The vacation industry presents investors with a diverse array of opportunities – but one that sometimes gets overlooked is the timeshare sector. Timeshares are what their name suggests: properties with multiple joint owners. The aim is to make vacation destinations more affordable; vacationers buy rights to use a property at specific times, rather than full ownership.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The model has proven particularly attractive in the millennial demographic, a fact that gives the industry a sound path toward long-term profits. Millennials are relatively young and are buying timeshare rights at a proportionately higher rate than other age groups. For timeshare companies, this presents the prospect of a sound business base for the next decade or more.

For now, many timeshare stocks have been passed over by investors, resulting in a share price discount. The sound future and the current low price have caught the attention of JMP analyst Aaron Hecht, who is opening his coverage of timeshare stocks with a bullish stance.

“In our view, near-term headwinds have been priced into the stocks and/or are reflected in 2024/2025 estimates. We believe any additional near-term weakness in consumer activity will result in pent-up demand that should be monetized as economic conditions steadily improve. Shares sit at the bottom of historical multiple ranges, making this an opportune time to accumulate shares, in our opinion,” Hecht opined.

Against this backdrop, Hecht has picked timeshare industry 3 stocks that he thinks are primed to outperform over the long term. We’ve used the TipRanks database to get a look at the broader Wall Street view of these shares; here are the details, and the analyst’s comments.

Hilton Grand Vacations (HGV)

The first timeshare stock we’ll look at is Hilton Grand Vacations, a timeshare company carrying a major name in hotels and leisure. Hilton Grand Vacations spun off from the famous Hilton hotel company and since 2017 has been working independently in the timeshare niche, with operations in 16 US states. Hilton Grand Vacations is active in prime vacation destinations, and has properties in California, Florida, and Hawaii as well as DC and Las Vegas. The company’s international footprint includes Canada, the UK, Europe, Japan, Mexico, and the Caribbean.

The company’s portfolio of destinations includes more than 200 locations, accessible to some 700,000 timeshare owners. The company’s timeshare owners can choose from properties with a wide range of amenities, including golf resorts, beachfronts, ski slopes, casinos, and urban scenes. Many of the resorts also include amenities for kids and families, and vacationers can find sports, shopping, spas, movies, restaurants and plenty of other attractions.

Last year, Hilton Grand was impacted by the Maui wildfires, which hurt revenues on its Hawaii properties. While only two of the company’s properties in the islands were located on Maui, and neither was in the path of the Lahaina fire, the related factors of reduced tourist travel to Hawaii and vacation cancellations each took their toll.

In another event that impacted the stock, but one that is more idiosyncratic to Hilton Grand, the company in November entered an agreement to purchase the resort company Bluegreen Vacations. The purchase was announced as completed on January 17, in an all-cash transaction for approximately $1.5 billion, a total that included net debt. The acquisition adds Bluegreen’s destinations to Hilton Grand’s portfolio, an important gain for the company. HGV shares took a 6% hit at the time of the initial announcement, however, due to the size of the cash outlay.

Hilton Grand is expected to release its 4Q23 results on leap day, February 29, but we can look back at the company’s Q3 results for an idea of its current status. Those results were somewhat mixed. The revenue total of $1.02 billion was down 9% from the prior-year period, and missed the forecast by $20 million – but the bottom line, the non-GAAP earnings per share of 98 cents, was a penny better than had been anticipated.

Checking in with JMP’s Hecht, we find the analyst outlining an upbeat outlook based on HGV’s solid asset portfolio. He says of the company, “HGV has a unique fee-for-service business model and ~700K owners across 200+ resorts and ~735K members through its club offerings, including the addition of Bluegreen Vacations. Hilton’s club offerings encompass more than 738k members across HGV Vacation Club, HGV Max, the Hilton Club exchange program, and the Legacy-Diamond Club… On an adjusted EBITDA margin basis, HGV remains well above the peer group at 27.8%… HGV currently trades at 6.4x 2025E adj. EBITDA, below its long-term historical average of 6.8x…”

