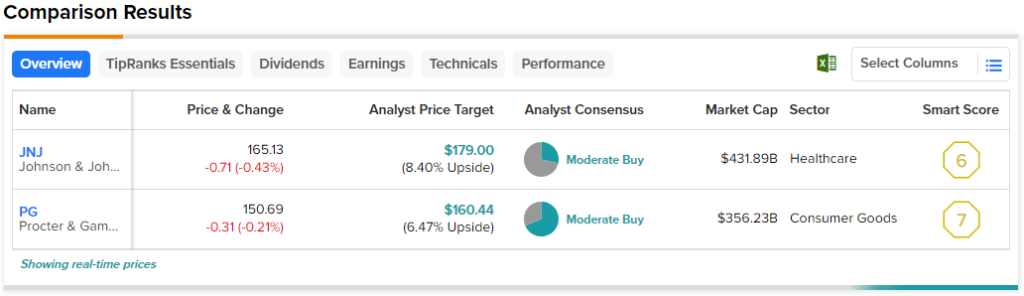

In this piece, I used TipRanks’ Comparison Tool to evaluate two blue-chip consumer goods stocks, Johnson & Johnson (NYSE:JNJ) and Procter & Gamble (NYSE:PG), and determine which is better. From a stock-performance standpoint, Procter & Gamble has held up better than Johnson & Johnson. While PG stock is roughly flat year-to-date and down 1.5% over the last year, JNJ stock is off 6% year-to-date and 4% for the last 12 months.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Zooming out to a five-year window reveals that Procter & Gamble has risen 128%, while Johnson & Johnson is up 48%. However, a closer look at these companies’ fundamentals is in order to determine which offers the better value for investors.

Johnson & Johnson (NYSE:JNJ)

Johnson & Johnson is a blue-chip stock that’s been dealing with a major legal overhang for over a decade. Because that overhang could be nearing its end and given the recent sell-off in the stock along with the company’s long-term stability, a bullish view looks appropriate.

Johnson & Johnson sits at the intersection of consumer staples and pharmaceuticals, suggesting a valuation somewhere between those two sectors. The consumer staples sector is trading around its three-year average price-to-earnings (P/E) ratio of 28.1, while the pharmaceutical sector is trading at a P/E of around 24.3, versus its three-year average of 43.8.

JNJ is trading at a P/E of about 24.3 versus its average P/E of 59.2 over the last five years. However, the reality is that Johnson & Johnson was overvalued for quite some time, as its P/E plummeted sharply from above the 200s in early 2019.

There’s no denying that the talc lawsuits filed against Johnson & Johnson have impacted its valuation in recent years. In January 2019, 13 claims by women who developed ovarian cancer and blamed the company’s talcum powder went before a jury.

Johnson & Johnson’s stock dropped significantly around that time. The company arranged to settle most of those lawsuits recently, and its stock popped as investors glimpse light at the end of the tunnel. However, it has yet to recover to a fair valuation, leaving room to buy the dip. Finally, Johnson & Johnson offers a solid dividend yield of 2.73%.

What is the Price Target for JNJ Stock?

Johnson & Johnson has a Moderate Buy consensus rating based on four Buys, 10 Holds, and zero Sell ratings assigned over the last three months. At $179, the average Johnson & Johnson stock price target implies upside potential of 8.3%.

Procter & Gamble (NYSE:PG)

Procter & Gamble is also a blue-chip stock, which is why it has held up quite well over the years. Its robust six-month gain (19%), as signs of a recession developed, indicates that investors have been pleased to pay a premium for a steady-eddy stock with predictable earnings and sales growth. However, Procter & Gamble looks fairly valued, so a neutral view looks appropriate in light of an imminent market shift.

Procter & Gamble is largely a consumer goods company, although it does sell a lot of healthcare products, even though it doesn’t sell any pharmaceuticals like Johnson & Johnson does. The company is trading at a P/E of about 26.5, suggesting it could be slightly undervalued compared to the consumer staples industry, especially considering that its five-year average P/E is about 34.9.

However, Procter & Gamble shares have slipped meaningfully from their 52-week high of about $165, and it doesn’t look like a recovery is imminent due to a lack of catalysts.

As a blue-chip name, the company is certainly worth considering for a long-term buy and hold. Thus, investors with an exceptionally long time horizon might still want to buy in, especially given its solid dividend yield of 2.4%. Still, the caveat that no significant gains may be coming anytime soon should be added.

What is the Price Target for PG Stock?

Procter & Gamble has a Moderate Buy consensus rating based on 11 Buys, five Holds, and zero Sell ratings assigned over the last three months. At $160.44, the average Procter & Gamble stock price target implies upside potential of 6.5%.

Conclusion: Bullish on JNJ, Neutral on PG

With Johnson & Johnson and Procter & Gamble both being blue-chip stocks, one might think their stocks might be performing similarly. However, the imminent resolution of the long-running talc lawsuits has created a buy-the-dip opportunity in Johnson & Johnson, which has yet to recover fully.

On the other hand, Procter & Gamble shares have soared in the last six months as investors happily paid a premium for the assurance of holding a company with predictable growth. Thus, when trying to determine which stock is more attractive now, I believe the winner of this pair is Johnson & Johnson.