergers. In fact, Tractor Supply currently operates 2,164 stores, including 81 stores acquired last year from Orscheln Farm and Home. Tractor Supply’s customer loyalty program boasts over 20 million members, and the chain ranks as one of the largest farm and ranch retailers in the US.

Unsurprisingly, Tractor Supply’s earnings follow a predictable seasonal pattern, with the strongest results occurring in Q2 during the spring when retail customers and professionals restock their outdoor gear. The company’s latest financial report, from 1Q23, showed a top line of $3.3 billion and a bottom line of $1.65 per share. Year-over-year, the revenue total increased by 9.1%, while the EPS remained flat.

We should note that the Q1 revenue and earnings both missed analyst expectations, revenue by $11 million and EPS by 6 cents. The miss was attributed to slow sales due to the late arrival of spring weather – the longer-lasting winter conditions depressed demand.

However, despite the earnings miss in Q1, investors have reasons to stay bullish, according to Ciccarelli.

“While 1Q comps came in modestly below expectations (2.1% vs. our in-line ~5%E), it was largely driven by the late start to Spring/soft seasonal sales rather than broader consumer weakness. Supporting this view, the company experienced consistent sales in its ‘everyday items’ (CUE outperformed the chain average), a wide divergence in sales performance by geographies and comps have accelerated to +MSD in April as weather headwinds have eased in some markets. Further, the late start to Spring could fuel incremental upside in 2Q and, potentially, even 3Q,” Ciccarelli explained.

“We believe TSCO remains one of the most compelling defensive growth equities in the market and remain aggressive buyers,” the top analyst summed up.

Ciccarelli goes on to give this stock a Buy rating with a $280 price target that implies a 30% upside in the next 12 months.

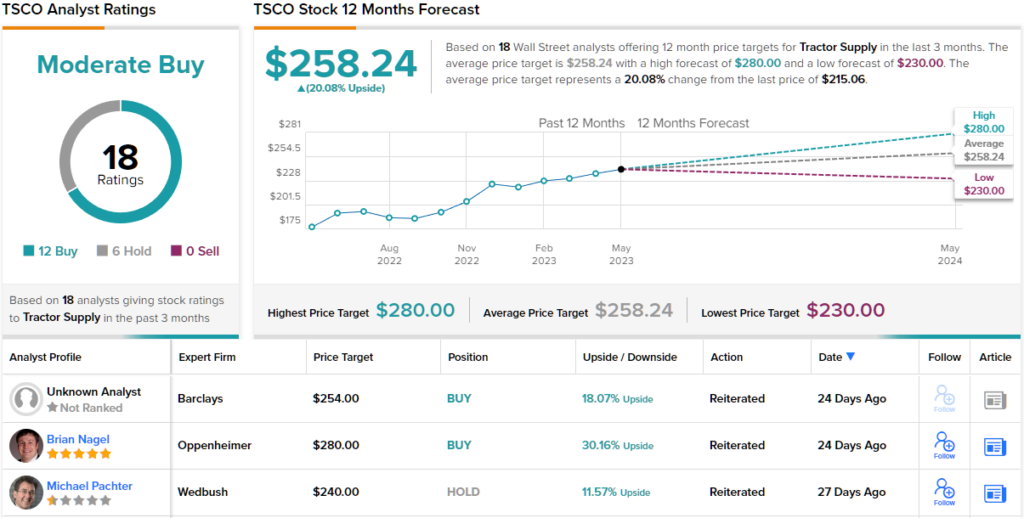

So, that’s Ciccarelli’s view, let’s take a look now at what the rest of the Street has in mind for TSCO. Based on 12 Buys and 6 Holds, the analyst consensus rates the stock a Moderate Buy. With an average price target of $258.24, the analysts expect shares to appreciate 20% over the next 12 months. (See TSCO stock forecast)

European Wax Center (EWCZ)

The second stock we’ll look at here is European Wax Center, a chain of retail hair-removal and skincare salons. Despite its name, European Wax Center was founded in Florida and is currently headquartered in Texas. The company operates 978 locations across the continental US and Hawaii, spanning a total of 45 states. Their services include body hair removal, with specialties such as eyebrow shaping, as well as skincare treatments offered both before and after waxing. These services are available for both women and men.

Body waxing is a growing niche in the US, and European Wax Center is capitalizing on this trend. The company offers customers services provided by professional staff in the comfort of individual waxing suites. Their salons operate on a franchise basis, and in March of this year, the trade magazine Entrepreneur ranked European Wax Center as the 30th fastest-growing franchise in the US out of over 1,300 franchises ranked.

Earlier this month, EWCZ reported its results for Q1 of fiscal year 2023. The quarter, which ended on April 1 of this calendar year, showed a top line total revenue of $49.9 million. That revenue, while up 9.8% from the prior-year period, missed the forecast by ~$573,000. The company reported a GAAP net loss of $1.1 million, and an adjusted EBITDA figure of $16.3 million.

During the quarter, EWCZ also showed some sound growth numbers. The company opened a net of 34 new centers, for a 12% year-over-year increase, and its system-wide sales were up 5.5% to $218.4 million. The chain’s same-store sales grew y/y by 4.5%.

Checking in again with Ciccarelli, we find him taking an upbeat stance on EWCZ, writing of the stock: “Overall demand trends are very solid (and likely to look even better following other EPS reports), EWCZ is highly profitable, has a massive expansion opportunity (3x) and generates huge returns for their franchisees (estimated ~60% cash on cash returns by year 5).”

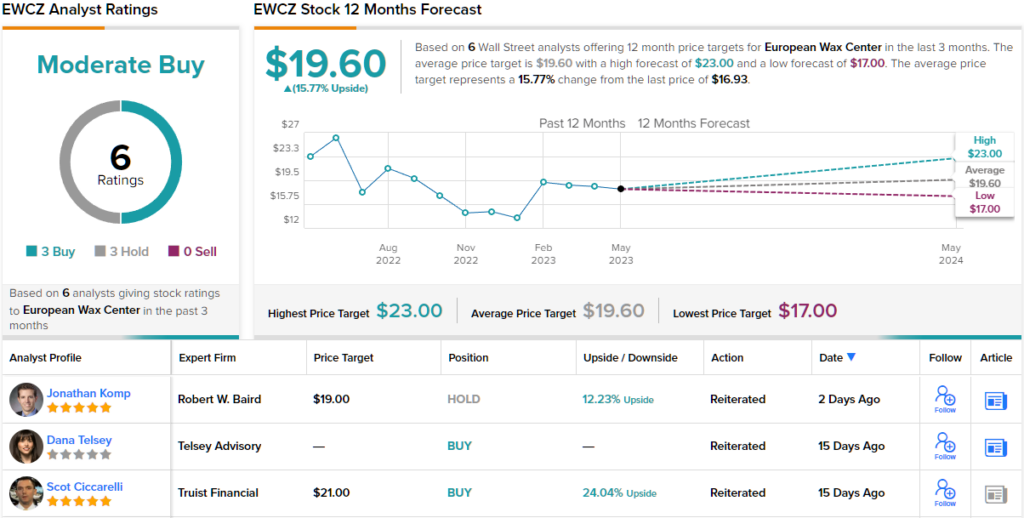

In-line with those comments, Ciccarelli gives EWCZ shares a Buy rating, and his price target, set at $21, indicates his confidence in a 23% one-year upside potential.

Overall, the five recent analyst reviews on this stock break down to 2 Buys and 3 Holds, making a Moderate Buy consensus rating. The shares have a current trading price of $16.93 and the $19.60 average price target suggests ~16% upside from that level. (See EWCZ stock forecast)

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.