It’s been a wild ride this past summer. Perhaps the least we can say of the macro situation is, at least it wasn’t as wild as 2020 – but 2021 has had its share headlines hitting the markets. One thing is clear, however: stocks have weathered the storm. The S&P 500 index is up 19% so far this year, and the NASDAQ has gained 17%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Looking at the macro situation for JPMorgan, strategist Marko Kolanovic notes the confused headwinds and tailwinds, and comes down firmly for the bulls.

“The peak in activity indicators is now firmly behind us and growth is likely to stay significantly above trend into year-end. We look for both strong consumer and capex given pent-up demand, improving labor markets, and robust fundamentals. Further, positive shifts in China policy and the upcoming implementation of the EU recovery fund will help. We continue to think that the market should not worry about both the cycle and the Fed at the same time as they should be mutually exclusive. Delta is a wild card, but we believe it is unlikely to result in renewed strict lockdowns,” Kolanovic opined.

Kolanovic’s view has filtered down to his firm’s stock analysts, who have been busy picking the stocks they see as gainers in the current environment. Using the TipRanks database, we’ve found three stocks that JPMorgan’s analysts have picked out for at least 50% gains. Even better, these tickers have Strong Buy consensus ratings from the analyst community. Let’s take a closer look.

Hyzon Motors (HYZN)

We’ll start with Hyzon Motors, a unique company in the ‘green’ automotive sector. Hyzon is working on hydrogen fuel cell vehicles, using fuel cell tech as an alternative to batteries to power automotive electric systems. The company is focused on trucks and commercial vehicles, and is gearing up for full production of medium-duty and heavy-duty trucks as well as full-sized urban busses and long-distance bus coaches. The company has already delivered some 500 vehicles from prototype and early-run production.

Hyzon made its first production deliveries to European customers in July of this year, and is making preparations for customer trials in the US. The trial program will operate in Southern California, with a commercial port and trucking company, Total Transport. Hyzon will provide a Class 8 heavy duty full-cell truck to Total for a 30-day road test under regular operational conditions. The trial will run in 4Q21.

This cutting-edge automotive tech company is also a newcomer to the public markets. Hyzon completed a SPAC merger with Decarbonization Plus Acquisition Corporation in July, and the HYZN ticker debuted on the market on July 19. The merger brough Hyzon approximately $550 million in new capital, which the company is putting to use in its current expansion activities.

In August, Hyzon reported its first quarterly results as a public company, for 2Q21. Management noted that Hyzon has two factories in operation, in the Netherlands and in Chicago, and that third, larger, facility will open in Rochester, New York in mid-2022. Management described Q2 as the company’s last ‘pre-revenue’ quarter, and stated that the company has $517 million in cash available for scaling-up operations.

Covering the stock for JPMorgan, analyst Bill Peterson believes HYZN presents a compelling risk reward. Peterson rates the stock an Overweight (i.e. Buy) along with a price target of $18. Hitting Peterson’s target could yield returns of 78%. (To watch Peterson’s track record, click here)

Peterson backed his stance saying, “Our Overweight thesis on Hyzon is based on the company’s meaningful growth opportunities and differentiated product. Hyzon is a pure-play hydrogen mobility company poised to disrupt the rapidly growing heavy-duty FCEV market (double digit CAGR). Hyzon is an early leader with advanced fuel cell technology that can be applied to on-road transportation today, as well as grow to rail, aviation and marine in the future, expanding its addressable market opportunity.”

The analyst summed up, “We anticipate outsized appreciation potential relative to our coverage universe, thus driving our Overweight rating on HYZN shares.”

