Given the decline in crypto prices and activity during 2022, it was hardly surprising to learn that the headline metrics in Coinbase’s (NASDAQ:COIN) 4Q22 report dropped dramatically compared to the same period a year ago. Nevertheless, the results still managed to beat Street expectations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The leading crypto exchange saw revenue drop by almost 75% year-over-year to $629.1 million but the figure came in $41.73 million above the analysts’ forecast. The company has been diversifying its revenue stream so although transaction revenues fell by 12% sequentially, subscription and services revenue increased by 34% quarter-over-quarter to $283 million. On the bottom-line, Q4 GAAP EPS of -$2.46 came in better than the -$2.51 expected by the prognosticators.

As for the current quarter, Coinbase said that in January it generated transaction revenues of $120 million, and it anticipates subscription and services revenue between $300-$325 million in Q1, a 6%-15% sequential uptick.

The company is also making concerted efforts to manage costs and turn EBITDA positive, believing the job culls announced last month and continued cost management endeavors will result in more than a 30% drop in first quarter expenses vs. 4Q22.

Results aside, with crypto increasingly in the regulators’ crosshairs, and Coinbase expecting further regulatory scrutiny this year, Wedbush analyst Moshe Katri thinks the company’s “investments in transparency and compliance (since its IPO) will go a long way.”

“Bottom line,” the 5-star analyst further said, “excluding the possibility of a ‘black swan’ event, where regulators completely bar crypto ownership, and assuming regulatory enforcement forces compliance in the areas of: transparency (fee), safety (liquidity), and security (privacy, fraud, cyber), we believe COIN is well positioned to survive and succeed especially given recent, aggressive focus on cash preservation. This is the same company that generated north of $14.00 in CY21.”

So, how does this all translate to investors? Katri rates COIN shares an Outperform (i.e., Buy), while his $75 price target implies ~31% upside for the year ahead. (To watch Katri’s track record, click here)

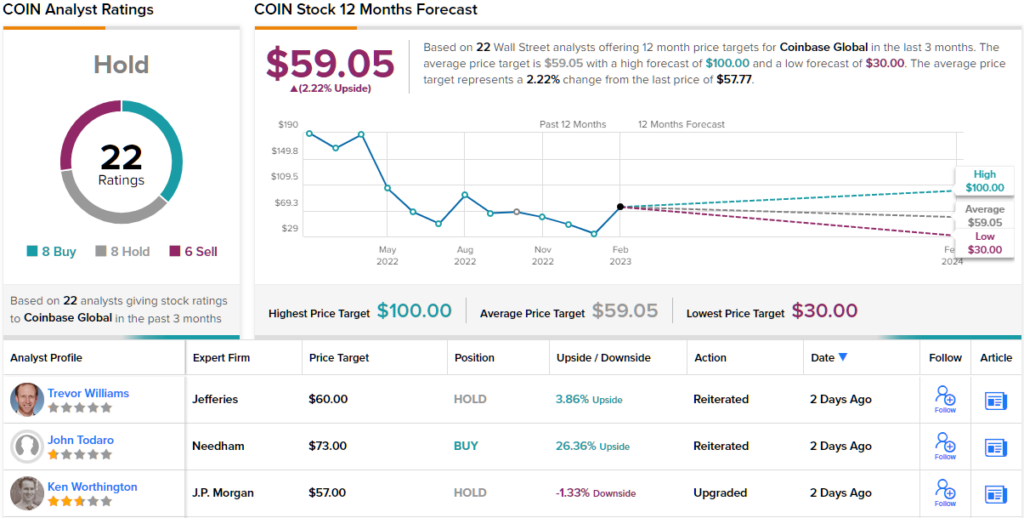

Katri takes the bullish view of COIN, but there is a range of opinions on Wall Street. The stock has a Hold rating, based on a 8-8-6 split between Buy, Hold, and Sell ratings. The current share price is $58, and the average price target of $59.05 suggests a 2% downside upside from that level. (See Coinbase stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.