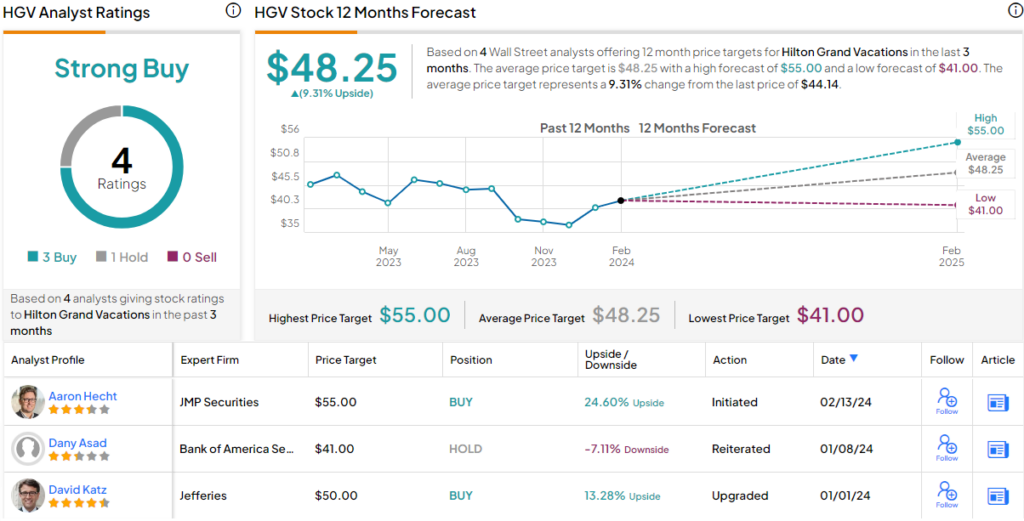

Hecht goes on to give these shares an Outperform (Buy) rating as a start, with a $55 price target that suggests the stock will show a 24.5% gain over the next year. (To watch Hecht’s track record, click here)

This stock holds a Strong Buy rating from the Street’s consensus, based on 4 recent reviews that include 4 Buys against a single Hold. The stock’s $44.14 trading price and $48.25 average target price together imply a one-year upside potential of 9%. (See HGV stock forecast)

Travel + Leisure Company (TNL)

Next up on our JMP-backed list is Travel + Leisure Company, another one of the timeshare industry’s well-established names. The company makes its home in the vacation-friendly locale of Orlando, Florida, and its primary business is the development, sale, and management of timeshare properties in prime vacation destinations. The company’s properties are offered through multiple brands, and feature well-reputed names such as Margaritaville, Worldmark, and Wyndham.

In addition to timeshares, TNL also works in the timeshare exchange business. As the name implies, exchanges involve timeshare owners making trades among themselves – an owner swapping his week at one location for someone else’s time at a different location. This business, which Travel + Leisure operates through RCI, counts over 3.5 million members and generated over $170 million in revenue during the last reported quarter.

On the core timeshare business, TNL facilitates services for more than 816,000 owners on its properties. This core forms the base of a strong model, that has shown a modest upward trend in revenue and earnings in recent quarters. The last reported quarter, 3Q23, had a top line of $986 million, for a 5% year-over-year gain that was also $14.3 million ahead of the estimates. The company’s bottom line, reported as a non-GAAP EPS of $1.54, was 8 cents per share over the forecast.

These were considered sound results, and the company complemented them with another feature that return-minded investors should find attractive: a steady commitment to generous capital returns. The company has a share buyback program, which saw $65 million worth of stock repurchased in Q3, and had $210 million remaining in its buyback authorization at the end of the quarter. Also of note, the company pays out a regular common share dividend, last paid at 45 cents per share on December 29. The annualized payment of $1.80 per common share gives a forward yield of 4.35%, more than enough to beat inflation.

This stock has also piqued Hecht’s interest, and he is just plain upbeat on the shares, saying of them, “We anticipate TNL will continue to repurchase stock at a historical pace, utilizing this avenue to drive earnings growth in the out years… RCI provides a strong consistent earnings stream for TNL, offering some insulation from the macro impact on VOI sales, which we view as a positive differentiator… TNL currently trades at 6.5x 2025E adj. EBITDA, below its long-term historical average of 7.8x.”

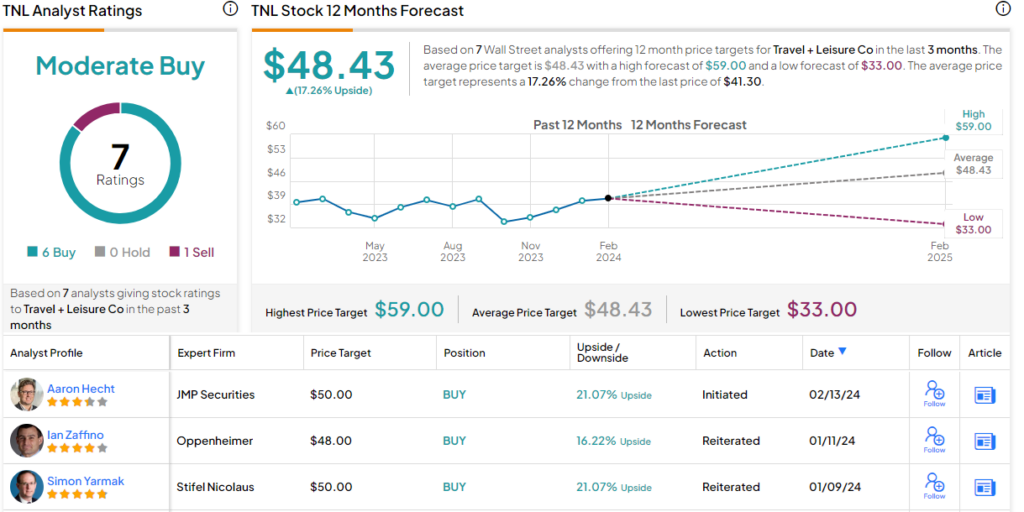

Looking forward, Hecht opens his ratings on TNL stock with an Outperform (Buy) outlook, and with a $50 price target that implies a gain of 21% on the one-year horizon.

