It’s on to the rubbish heap for flashy tech stocks, and time to place bets on the old-timers. That at least seems to be Jim Cramer’s latest piece of advice for investors. The well-known host of CNBC’s ‘Mad Money’ program says investors need to accept the “new reality” in which tech names are shunned aside in favor of the stock market’s more vintage collection.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

“It’s the revenge of the old guard right now, right here,” Cramer said. “All sorts of boring, conventional companies are taking back the market while the digitizers and disruptors are being burned.”

Cramer offered a list of names he thinks investors should lean into and following his footsteps, we dipped into the TipRanks database and pulled up the details on two of his picks. Do the Street’s analysts think Cramer’s nominees make sound investment choices right now? Let’s find out.

Raytheon Technologies (RTX)

If we’re talking of the “old guard,” then the first Cramer pick we’ll look at certainly fits the bill. Formed a century ago, Raytheon Technologies is one of the largest aerospace and defense manufacturers in the world and boasts a market-cap of $141 billon.

The company offers technology systems and services to government, military, and commercial clients all across the globe. Its business consists of 4 major divisions: Collins Aerospace Systems, Pratt & Whitney, Raytheon Intelligence & Space, and Raytheon Missiles & Defense. How big is Raytheon? Well, it has 174,000 employees on the payroll, so rather huge.

The kind of value proposition it offers is one you would think would relatively shield it from the negative current market conditions, and indeed while most have suffered at the hands of 2022’s bear, the stock is up by 13% year-to-date, far outpacing the S&P 500’s 21% drop.

That said, it has not been all plain sailing. The company missed top-line expectations in its recently released Q3 results. At $17 billion, the figure came in $250 million shy of the analysts’ forecast. Macro issues weighed on the outlook too, with the company lowering its sales forecast for the year from the range between $67.75 – $68.75 billion to 67.0 – $67.3 billion.

However, countering those negative trends, the profitability profile appears in good shape. Raytheon delivered adj. EPS of $1.21, beating the Street’s $1.14 call by $0.07. At the same time, the company increased the full year adj. EPS outlook from $4.60 – $4.80 to $4.70 – $4.80.

As befits a grand dame of the market, Raytheon pays a reliable dividend. The quarterly payout currently stands at $0.55 which annualizes to $2.20 and yields 2.3%.

While the shares have outpaced the market this year, Morgan Stanley’s Kristine Liwag thinks the stock is still not appreciated enough.

“We continue to see upside in RTX’s commercial aerospace business as commercial aftermarket remains a bright spot with airlines continuing to add capacity and global air traffic remaining ~65% of 2019 levels (August YTD 2022 vs. August YTD 2019). We also see the business as a benefactor from increased production rates at Boeing and Airbus,” Liwag opined.

“Given the backdrop facing RTX’s end markets, we see the stock undervalued today trading at ~17x our 2023E EPS. This places the stock at a pure discount to Defense peers and does not consider the magnitude of upside from commercial aerospace recovery,” the analyst added.

Accordingly, Liwag rated RTX shares an Overweight (i.e. Buy) while her $119 price target makes room for one-year growth of 24%. (To watch Liwag’s track record, click here)

Overall, we’re looking here at a stock with a Moderate Buy consensus rating. RTX has 11 analyst reviews on record, including 8 Buys and 3 Holds. (See RTX stock forecast on TipRanks)

Boeing (BA)

From one A&D giant to another. The second Cramer old school recommendation is Boeing. The corporation, which is the U.S.’s largest exporter, manufactures commercial aircrafts as well as space systems, aerospace components and defense equipment.

Boeing is one of the stock market’s giants but, as has been well documented, has had its fair share of troubles over the past few years, not least the two 737 Max crashes in late 2018 and early 2019 which grounded the passenger airliner for almost two years. The company also almost went bankrupt during the pandemic.

So, the past few years have been a bit of a slog and while the company missed expectations in its latest quarterly statement and once again slashed its estimate of 737 deliveries, things are generally looking better – more planes have already been delivered by the company in 2022 than in all of 2021. Additionally, the A&D giant latterly disclosed a new order from Emirates – a key client in the Middle East.

Elsewhere, BA’s recent Investor Day was a pleasing affair. The company said it expects free cash flow of $1.5 billion-$2 billion for 2022. The consensus estimate stood at just $670.3 million.

Among those adapting a bullish approach is Morgan Stanley’s Kristine Liwag (also covers RTX), who believes the worst is behind the company.

“We left Boeing’s Investor Day incrementally more positive on the stock as the company provided unexpected supporting details for a visible and credible path to $10bn of free cashflow… What’s clear to us is that even though Boeing has a lot of work to do (stabilizing the supply chain, delivering aircraft from inventory, preparing for the next rate break in BCA, etc.) the worst is behind the company and we’re now in a period of positive free cash flow. We’re forecasting free cash flow of $8.9bn in 2025 and $9.1bn in 2026,” Liwag wrote.

“We recognize that Boeing is a ‘show me’ story and there could be upside to our estimates if they meet milestones,” the Morgan Stanley analyst summed up.

How does this all translate to investors? Liwag sticks with an Overweight (i.e., Buy) rating on Boeing shares, while her $213 price target implies ~27% upside a year from now.

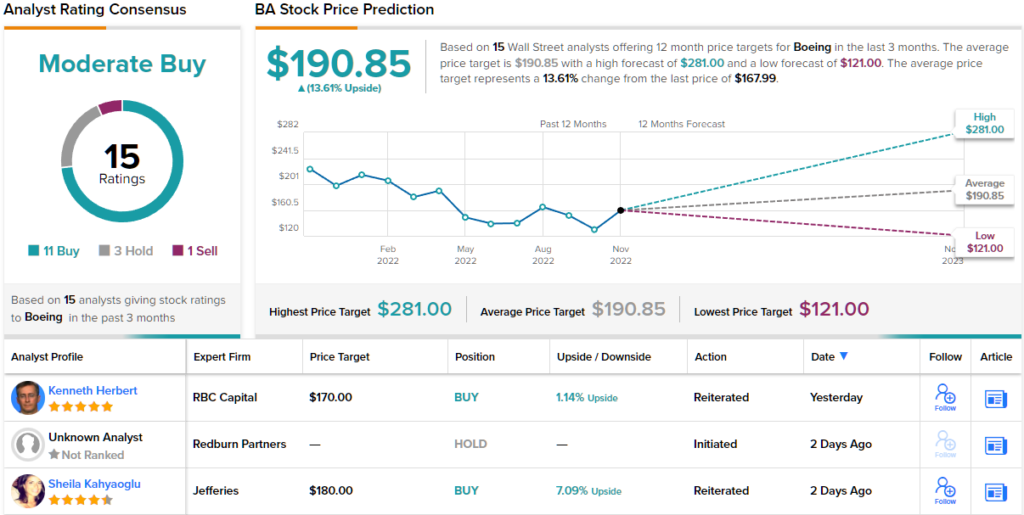

Turning now to the rest of the Street, where the analyst consensus rates the stock a Moderate Buy, based on 11 Buys, 3 Holds and 1 Sell. (See Boeing stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.