JPMorgan Chase (NYSE: JPM) is making progress in terms of profitability, but temporary headwinds related to FX and other comprehensive income losses are obscuring the strong underlying performance. The premium to book value appears justified, given the earnings potential of the bank. That said, there is no immediate catalyst for the stock, as investors are concerned about a 2023 recession. Thus, a gradual approach to building a position is warranted. Also, the preferred shares of the bank have fallen in tandem with rising rates and offer a safe harbor to ride out a potential recession.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

JPMorgan Chase operates in five key divisions: Consumer & Community Banking (CCB), at about 43.8% of Q3-2022 revenue; Corporate & Investment Bank (CIB), at 36.3% of revenue; Commercial Banking (CB), at 9.3% of revenue; Asset & Wealth Management (AWM), at 13.9% of revenue, and Corporate at negative 1% of revenue.

JPM’s Q3-2022 Operational Overview

The third quarter was marked by further improvement in terms of return on tangible common equity (RoTCE), with JPMorgan Chase delivering 18% for the quarter after delivering 16% in Q1 and 17% in Q2.

What’s more, the results come against a challenging backdrop at the deal-activity-dependent portions of investment banking (IB revenue was down 43% year-over-year). This was offset by strength in the transaction-activity-dependent Markets & Securities segment, which saw 8% year-over-year revenue growth. Overall, the Corporate & Investment Bank division reported a 4% decline in revenues compared to 2021.

Aside from the CIB division, the other divisions reported solid revenue growth, with the biggest increase of 14% coming from CCB. All in all, the bank saw revenue growth of 10%, with operating leverage still negative – expenses grew at a steeper 12% year-over-year. However, if you exclude the $959 million loss on the sale of U.S. Treasuries and mortgages in the Corporate division, revenue growth was 13%, and operating leverage was actually positive.

Its tangible book value increased marginally (0.5%) in the quarter to $69.90, with post-dividend retained net income of around $6.7 billion offsetting the $4.8 billion increase in accumulated other comprehensive loss of $19.1 billion. Clearly, the strong U.S. Dollar and rising rates are still obscuring the strong underlying profitability of the bank and the high earnings retention rate (about 69% for Q3).

Looking ahead, I think both the dollar and rates should peak fairly soon, if not already, and the bank will show substantial tangible book growth in 2023. Even if rates do rise further, CEO Jamie Dimon disclosed on the conference call that a further 100 basis points rise in rates would lead to a $4 billion loss in other comprehensive income – something the bank can easily absorb.

Turning to JPM’s capital position, its standardized CET1 capital improved by 0.3% to 12.5% in the quarter, already at the bank’s target for Q4 2022. Barring a substantial rise in provisions, even after dividends, JPMorgan Chase should generate 35-40 basis points of organic capital per quarter and is on track to meet its 13% target for Q1 2023. The 13% aspiration incorporates a 0.5% buffer to regulatory requirements, and I think the bank will be in a good place to raise its dividend and resume buybacks later in 2023.

Key Highlights from the Conference Call

Highlights from the conference call were still upbeat about the U.S. consumer, albeit with storm clouds on the horizon:

Let me provide you with an update on the health of U.S. consumers and small businesses based on our data. Nominal spend is still strong across both discretionary and nondiscretionary categories, with combined debit and credit spend up 13% year-on-year. Cash buffers remain elevated across all income segments. However, with spending growing faster than income, we are seeing a continued decrease in median deposits year-on-year, particularly in the lower-income segments. And not surprisingly, small business owners are increasingly focused on the risks and the economic outlook.

Source: JPMorgan Chase Q3-2022 Conference Call

Turning to the outlook, JPMorgan Chase unveiled further details about its net interest income (NII) trajectory in the conference call:

Going forward, we will also provide guidance for total firm-wide NII. For the fourth quarter, we expect it to be approximately $19 billion, implying full year 2022 NII of approximately $66 billion. And we expect NII ex Markets for the fourth quarter to also be about $19 billion, implying that we expect Markets NII to be around zero, which brings the full year to about $61.5 billion.

While we’re not giving 2023 NII guidance today, you will recall that at Investor Day, we talked about a fourth-quarter 2022 NII ex Markets run rate of $66 billion, with potential upside for the full year 2023. Today’s guidance for the fourth quarter of this year implies an approximate run rate of $76 billion. And from this much higher level, we would now expect some modest decline for the full year 2023.

