Investors building a portfolio for their golden years often consider well-established companies that can pay reliable dividends and generate solid cash flows to support continued growth in dividends. Healthcare giant Johnson & Johnson (NYSE:JNJ) can be a great addition to investors’ retirement portfolios. JNJ is a dividend king, a term used for companies that have hiked their dividends for at least 50 consecutive years.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In April 2022, Johnson & Johnson announced a 6.6% hike in its quarterly dividend, bringing it to $1.13 per share (annual dividend of $4.52 per share). JNJ’s dividend yield stands at 2.54%, which is higher than the sector average of 1.56%. Based on the trailing twelve months (TTM) adjusted EPS, JNJ’s dividend payout ratio is 44.8%. The company generates enough cash flows to cover this payout while continuing to invest in growth initiatives.

JNJ Geared Up for a Major Transformation

JNJ is all set to spin off its Consumer Health business, which includes popular brands like Listerine, Band-Aid, and Neutrogena, into a new publicly traded company called Kenvue. The spin-off, scheduled to be completed by mid to late 2023, will allow JNJ to pursue high-growth opportunities in its Pharmaceutical and MedTech divisions.

The company is optimistic about boosting its revenue growth organically and through strategic acquisitions in the pharmaceuticals and medical devices businesses. As of October 18, 2022, JNJ’s pharmaceuticals pipeline comprised 107 programs across various therapeutic areas, including cardiovascular, immunology, neuroscience, and oncology. JNJ expects its Pharmaceutical business to generate sales of $60 billion by 2025.

Last month, JNJ announced a deal to acquire heart pump maker Abiomed (ABMD) for $16.6 billion. It expects the deal to close by March 2023 and be accretive to its earnings in 2024. The Abiomed acquisition is in line with the company’s strategy to expand its MedTech business into high-growth markets and accelerate its revenue growth.

Is JNJ a Good Stock to Buy Now?

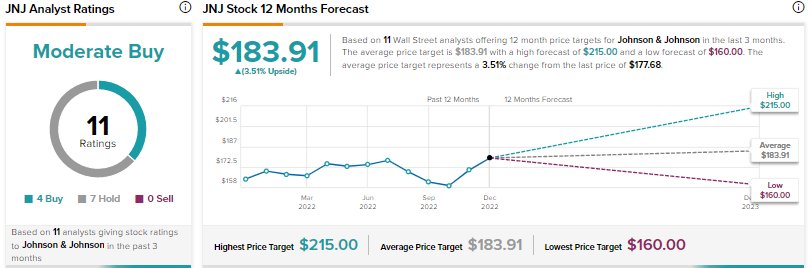

Amid a challenging macro backdrop, Wall Street is cautiously optimistic about Johnson & Johnson stock. The Moderate Buy consensus rating for JNJ stock is based on four Buys and seven Holds.

Analysts’ price targets for JNJ stock range from $160 to $215, with the average price target of $183.91 implying 3.5% upside potential. Shares have advanced nearly 4% year-to-date, outperforming the broader market.

Final Thoughts

JNJ’s dividend king status, strong fundamentals, and the company’s focus on high-growth areas in the Pharmaceutical and MedTech divisions make it worthwhile to be a part of investors’ retirement portfolios.