Apple’s (NASDAQ:AAPL) new iPhone is literally hot property. Many new iPhone 15 users have been complaining of overheating devices, claiming they have been heating to such an extent that they are even too hot to handle. Apple on its part has said a software update that should solve the issue is on the way, claiming the overheating is a result of several factors, including bugs in iOS 17 and some third-party apps.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Whether this setback affects sales remains to be seen, but in any case, a recent survey conducted by Evercore analyst Amit Daryanani, suggests demand for Apple’s flagship product remains solid.

For one, the findings of the 4,000-strong survey show that ASPs (average selling prices) are shifting higher. Boosted by Apple taking away the 128GB option on the ProMax model and a “broader shift towards higher configurations across the models,” Daryanani reckons blended ASPs should see a ~3% uptick during the iPhone 15 cycle.

It also looks like the overall trend of a shift toward Pro models has legs. Compared to the previous cycle, 87% plan on buying iPhone 15s against 84% for the iPhone 14 with the “sharp uptick in demand” for the Pro and Pro Max models seen in last year’s iPhone 14 survey being sustained with the latest survey.

Lastly, at 318GB per device (compared to 286GB last year), average memory per unit continues to inch higher. “This has a positive impact to ASP/revenues but also on margins for AAPL,” notes the 5-star analyst.

The iPhone aside, compared to last year, both for the Apple Watch & Airpods, interest remains at “all time high levels.”

The survey’s results indicate Apple will meet or even outpace the Street’s forecast when it dials in its next earnings report. “Overall,” Daryanani summed up, “we think the survey data along with the lead-time elongation for iPhone 15 Pro and Pro Max delivery suggest we should see in-line to modest upside vs. street expectations for Sept-qtr and likely Dec-qtr.”

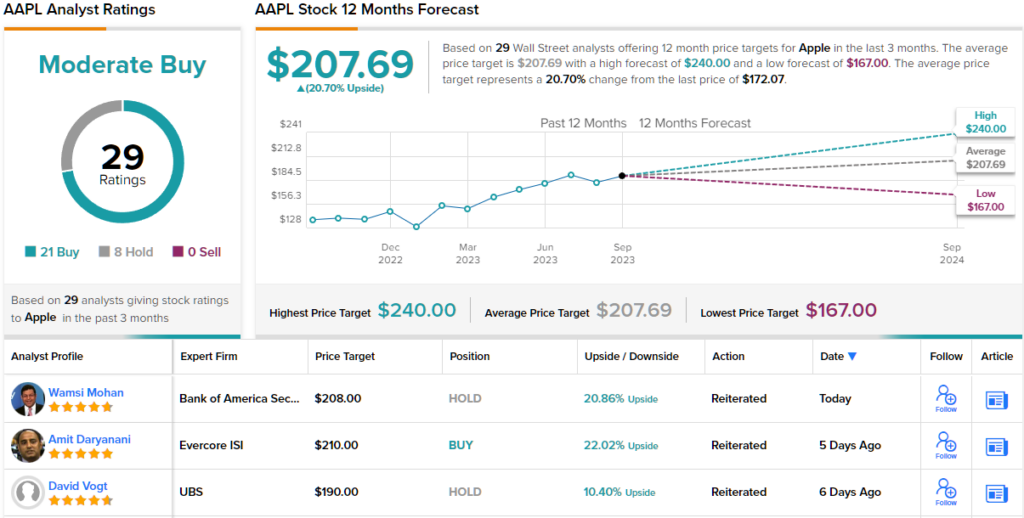

Down to business, what does this all mean for investors? Daryanani reiterated an Outperform (i.e., Buy) rating on Apple shares, backed by a $210 price target, suggesting share will gain 21% in the year ahead. (To watch Daryanani’s track record, click here)

Apple retains most of the Street’s support but not all are convinced. The stock claims a Moderate Buy consensus rating, based on 21 Buys vs. 8 Holds. The forecast calls for 12-month returns of 19%, considering the average target currently stands at $207.69. (See Apple stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.