Overall, the unanimous Strong Buy consensus on Hyzon shows that Wall Street agrees with the bullish JPM view. The stock’s rating is based on 4 recent positive reviews, and the $19 average target suggests a robust 87% upside from the trading price of $10.16. (See HYZN stock analysis on TipRanks)

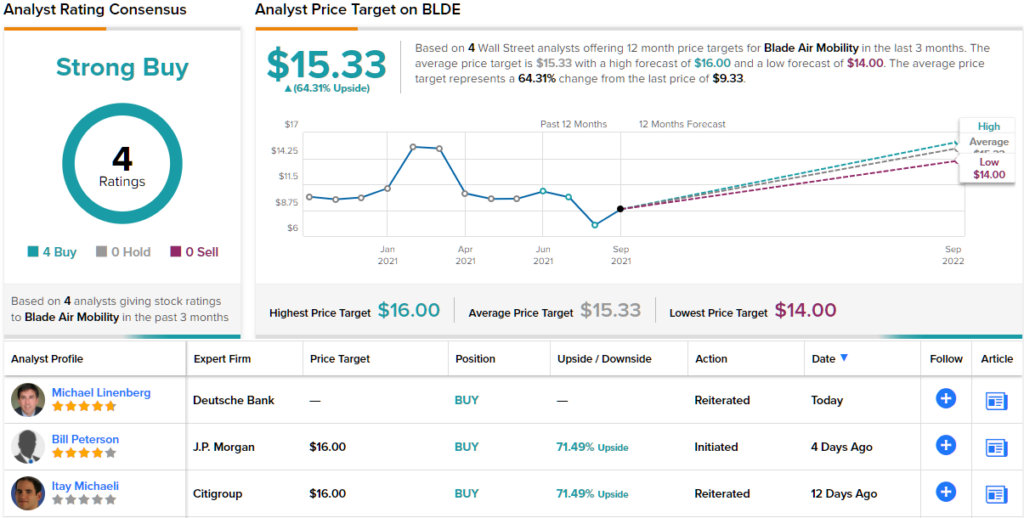

Blade Air Mobility (BLDE)

The next JPM pick we’re looking at is Blade Air Mobility, a provider of urban air transit. This New York City-based company operates in the Northeast and on the West Coast, where it allows customers to book short-hop helicopter flights and private chartered flights, offering greater flexibility and a more luxurious travel experience than commercial airlines.

Urban air mobility has been a high-end niche for decades, but Blade is working to expand it – both by expanding the customer base, and the services offered. The company’s core service remains helicopter transit between Manhattan and the New York area’s airports, but Blade also offers flights to much of Long Island, and to Massachusetts. Private chartered jet flights offer passengers even more flexibility as to destinations. And, just this month, Blade announced that it will acquire Trinity Air Medical, bringing a dedicated organ air transport service into its package. The acquisition will cost Blade some $23 million in cash up front – but Trinity is a profitable company with approximately $16 million in annual revenues.

Earlier this year, in May, Blade became the first publicly traded urban air mobility company when it completed a SPAC merger with Experience Investment Corporation. The merger saw the BLDE ticker start trading on May 10, and brought Blade some $365 million in new capital to fund expansion activities like the Trinity acquisition.

In his coverage of BLDE for JPMorgan, analyst Bill Peterson sees the company with a clear path forward. Peterson rates BLDE an Overweight (i.e. Buy), and his $16 price target suggests it has ~73% upside potential.

“Our Overweight thesis is supported by Blade’s first-mover advantage in the Urban Air Mobility (UAM) space. Blade has strong growth momentum that should accelerate on rising brand awareness and with increased use of the innovative on demand and scheduled helicopter services, expansion into new routes, with the business model to potentially be further catalyzed by the introduction of eVTOLs (electric vertical takeoff and landing aircraft) or, as the company labels, electric vertical aircraft (EVA) by mid-decade. As an agnostic user of aircraft, Blade’s model does not depend on the success of anyone or a handful of EVA companies,” Peterson explained.

