Electric cars leader Tesla (NASDAQ:TSLA) reported its Q1 2023 financial results last Wednesday, and as you may have guessed from the 10% decline in stock price, investors were not overly pleased with the results.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Although Tesla grew its revenue 24% year over year, to $23.3 billion, broadly meeting analyst predictions, “adjusted” earnings for the quarter declined 21% to just $0.85 per share. And yes, that number was also in line with analyst estimates. It’s just that both the estimates, and the results, were down steeply — as opposed to the sales number which was up. And adding injury to insult, earnings as calculated according to GAAP accounting standards showed a 24% decline to just $0.73 per share.

So you can see why investors reacted negatively to the news. The question posed by Morgan Stanley analyst Adam Jonas is whether investors might possible have over-reacted to the news.

To check this hypothesis, Morgan Stanley conducted a couple of unscientific surveys to gauge investor sentiment towards Tesla right now. Following in the wake of several months’ worth of price cuts on Tesla EVs, and one disappointing earnings report that confirmed that — shocker! — when a company cuts the price of its product, it earns less money, Morgan Stanley first held a “bull/bear lunch” and asked for a show of hands from investors expecting Tesla to outperform the market over the next six months.

Zero hands went up.

Next, Morgan Stanley sent out an email survey asking, basically, for outperform/underperform predictions from 44 institutional investors and industry experts. 71% of these worthies opined that Tesla will underperform the S&P 500 over the next six months. And while 71% is a lot better than 100%, the Tesla bears in this second survey still outnumbered the Tesla bulls by more than 3-to-1.

That’s an awful lot of negativity surrounding a stock that has gone up 755% over the last five years, versus a 52% gain for the S&P 500.

Then again, it’s also not entirely illogical. If Tesla went up faster than it should have, then perhaps it makes sense that from here on out the stock might not keep going up so fast — or that it might even come down a bit.

But even so, Jonas is of the opinion that Tesla is the “alpha in EVs” — as in, the pack leader — and that by initiating a price war against everyone else trying to make electric cars, it’s essentially setting the pace of this race, and forcing everyone else’s prices (and profit margins) down as well. While it’s true that, for now at least, this seems to be bad news for Tesla’s profit margins, it could end up being even worse for everyone else’s.

This is still cold comfort for Tesla investors, however, whose shares — while up strongly over the last five years — are also down by more than half over the last five months. And Jonas warns Tesla investors that the pain may keep coming. However everyone else in the industry responds, Tesla’s own “price cuts are likely not over yet,” with all the implications that prediction has for continued falling profit margins, and falling profits, at the electric cars leader.

Whether Elon Musk’s price war turns out to be a “masterstroke” or a “blunder” in the long term, in the short term investors are probably right to anticipate further share price declines.

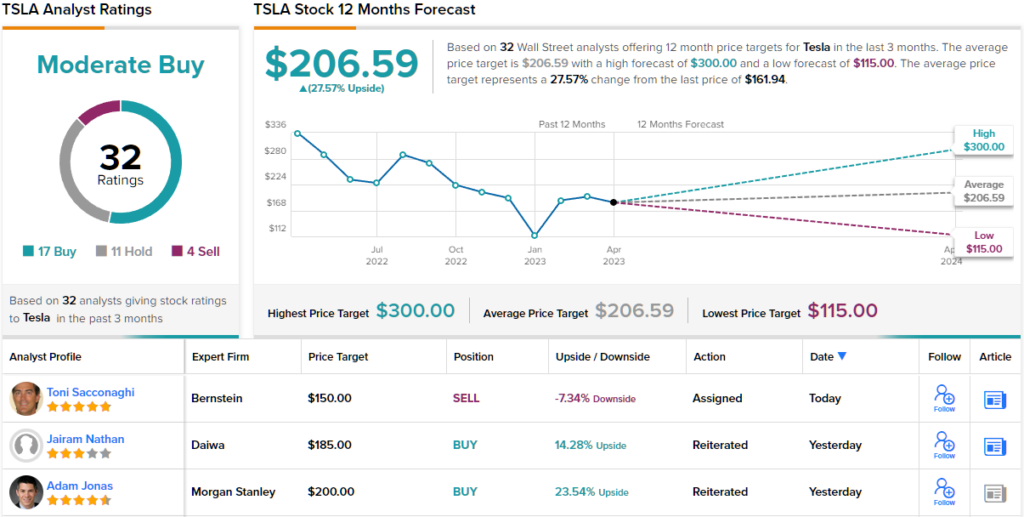

But that doesn’t mean you should sell Tesla, says Jonas. The analyst rates the stock an Overweight (i.e. Buy), along with a $200 price target. Therefore, he expects the stock to change hands for 23.5% premium over the next 12 months. (To view Jonas’ track record, click here)

What does the rest of the Street think? Looking at the consensus breakdown, opinions from other analysts are more spread out. 17 Buys, 11 Holds and 4 Sells add up to a Moderate Buy consensus. In addition, the $206.59 average price target indicates 27.5% upside potential. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.