Inferences drawn from delinquency rate data could easily be misleading. JPMorgan (JPM) stock has suffered significant losses year-to-date, as prospects in its non-interest-bearing activities have faded. Yet, I believe there’s more downside ahead for JPMorgan as the bank could struggle to succeed in a topsy-turvy market. Thus, I’m bearish on the stock; here’s why.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Delinquency Rate Update

JPMorgan’s consumer credit quality remains stronger than pre-pandemic levels, with the bank’s credit card delinquency rate improving in May. JPMorgan’s May delinquency rate receded to 0.67% last month, which is a 0.03% year-over-year improvement.

Overall, credit card metrics remain robust across the banking industry, with loan growth and delinquencies looking up.

According to Dominick Gabriele of Oppenheimer (OPY): “Although there are likely pockets of consumers struggling from higher prices, overall the average consumer has continued to manage their balance sheet.”

Even though credit card debt, along with most asset-backed securities, still shows good form, it is sometimes a lagging indicator of economic health as it doesn’t consider that balance sheets are latent to cash-based movements. Thus, a deeper dive into systemic risk is required to draw an accurate conclusion.

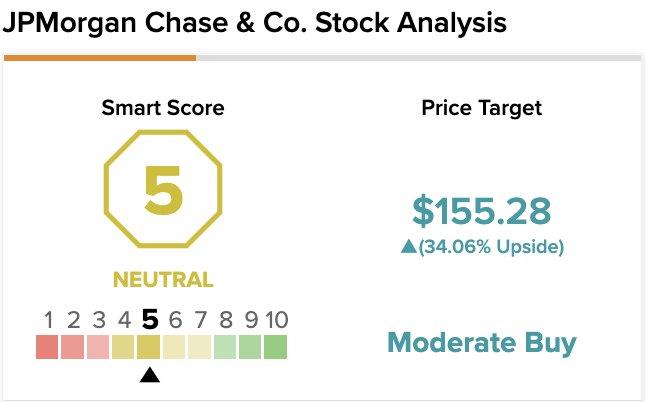

On TipRanks, JPM scores a 5 out of 10 on the Smart Score spectrum. This indicates the potential for the stock to perform in line with the broader market.

Systemic Risks

Rising interest rates usually assist banks as they provide leverage to their interest-bearing activities and curb their employees’ wage demands. Nevertheless, matters need to be looked at out of isolation.

For example, the yield curve shows that we’re heading into a contractionary economic period for the next two years. Will the mentioned base case then still hold for banking stocks? Probably not.

The inversion of the yield curve and various qualified opinions predict that a recession is on its way. For instance, Jamie Dimon recently opined on the economy and said: “You know, I said there’s storm clouds, but I’m going to change it … it’s a hurricane.”

Banking stocks are exceptionally vulnerable to recessions, as they are inextricably linked to the economy’s health; their betas shoot through the roof whenever the economy hits cyclical peaks and bottoms. In JPM stock’s case, matters could exacerbate its poor year-to-date performance (-28%) as the company generates 54% of its revenue from volatile non-interest-bearing activities.

Earnings Overview

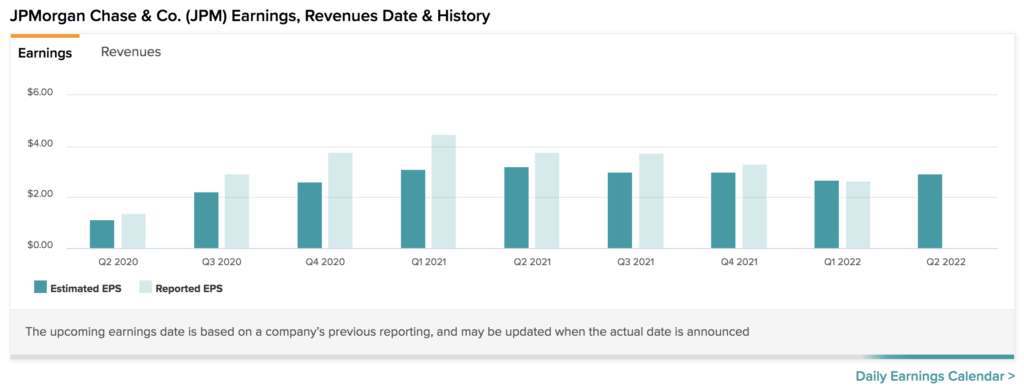

A large part of JPMorgan stock’s recent drawdown is due to its earnings momentum being broken. Earnings momentum often translates into technical price momentum until it breaks down.

JPMorgan beat its earnings target in six straight quarters, after falling short of estimates in its previous quarter by 8 cents per share. The bank racked up loads of operating expenses during its first quarter amid rising wage demands. Moreover, some of the company’s key segments retreated with its Investment and Community Banking receding by 7% and 2%, respectively, from a year ago.

It’s unlikely that sales growth in key segments will have picked up since JPMorgan’s first-quarter results were released, as the investment banking and consumer banking environment continues to wane. Additionally, the stock market has entered bear-market territory, which could have affected the bank’s non-interest-bearing income, such as trading and underwriting.

Valuation Concerns

Banking stocks often oscillate around a price-to-book value threshold. JPMorgan stock is considered overvalued, as its stock price is trading at 1.31x its book value, leaving much to ponder about.

Furthermore, JPMorgan’s PEG ratio of 1.19x indicates that the market has overshot the bank’s earnings-per-share growth potential, meaning that the stock could be trading at a premium on an earnings basis alone.

Lastly, JPM stock is trading at 2.74 times its sales, which is considered exorbitant for a mature company. If the global economy unravels as expected, JPMorgan’s sales will likely slip further due to asset pressure, which could leave its stock in a conundrum.

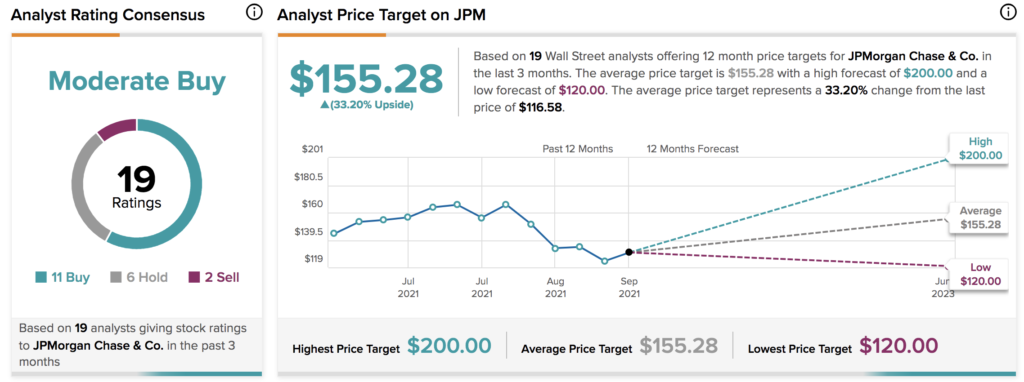

Wall Street’s Take

Turning to Wall Street, JPMorgan earns a Moderate Buy consensus rating based on 11 Buys, six Holds, and two Sell ratings assigned in the past three months. The average JPM stock price target of $155.28 implies a 33.2% upside potential.

Concluding Thoughts

With the possibility of a recession, JPM stock isn’t in good shape. The bank reported solid credit card delinquency rates for May. However, it must be considered that asset-backed securities are often lagging indicators of the banking industry’s health. Furthermore, JPMorgan stock is overvalued based on key metrics, implying that its risk versus reward profile is poorly aligned.