Markets this year are down generally, but no one can deny that the tech industry has been hit harder than most. We can see that in the tech-heavy NASDAQ index, which even after recent gains is still down 28% year-to-date.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Some key factors that have been battering tech include the usual litany of market headwinds. Inflation is both high and persistent, and it has pushed the Federal Reserve to a policy of interest rate hikes and tighter money; the combination is choking off the easy money that fueled tech’s expansion during the pandemic.

But has the tech sell-off run its course? Jim Cramer, the well-known host of CNBC’s ‘Mad Money’ program, doesn’t think so – although he admits that not every tech stock is created equal. Cramer believes that the Fed will start easing back on the rate hikes in the near future, and when that happens, he sees a few of them poised for a rebound.

“Nearly all of these… are variations on the same story — stocks that were cut in half when their businesses had no such comedowns. Their stocks just got way ahead of themselves before the Fed took away that easy money… Once the Fed relents, I’d much rather be in Big Tech, or the top cloud plays,” Cramer opined.

With this in mind, let’s take a look at two of Jim Cramer’s favorites from the cloud tech world. According to TipRanks’ database, Cramer is not alone in thinking these stocks have plenty to offer investors; both are rated as Strong Buys by the analyst consensus, and boast double-digit upside for the coming year. Here are the details.

Salesforce.com (CRM)

The first ‘Cramer pick’ we’re looking at is Salesforce, a name that won’t need much introduction. Salesforce is a long-time industry leader in the realm of Customer Relationship Management (the source of the company’s CRM stock ticker), and offers a wide range of cloud-based software solutions for enterprise customers. Salesforce has made good use of the Soft-as-a-Service subscription model, and the company’s earnings and revenues have both been climbing so far this year, even as the stock itself has lost some 40%.

In its last reported quarter, the fiscal quarter 2Q23 ending on July 31, Salesforce reported a 22% year-over-year gain in top line revenues, to a total of $7.7 billion. At the bottom line, the non-GAAP EPS of $1.19 was down y/y, from $1.48, but was up sequentially. In fact, non-GAAP EPS rose through all of fiscal 1H23, from its low point of 84 cents in fiscal 4Q22.

During the quarter, Salesforce moved to support its share price through a share repurchase program. This marks the first time that the company has taken such a move, and it is substantial. The Board authorized share repurchases up to $10 billion. The company currently has $6.9 billion in cash and cash equivalent assets on hand. The company will report its third quarter fiscal year 2023 results on this coming November 30.

Salesforce has a solid base in its industry, and survey of more than 3,500 customers, reported on earlier this month, showed that companies using Salesforce products are saving an average of 25% on IT costs. Along with that, the survey indicated that customers are also seeing significant increases in employee productivity.

Writing for Macquarie Research, 5-star analyst Sarah Hindlian-Bowler puts Salesforce’s advantages into context: “Today, global challenges require businesses to digitally transform while leveraging customer data to become more responsive, resilient, and efficient. Companies also must rethink and alter how and where their employees work. As a result, we are seeing businesses in virtually every industry looking to optimize for a digital-first customer, employee, and partner experience and connect with their customers through digital channels. We believe that Salesforce remains one of a handful of key beneficiaries of businesses needing to digitalize…”

Standing squarely in the bull camp, Hindlian-Bowler rates CRM an Outperform (i.e. Buy), and her $210 price target suggests that a one-year gain of 38% lies ahead for the stock. (To watch Hindlian-Bowler’s track record, click here)

Big-name cloud tech has no trouble attracting attention from the Street’s analyst corps, and Salesforce has 36 recent analyst reviews on file. These include 29 Buys against just 7 Holds, for a Strong Buy consensus rating. The shares are selling for $152.08, and their $216 average price target is slightly more bullish than the Macquarie view, implying a 42% gain on the one-year horizon. (See CRM stock forecast on TipRanks)

Workday, Inc. (WDAY)

The next stock our list of Cramer picks is Workday, another provider of cloud-based software applications for enterprise clients. The company’s software gives solutions for HR and finance operations, allowing businesses to keep their personnel and finance files organized and efficient for a proper work flow. This is a vital niche, and Workday has seen its revenues grow consistently over the past several years.

The company will report its fiscal third quarter earnings on November 29; in the meantime, it may be beneficial to look back at Q2. Workday showed $1.54 billion in total revenue for Q2, a 22% year-over-year gain. The solid revenue performance was driven by a 23% y/y gain in subscription revenue, which hit a total of $1.37 billion. Looking forward, the company has a 24-month subscription revenue backlog of $8.37 billion; the total subscription revenue backlog is $13.47 billion, representing a 27% increase from fiscal 2Q22.

Despite these solid metrics, Workday’s shares have lost 45% year-to-date. The company’s shares have been pummeled by the general tech sell-off, and earnings, while positive, were softer than hoped for during the first half of this calendar year.

This cloud software firm has caught the eye of Brian Schwartz, a 5-star analyst from Oppenheimer, who takes an upbeat view of Workday.

“Our F3Q research mosaic reveals good trends for Workday. We detected healthy lead generation and installed base activity offset by elongating new customer deal cycles and tough growth optics from the effects of difficult year/year comparisons… We believe a durable margin growth and a cash flow acceleration story are strengthening for Workday, and the Street is underappreciating several improving efficiency drivers over the FTM and longer term from the Financial Management business scaling,” Schwartz wrote.

To this end, Schwartz rates WDAY shares an Outperform (i.e. Buy), and his price target of $205 implies an upside potential of 37% in the next 12 months. (To watch Schwartz’s track record, click here)

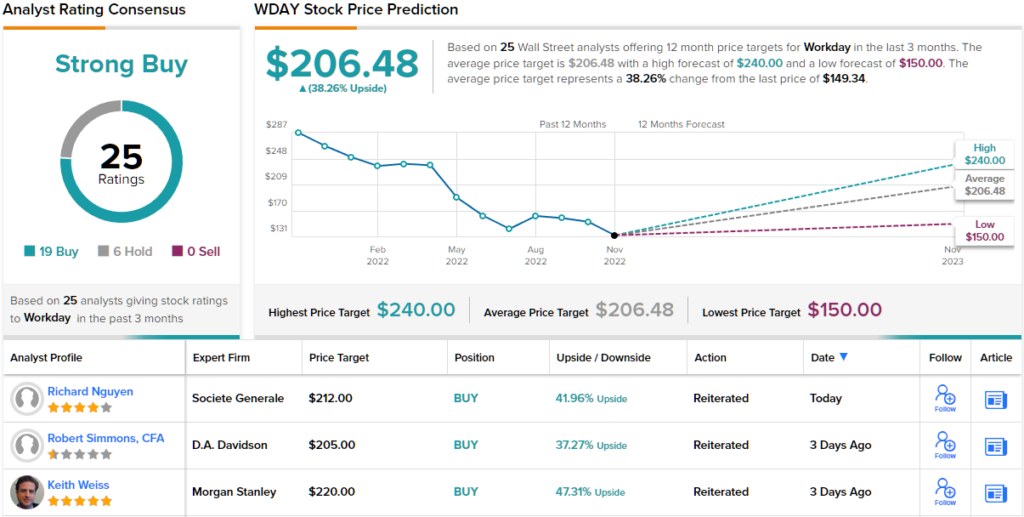

All in all, with 24 analyst reviews on file, breaking down 18 to 6 in favor of Buy over Hold, this stock has earned its Strong Buy consensus rating. The average price target of $206.48 indicates a potential upside of 38% from the current trading price of $149.34. (See WDAY stock forecast on TipRanks)

To find good ideas for tech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.