Broader markets were weighed down last week, thanks to Fed chair Jerome Powell’s latest comments, which likely helped push 10-year rates briefly above 5%. Resilient staple stocks like KDP and PEP, which typically withstand market turbulence, have lately faced challenges. This isn’t just due to macro unknowns but a headwind specific to food and beverage stocks. Indeed, the headwind I speak of is the effect of Ozempic and other weight-loss drugs and their impact on consumption.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Such obesity drugs, which, while popular among people looking to shed pounds, seem extremely overhyped at this point — so much so that I think the latest sell-off in the food and beverage scene may have produced numerous opportunities for investors looking to ride out a rough economic landing.

Therefore, let’s check in with TipRanks’ Comparison Tool to see how the two aforementioned beverage stocks are faring after the market’s latest spill.

Keurig Dr. Pepper (NYSE:KDP)

KDP stock is down ~28% from its August 2022 high of $41.31 per share. The sell-off in the $40 billion beverage company kicked off well before most other food, beverage, and staple stocks really rolled over just in time for autumn. Even if you’re not a fan of the soft drink or the industry outlook as more people go on Ozempic, it’s hard not to like the stock’s valuation going into an environment that may very well see an economic landing that’s anything but soft. For this reason, I am inclined to be bullish on KDP.

At writing, shares of KDP trade at just 15 times forward price-to-earnings (P/E), well below the non-alcoholic beverage industry average of 19.4 times. Of course, you’re not just getting sugary soda exposure from the firm; its Coffee business stands to be more resilient in the face of Ozempic and other weight-loss drugs.

Ozempic may curb demand for fatty foods, but many people still need their morning caffeine fix. In that regard, Keurig’s Coffee segment, which has faced inflation-fueled cost headwinds of late, could become a pillar of stability moving forward once expenses normalize.

Soda sales are better than flat (forgive the pun), with organic revenues in the beverages division rising just north of 6% for the second quarter. Though Coffee was a sore spot for the latest quarter, UBS analyst Peter Grom is a bull on the segment, moving forward. In fact, he thinks the segment could help expand revenues going into the new year. I’m inclined to agree with Grom. Investors should wake up and smell the turnaround potential in Keurig’s Coffee business.

Nevertheless, while K-cups are pretty much synonymous with rapid-brew coffee, there is competition in the space. Nespresso has really leaned into the premium end of the market in recent years, making it a potential threat if the firm decides to form partnerships with various retailers to bring Nespresso pods to their stores. For now, K-pods rule the retail scene as Nespresso goes down the direct-to-consumer route, at least with its pods.

What is the Price Target of KDP Stock?

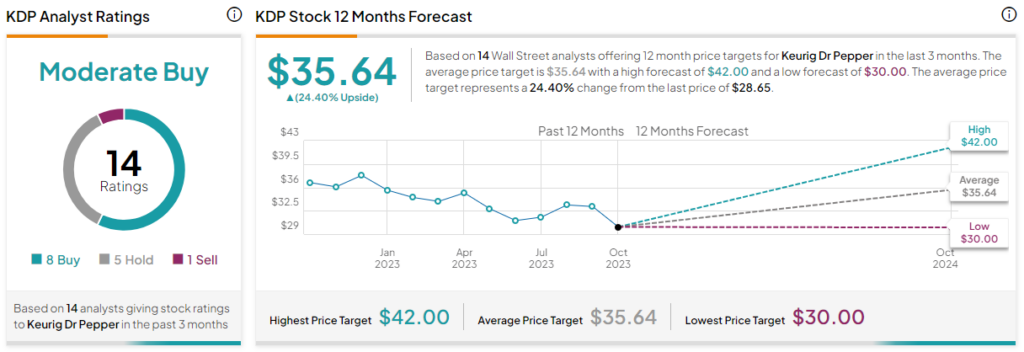

Keurig Dr. Pepper is a Moderate Buy, according to analysts, with eight Buys, five Holds, and one Sell rating given in the past three months. The average KDP stock price target of $35.64 implies 24.4% upside potential.

Pepsi (NASDAQ:PEP)

Pepsi isn’t just a great beverage stock; it has a pretty robust snack business as well. Normally, the drink-and-snack combo makes for a terrific one-two combo in a rocky market environment. However, with growing worry over the impact of Ozempic, Pepsi stock hasn’t been immune to the market’s choppiness this time around. In fact, shares have done worse than the market so far this year, now down around 9% year-to-date compared to the 10.5% gain for the S&P 500 (SPX).

Sure, Pepsi may be more vulnerable to sales erosion at the hands of Ozempic versus other food stocks. That said, I continue to find Pepsi to be a great stock with strong brands and a now modest valuation. For that reason, I must stay bullish.

Pepsi stock trades at 19.6 times forward P/E, pricier than Keurig Dr. Pepper’s 15 times multiple but in line with the non-alcoholic beverage industry average (19.4 times forward). Though there are a lot of great staples in the peer group, Pepsi’s brands still stand out as deserving a premium. Therefore, the current valuation looks discounted.

The company is also fresh off a solid beat and raise that the market may be overlooking amid the woes caused by weight-loss drugs. Third-quarter earnings came in at $2.25, a dime higher than the analyst estimate of $2.15. Management also hiked its guidance, which was enough to help the stock enjoy a very short-lived pop.

At $160 per share, I view Pepsi stock as one of the better ways to play defense in an increasingly rocky market landscape.

What is the Price Target of KDP Stock?

Pepsi stock is a Moderate Buy, according to analysts, with 10 Buys and seven Holds assigned in the past three months. The average PEP stock price target of $189.00 implies 18.1% upside potential.

The Bottom Line

Don’t let the haze of Ozempic worries cloud the value to be had in names like Keurig Dr. Pepper or Pepsi. Ozempic onslaught or not, the power of a strong brand will shine through, especially as inflation continues to be tamed. Nonetheless, of the duo, analysts see more upside in KDP stock.