Bank runs and extreme market volatility – are the shades of 1929 upon us? Probably not, the current situation, while dangerous, is unlikely to trigger an economy-wide depression.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The real test, at least according to David Kelly, JPMorgan’s chief global strategist for asset management, will come on Wednesday, at the Federal Reserve’s next interest rate policy meeting. The central bank will have to determine which risk is more urgent, persistent high inflation or a bank crisis, and adjust its recent monetary tightening policy accordingly.

Kelly has some definite opinions on what course the Fed should take. “We’ve learned what the limit is in terms of quick Fed tightening,” he said in a recent interview, “and the limit is here, and the Federal Reserve should just stop.”

Whatever the Fed decides to do, the stock analysts at JPMorgan are taking a sharp turn toward high-yield dividend stocks, a standard defensive stock move when markets grow turbulent. We’ve used the TipRanks platform to pull up the details on two JPM dividend picks – finding from the data that these are Buy-rated equities with double-digit upside potential – and one has a dividend yield of 9%. Let’s take a closer look and find out why they believe these are compelling choices for investors right now.

MPLX LP (MPLX)

First up on our list of JPM dividend picks, is MPLX, the midstream spin-off of Marathon Petroleum. MPLX functions as a master limited partnership, owning and operating the original parent firm’s midstream energy transport network, as well as other logistic assets. MPLX also works in fuel distribution, moving refined fuel products from refineries to terminal nodes. MPLX’s network includes transport, terminal, and storage assets for crude oil, natural gas, and natural gas liquids, as well as an extensive pipeline web and an inland marine section on the navigable rivers of North America. MPLX’s transport network leads to coastal export terminals, various refineries, and tank farms and storage facilities.

All of this, and a market north of $33 billion, makes MPLX one of the largest midstream operators in North America, and its recent financial report, for Q4 and full year of 2022, shows the full scale. The company saw $2.5 billion at the top line, although the figure came in below the $3.3 billion achieved in Q3 and the $2.64 billion in the prior-year quarter. The Q4 EPS came in at 78 cents; this was flat y/y, and missed the forecast by 7%.

As for the full year 2022 numbers, overall, MPLX saw y/y gains for last year. The annualized revenue came in at $11.15 billion, up almost 15% from 2021, and the 2022 net income, at $3.95 billion, was up 28% from the previous year. These results supported solid cash flows, with 2022’s net cash from operations hitting $5 billion, a total that allowed MPLX to return more than $3.5 billion to shareholders through a combination of share buybacks and dividends.

On the dividends, there is plenty for investors to like. MPLX last paid out its common share dividend on February 14, at 77.5 cents per share. This annualizes to $3.10 per common share and gives a yield of 9.13%. The last numbers on inflation, for February, showed a 6% y/y rate, so MPLX’s dividend beats that by a wide margin, guaranteeing a real rate of return for investors. The company has kept up a reliable dividend payment for the last 10 years.

JPM analyst Jeremy Tonet gives this stock a long look, and comes down on the side of the bulls. In his recent note on MPLX, Tonet write, “Similar to refined pipeline product peers, MPLX stands well positioned to capitalize on margin expansion as inflation escalators lift tariffs more than realized cost increases. Moreover, delivering on an ‘all of the above capital allocation’ philosophy, including steady distribution growth and buy-backs, eases our historical concerns on corporate governance…. at a healthy 3.5x YE22 leverage, MPLX tracks closer to the low end of the peer set, providing management with strong optionality between distribution increases and unit repurchases… From valuation perspective, while MPLX does not screen as the cheapest name in the group, we see the valuation as undemanding and favorable given the aforementioned defensive downstream characteristics.”

Tonet complements his comments with an Overweight (Buy) rating, and gives a $41 price target that implies an upside of 21% for the year ahead. (To watch Tonet’s track record, click here.)

The JPM view is of the bullish variety here. This company’s 9 recent analyst reviews include 6 Buys, 2 Holds, and 1 Sell, for a Moderate Buy consensus rating. The shares are selling for $33.73, and the $39 average price target suggest that a gain of 16% lies ahead for the stock this year. (See MPLX’s stock forecast at TipRanks.)