All in all, as discussed in the conference call, rapidly rising interest rates will create an abnormally high NII run-rate in Q4 (due to deposits repricing less quickly than loans). However, if the FED funds rate peaks in 2023 and deposits catch up to loan rates, the actual NII for 2023 should be less than the annualized $76 billion, more in the range of $74 billion. This is still a healthy increase from the $66 billion expected for 2022.

If indeed the forward rate curve is largely realized, the $74 billion NII will be significantly above the $52.3 billion achieved in 2021 and will mark a shift in JPMorgan Chase’s revenue structure, with NII contributing roughly half of total revenues, on par with noninterest revenue. For comparison, the mix in 2021 was 57% noninterest revenue and 43% NII.

JPM’s Credit Risk

With calls for a 2023 recession growing louder and louder, it is pertinent to look at how JPMorgan Chase is approaching its provisioning. Starting in Q1 2022, the bank has consistently been provisioning above net charge-offs (which are losses on loans minus recovered amounts from loan collateral). As a result, the allowance for credit losses is up 11% year-to-date, while loans are up only 3.2%.

What’s more, the total allowance for credit losses, at $20.8 billion, is already above Q4-2021 levels, albeit well below the $30.8 billion balance at the end of 2020. In fact, while the 2020 provisioning cycle was anything but normal, I think a look back is useful nevertheless.

The bank started 2020 with a total credit loss allowance of $14.3 billion. In Q1 2020, it was already up to $25.4 billion. In Q2, the amount peaked at $34.3 billion, and JPMorgan Chase spent the rest of 2020 and 2021 releasing reserves. Looking at the current profitability of the bank, it is actually still in a position to absorb such a large provision build of around $10 billion in a single quarter. All in all, even a severe downturn such as the one of early 2020 should not tip JPMorgan Chase deep into the red.

Also, while all divisions recorded increases in credit provisions, CCB was the biggest contributor. At the end of 2019, the division accounted for 61.5% of all credit loss allowances. At the end of Q2 2020, the percentage was up to 67.5%. This, coupled with the fact that CCB has been growing in importance recently (as exemplified by the bigger contribution of NII to total revenues outlined above), means that even a milder recession compared to 2020 may bring substantial credit provisions.

One final point to mention is that in 2020 and 2021, thanks to government stimulus, the vast majority of the provisions were never realized and were reversed back into the bank’s bottom line. This time around, even if the recession is not as severe, the provisions are more likely to result in actual credit losses. All in all, if we observe above-average provisioning in 2023, we should not expect below-average provisioning (or outright provision releases) in 2024.

Is JPM Stock a Buy, According to Analysts?

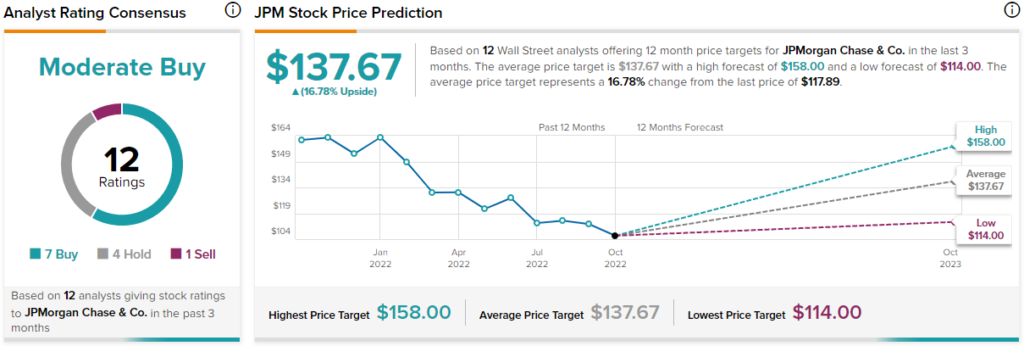

Turning to Wall Street, JPMorgan earns a Moderate Buy consensus rating based on seven Buys, four Holds, and one Sell rating. Additionally, JPMorgan’s average price target is $137.67, implying 16.8% upside potential.

Conclusion: Investors Should Consider Buying JPM Stock

A strong dollar and losses in other comprehensive income due to rising rates have overshadowed strong underlying operational performance. Nevertheless, the bank is well on its way to boosting its capital position, and its formidable earnings potential can weather a recession-induced spike in credit costs. Investors should consider using the current consolidation in its share price to patiently build a long position.