The week kicked off in busy fashion for Oracle (NYSE:ORCL) with one big development and potentially another in the cards for the business software giant.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

On Monday, the company unveiled a major leadership shift, with long-time CEO Safra Catz stepping aside as Clay Magouyrk and Mike Sicilia take over as co-CEOs. Magouyrk had been leading the OCI (Oracle Cloud Infrastructure) division, while Sicilia oversaw Oracle Industries, concentrating on vertical applications. During its business update call, management emphasized the scale of the AI opportunity across its operations and the unique advantages Oracle can deliver by integrating infrastructure, data, and applications. “Despite the management change,” says William Blair analyst Sebastien Naji, “we expect Oracle will remain on its current path, with the new co-CEOs doubling down on the AI theme and the company reaffirming its prior guidance.” Naji thinks more clarity on each executive’s strategic agenda will be forthcoming when Oracle hosts its AI World event next month.

Beyond the leadership shuffle, the Wall Street Journal reported yesterday that the U.S. and China are close to finalizing a deal on TikTok’s sale. The plan calls for a newly formed TikTok U.S. entity, with a consortium of investors led by Silver Lake and Andreessen Horowitz holding about half the stake, existing investors controlling another 30%, and parent company ByteDance retaining just under 20%. ByteDance would license its algorithm to the new entity for use in a U.S.-specific app. Bloomberg added that Oracle is expected to provide the infrastructure needed to retrain and safeguard TikTok’s U.S. algorithm. For Oracle, this arrangement removes uncertainty about TikTok’s status as a customer, which Naji estimates accounts for $1–2 billion in annual revenue. “While there is still execution risk, with the potential shift to a new app and algorithm causing disruption and leading to user churn, we see an opportunity for Oracle to also substantially expand its revenue opportunity with the new U.S.-based entity,” Naji went on to add.

ORCL shares have been on a big runup recently, as the company hit a homerun in its recent quarterly report, with bookings having gone through the roof. But there’s no reason to step to the sidelines, says Naji. “While shares are not inexpensive, strong bookings growth points to a meaningful acceleration in Oracle’s revenue and earnings growth over the next several years,” the analyst opined.

Bottom line, with Oracle positioned as a “key AI beneficiary,” the set-up still looks favorable to Naji, who reiterated an Outperform (i.e., Buy) rating on the shares, with no fixed price target in mind. (To watch Naji’s track record, click here)

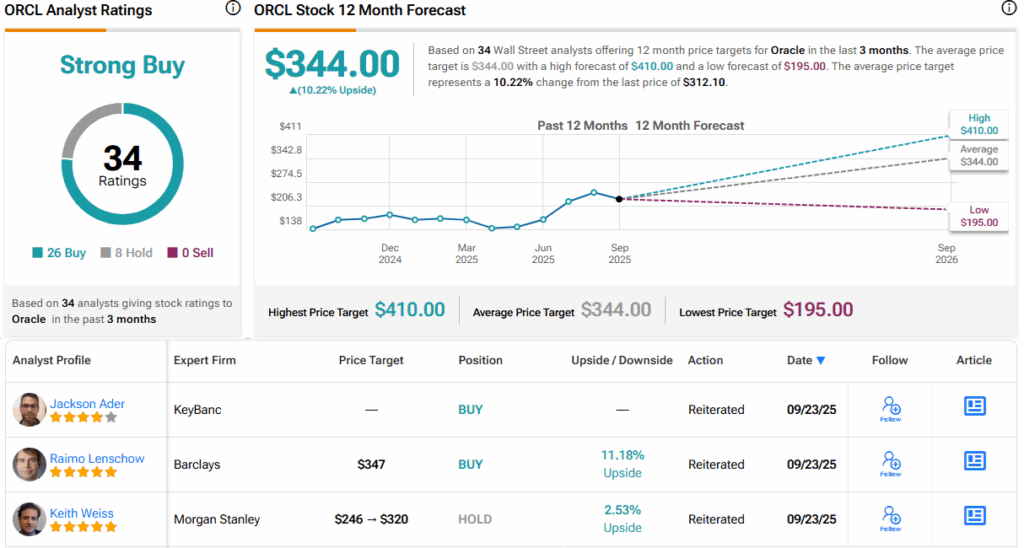

Others on the Street do have targets, and the average lands at $344, implying the shares will climb 10% higher in the months ahead. All told, the stock claims a Strong Buy consensus rating, based on a mix of 26 Buys and 8 Holds. (See ORCL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.