Overall, we’re looking at a stock with a unanimous Wall Street analyst consensus – 4 reviewers have weighed in, and they have all put a seal of approval here, for a Strong Buy rating. BLDE shares are trading for $9.31, and the $15.33 average price target suggests room for 64% growth this year. (See BLDE stock analysis on TipRanks)

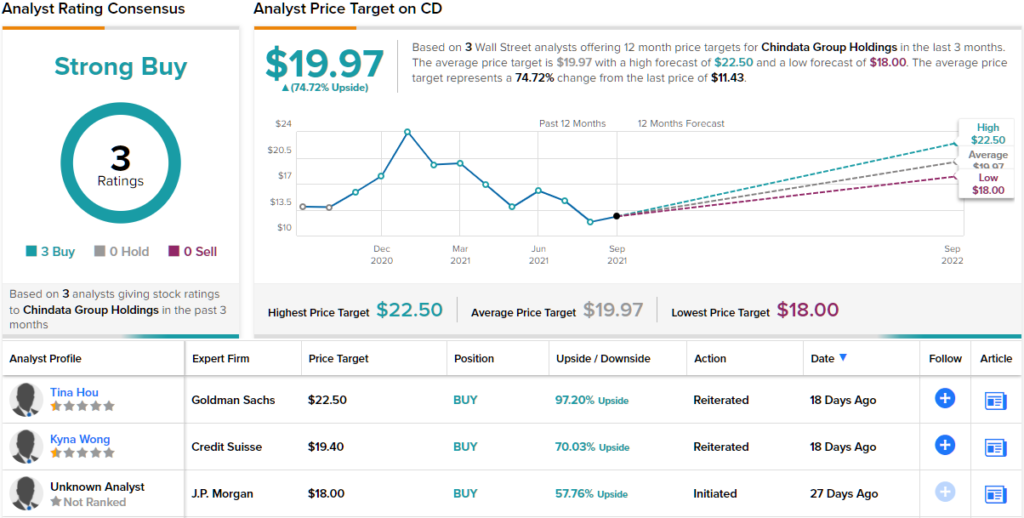

Chindata Group Holdings (CD)

Last on our list of JPM picks is Chindata Group, a major provider of carrier-neutral hyperscale data center solutions in the Asia-Pacific region. Chindata’s client base encompasses leading tech companies in China, India, and adjacent Southeast Asian countries. Chindata provides its customers base with a range of IT services, including end-to-end project management, design expertise, R&D capabilities, and supply chain management, in addition to its core data center services.

Part of Chindata’s allure, for its clients, is sheer size. The company boasts that it has over 578 megawatts of IT server capacity in service or under construction, and can deliver a 36 megawatt facility within 6 months in the Chinese market. The company has moved to protect its intellectual property with over 250 patents approved or pending.

In Q1 of this year, Chindata turned from net losses to profitability, and saw earnings continue at profitable levels in Q2. The company reported a net profit for the quarter of $10 million USD, based on total revenues of $106 million USD. The revenue number was up 64% from the year-ago quarter.

Albert Hung covers this stock for JPM, and he sees Chindata’s growth – its expansion, and its ability to move fast – as the key points here.

“Chindata has just announced 3 new datacenters in China North and China East, with a combined IT capacity addition of 87MW next year. This, coupled with previously announced pipelines, implies ~190MW capacity addition in 2022, vs. the company’s earlier target to add ~100MW datacenter capacity annually over the next few years. More importantly, the high contracted+IoI IT ratio (77%) of datacenter under construction signals high visibility into the next year’s growth and manageable customer concentration risks,” Hung noted.

The analyst added, “CD stock has declined by 52% from Feb peak (vs. CCMP Index up 14%) due to weak China ADR sentiment and rising concerns on moderating IDC spending on tighter policy restrictions. However, we believe the strong growth outlook could help dispel investor concerns and recommend investors to accumulate into stock weakness.”

To this end, Hung rates the stock an Overweight (i.e. Buy), with an $18 price target to indicate room for a 58% upside in the next 12 months. (To watch Hung’s track record, click here)

Sometimes, Chinese companies can slip under the radar of US stock analysts – and Chindata has only 3 recent reviews on record. They are all positive, however, for a unanimous Strong Buy analyst consensus rating. This stock is trading for $11.41 and its $19.97 average target suggests it has room to grow an impressive 75% in the coming months. (See CD stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.