The Moderate Buy consensus rating here is based on 7 recent analyst reviews, that break down to 6 Buys and 1 Sell. The shares are trading for $41.30 and their $48.43 average price target indicates potential for a 12-month gain of 17%. (See TNL stock forecast)

Marriott Vacations Worldwide (VAC)

Marriott is one of the best-known names in the hotel industry, and Marriott Vacations Worldwide, established in 2011 as a separate, pure-play timeshare entity building on the Marriott name and reputation, is one of the world’s major operators of timeshare destinations. The company operates its properties through several brands, including (but not only) Marriott Vacation Club, Sheraton Vacation Club, and Westin Vacation Club. Altogether, the company controls nearly 120 resort and vacation destinations, with more than 18,500 villas available for timeshare purchase.

The company’s destinations include the relatively affordable, and the purely luxurious, and timeshare buyers can find locations in the US, the Caribbean, Central America, Europe, Asia, and Australia. Vacation destinations include such desirable spots as the South Carolina and Florida coasts, the Colorado mountains, and urban locales in Washington DC or New York. Through its exchange and third-party management network, the company also makes available a broad portfolio of timeshare exchanges and rentals for customers who are looking to swap locations.

Some numbers will show the scale of Marriott Vacations’ operations. The company can boast of more than 700,000 owner and member families in its timeshare ownership business, and reports a guest satisfaction score of 90%. The company’s exchange network operates in more than 90 countries, claims nearly 3,200 properties, and has some 1.6 million members. It’s a solid foundation to support a leisure business.

Marriott Vacations Worldwide saw some headwinds last year, particularly the wildfires on Maui, where the company has several properties. While those properties did not report any physical damage, the company did feel a negative impact on revenues. The top line for the third quarter of 2023, the last reported, came to $1.19 billion, or 3.3% down from the prior year and $10 million less than expected. Earnings in the quarter, by non-GAAP measures, came to $1.20 per diluted share, missing the forecast by 94 cents per share. The stock is down approximately 43% over the last 12 months. We’ll see the company’s 4Q23 results later this week.

Despite the noted short-term headwinds, analyst Hecht sees long-term gain waiting in the wings here, with the depressed share price offering an opportunity. He writes of VAC, “Marriott remains our favorite brand affiliate for the timeshare industry given the quality of the associated customers and product… VAC currently trades at 5.6x 2025E adj. EBITDA, below its long-term historical average of 10.0x, and we see the market as undervaluing the company and we expect the company to outperform over the next 12-14 months… VOI (vacation ownership interest) sales margin for VAC is cleanest disclosure within the peer set. Margin has clearly been on an upward trend and we believe there is additional upside in the model’s long term.”

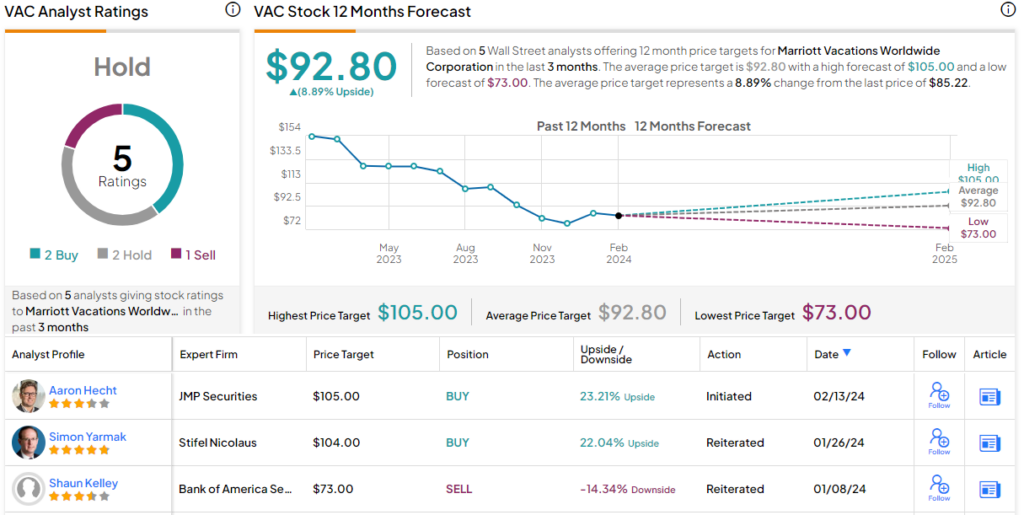

Quantifying his stance, Hecht rates this stock as Outperform (Buy) in his initiation-of-coverage write-up, and sets a price target of $105, implying a one-year upside potential of 23%. (To watch Hecht’s track record, click here)

On balance, the Street is less bullish. The stock gets a Moderate Buy consensus rating, based on 5 recent reviews that include 2 to Buy and Hold, each, and 1 to Sell. The shares are priced at $85.22 and their $92.8 average price target points toward a 9% share appreciation in the coming year. (See VAC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.