Oneok, Inc. (OKE)

Next on our list is Oneok, another midstream company in the hydrocarbon industry. Oneok focuses on the movement and transport of natural gas and natural gas liquids across the middle of the North American continent. The company’s network of gathering, processing, storage, and transport assets bring natural gas and gas products from production areas, especially in the Rocky Mountains and the Permian Basin, to the distribution and marketing centers.

As with MPLX above, this is big business, and Oneok boasts a $27 billion market cap and multi-billion dollar annual revenues. In 2021, Oneok saw a top line of $17.27 billion; this increased to $22.87 billion in 2022.

Drilling down to the most recent reported quarter, 4Q22, we find that Oneok’s quarterly revenues were lower y/y, at $5.97 billion compared to $5.7 billion in the prior year, while earnings rose. Q4’s bottom line, the net income, came in at $485 million, up 28% y/y. On a per-share basis, the company’s income came in at $1.08 per diluted share, up 27% from the 85 cents reported in the prior-year period – and beating the $1.02 forecast by more than 5%.

Oneok’s results gave management confidence to increase the regular common share quarterly dividend by 2%, to a new payment of 95.5 cents. At the annualized payment of $3.82 per common share, the new dividend yields 6.4%. That yield, while only 0.4 points above inflation, is 3x the average dividend yield found among S&P-listed firms – and Oneok had a long history of keeping reliable dividend payments.

We’ll turn again to JPM’s Jeremy Tonet, who sees reason for optimism on this stock, based on Oneok’s prospects for improved business through 2023. Tonet writes, “On storage, OKE continues to progress on expanding Oklahoma storage capabilities by 4bcfd and continues evaluating idled storage facility reactivation in Oklahoma and Texas. Additionally ethane extraction dynamics proved topical on the call, as management noted expectations for the Permian to stay in high ethane recovery while growing international demand incentivizes incremental ethane out of the Midcon and Bakken at wider spreads later in the year…. Notably, the 2023 well connect schedule includes some wells connects pushed from 2022.”

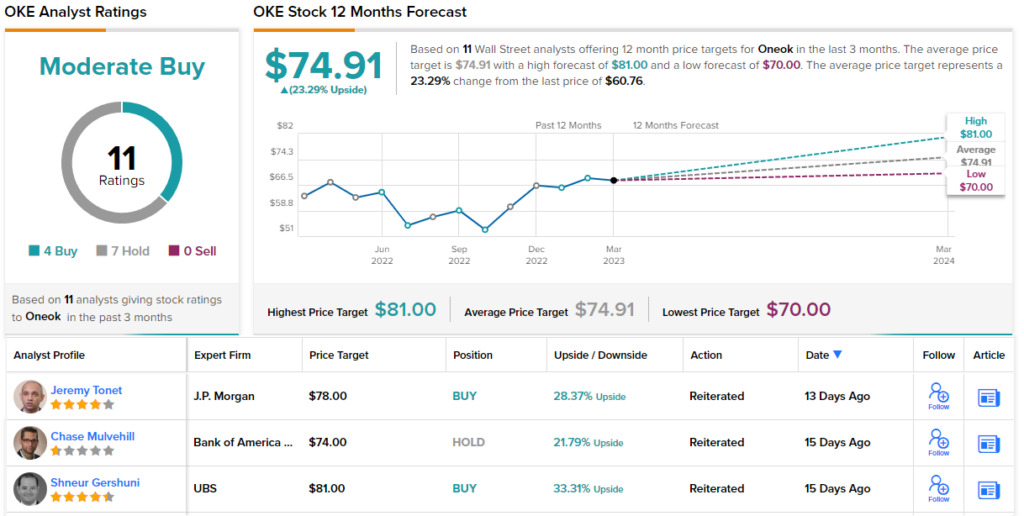

Taking this prospect into account, Tonet rates this stock as Overweight (Buy), with a $78 price target to indicate potential for 28% share appreciation in the next 12 months. (To watch Tonet’s track record, click here.)

With 11 recent analyst reviews, including 4 Buys and 7 Holds, Oneok’s shares have a Moderate Buy from the analyst consensus. The average price target of $74.91 implies a one-year gain of 23% from the current share price of $60.76. (See Oneok’s stock forecast at TipRanks.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.