Apple’s (AAPL) newest versions of its flagship product, the iPhone 15, has been getting a bit of a lukewarm reception. The evidence can be seen in the muted recent share price performance. Since the start of the month, the stock is down by ~7.5%, with the new model’s launch failing to ignite a rally while concerns around a Chinese ban of government employees using iPhones have lingered.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That said, checking in with the initial pre-orders data, Wedbush analyst Dan Ives says it is coming in much better than he – or the Street – initially expected. iPhone 15 pre-orders kicked off last Friday, and so far, based on Ives’ analysis, are up roughly 10%-12% vs. the iPhone 14.

“The mix is heavily skewed towards iPhone 15 Pro/Pro Max with Pro Max exceptionally strong in the US, China, India, and parts of Europe,” says the 5-star analyst. “This is a clear positive for Apple with ASPs set to be a major tailwind for Cupertino in this iPhone 15 cycle with our expectation of an ASP in the ~$925 range and up roughly $100 over the last 12-15 months given heavy Pro mix model shifts.”

The iPhone 15 is set to make its Apple Store/retail debut on Friday (Sep 22), with Ives believing this cycle’s “clear standout” will be the iPhone 15 Max. According to Ives, pre-orders in India are showing a 25% year-over-year increase, and promisingly, in the face plenty of China-related noise, are looking strong in that region too. Despite growing Street skepticism, Ives remains confident market share gains “will remain steady” in China during this cycle.

Based on Asia supply checks, Ives sees around 85 million iPhone 15 units “out of the gates” with even 90 million within reach, boosted by “eye-popping” carrier promotions already taking place, which heading into the holiday season, should be a “major catalyst for upgrades.”

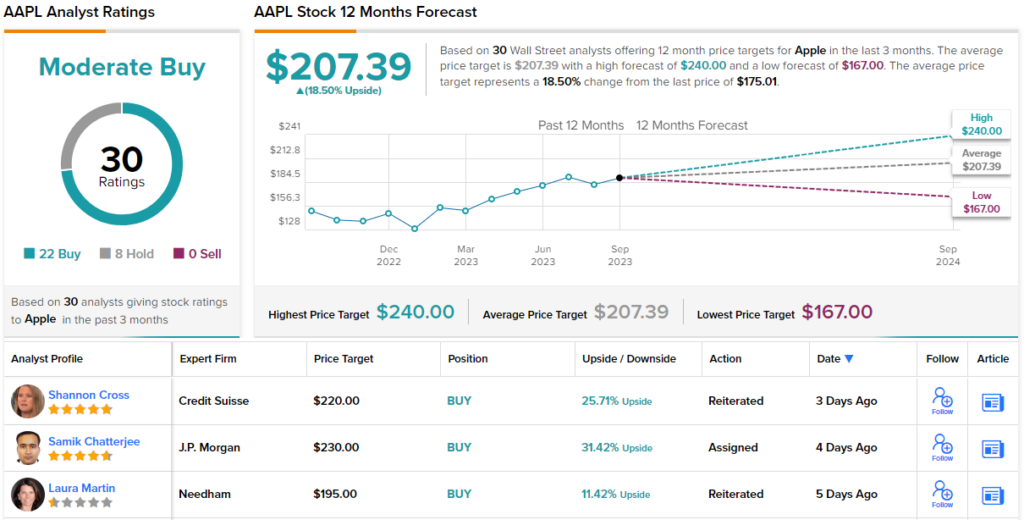

That said, there’s no need for an upgrade on Ives’ part right now. He sticks with an Outperform (i.e., Buy) rating and Street-high $240 price target. There’s potential upside of 37% from current levels. (To watch Ives’ track record, click here)

Most analysts agree with Ives’ stance but not all are on board. All told, the stock claims a Moderate Buy consensus rating, based on 22 Buys vs. 8 Holds. Going by the $207.39 average target, a year from now, the stock will be changing hands for an 18% premium. (See Apple stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.