Amazon (NASDAQ:AMZN) launched its Prime Day sales event in 2015, since when it has consistently shattered sales records every year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

And last October, it introduced a new sales event known as Prime Big Deal Days, also referred to as the Prime Early Access Sale. This event offered deals similar to those seen on Prime Day and served as the kickoff for the holiday shopping season. It also offered a way for the ecommerce giant to get a head start on holiday shopping over brick-and-mortar retail. Initially intended as a one-time event to boost Prime subscriptions, Amazon now has another Prime Early Access Sale event scheduled for October this year.

It’s hardly surprising Amazon has decided to run again with this second event, as going by Barclays’ credit card data, firm analyst Ross Sandler notes that these promotional activities are having a wider impact than just boosting sales on the event days.

Per the data, Sandler notes that the whole Prime month has regularly resulted in more spend per person compared to the average of the first six non-Prime months between 2019 to 2023.

And that is true also of the Prime Big Deal Days sale. A comparison of monthly spend per person in 2022 amongst Amazon, Walmart, Target, and eBay shows that the Prime Big Deal Days led to growth of 5.6% in October last year vs. the average spend per person of non-sale months among competitors.

Moreover, Walmart aside, none of the rivals exhibited positive growth in October and even Target with its Target Deal days, displayed negative 1% growth. “This indicates that introducing Prime Big Deal Days put Amazon ahead of competitors,” says the 5-star analyst.

The implications are clear. “Amazon’s Prime Day and Prime Early Access strategy seem to be accomplishing the intended goals,” Sandler sums up, “to drive more Prime membership and to increase wallet share among Prime members (from other retail outlets).”

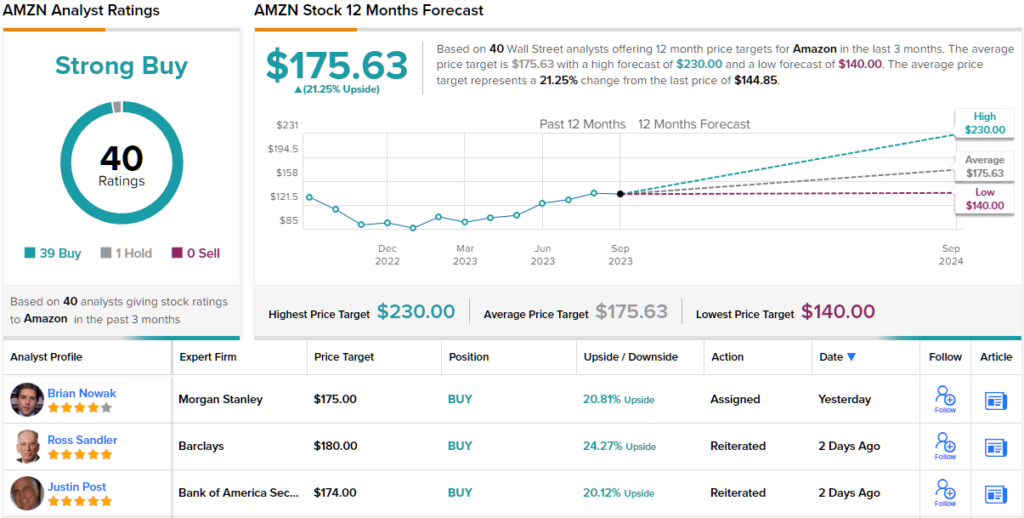

All told, Sandler rates Amazon shares an Overweight (i.e., Buy), while his $180 price target offers one-year upside of 24%. (To watch Sandler’s track record, click here)

Amazon has plenty of support elsewhere on the Street. Barring one skeptic, all 39 other reviews are positive, making the consensus view a Strong Buy. Should the $175.63 average target be met, in a year’s time, investors will be sitting on returns of ~21%. (See Amazon stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.