The market is getting all jittery again after the Fed signaled its intention to stick to its aggressive rate hike stance for now.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The general downbeat mood is a familiar one in 2022 as the market has been unable to shake off the bear hug with any uptick quickly followed by another pullback. However, with so many stocks still hovering in the doldrums, Jim Cramer, the well-known host of CNBC’s ‘Mad Money’ program, believes investors should pay special attention to the ones that are looking nicely priced.

“Ultimately, you’re just going to feel sorry if you don’t buy anything on the big sell-offs,” Cramer said. “When the market finally gets oversold enough, though, that’s when you need to pounce.”

In fact, in his lightning round, Cramer has pinpointed two stocks that he believes present opportunity for investors right now. Both are down by large amounts year-to-date, but Cramer thinks the time has come for them to push ahead.

Are Wall Street’s stock experts on the same page? That we can find out with the help of the TipRanks platform which offers a comprehensive set of data tools to help investors makes sound investment decisions. Let’s check the results, then.

Cano Health (CANO)

The first Cramer-endorsed name we’ll look at is Cano Health, a health provider with a tech-powered, primary care-centric approach emphasizing clinical quality. With 1,400+ employee and affiliated physicians, Cano is one of the biggest independent primary care physician organizations in the United States, caring for 280,000+ members in nine states and Puerto Rico.

Cano will report Q3 earnings later this week but we can take a look at Q2’s results for some background. The company has seen some strong growth over the past year as was evident in the latest revenue haul. The top-line more than doubled from the same period a year ago to $689.37 million although the figure came in $23.24 million shy of the consensus estimate. There was a beat on the bottom-line, however, with EPS of -$0.03 improving on the -$0.05 forecast. The outlook was pleasing too; for the full year, the company now expects revenue in the range between $2.85 billion to $2.90 billion, up from the previous guidance of between $2.80 billion to $2.90 billion.

In recent times, Cano has been subject to rumors it is a takeover target with several companies thought to be interested. The stock has swung both ways at the mercy of the rumor mill. However, over the past month the shares have taken a real beating and have shed 60% after it emerged that talks broke down with CVS Health and the healthcare giant decided not to move forward with an acquisition of Cano.

Despite highlighting some reservations, Raymond James’ John Ransom remains in Cano’s corner. The 5-star analyst writes: “The stock should make a stand in the ~$5 range, roughly where it was trading before the deal speculation. The stock is currently trading at 10.1x 2024 adj. EBITDA, and 0.6x 2024 revenue, a steep discount to peers…”

“CANO is an interesting model and while we are still bullish on CANO’s long-term prospects, CANO has some issues as a stand-alone company, namely its balance sheet, and inconsistent execution. We believe its 4Q print early next year will be a catalyst either to the upside or downside depending on 2023 guidance and FCF expectations,” Ransom added.

Concerns aside, Ransom obviously thinks the shares are now significantly undervalued; along with an Outperform (i.e. Buy) rating, his $8 price target makes room for 12-month gains of 133%. (To watch Ransom’s track record, click here)

What does the rest of the Street think? Looking at the consensus breakdown, opinions from other analysts are more spread out. 4 Buys, 3 Holds and 1 Sell add up to a Moderate Buy consensus. In addition, the $7.34 average price target indicates a whooping 114% upside potential. (See Cano Health stock forecast on TipRanks)

Tilray Brands, Inc. (TLRY)

The next Cramer lightning round stock we’ll look at is Tilray Brands, a leading Canadian cannabis company. Tilray Brands is the result of a May 2021 merger between two big industry players, Tilray and Aphria.

Most of the company’s business is done in Canada but it has global ambitions too, with operations spanning across the U.S., Australia, Latin America and Europe, in particular, where it boasts a strong presence in Germany, claiming a 20% share of the medical market (flower, extracts and dronabinol products). With more than 20 brands and a presence in 20+ countries, its offerings include not only cannabis but hemp-based foods, and craft beverages too.

The problem for Tilray, like many other Canadian cannabis companies, has been the intense competition in a relatively small market. These issues were evident again in its recently released first quarter of fiscal 2023 report.

Revenue dropped by 8.8% year-over-year to $153.21 million, while also falling shy of the consensus estimate by $3.64 million. Non-GAAP EPS clocked in at -$0.08, just missing the -$0.07 predicted on Wall Street. That said, cost cutting measures appear to be taking shape with cannabis gross margins improving from 43% year ago to 51%.

Overall, shares in TLRY are down 46% so far this year. This has opened up an opportunity, according to Cramer, who says to buy TLRY shares as “their time has come.”

Cowen analyst Vivien Azer also sees some encouraging trends playing out.

“TLRY’s market share in Canada is starting to finally stabilize,” the 5-star analyst remarked. “The company was able to improve trends for Good Supply, which is again the leading brand in the country post-1Q (first time since Jul 2021). Meanwhile, with new strains, new innovation has become a bigger contributor to segment revenues (at 7.5%). The company expects innovation to be a bigger driver going forward and is targeting ~25% of FY23 Canadian cannabis sales to come from new products (vs. ~2% in FY22).”

All told, Azer rates the shares an Outperform (i.e., Buy) backed by a $9 price target. Should the figure be met, investors will be pocketing hefty gains of ~137% a year from now. (To watch Azer’s track record, click here)

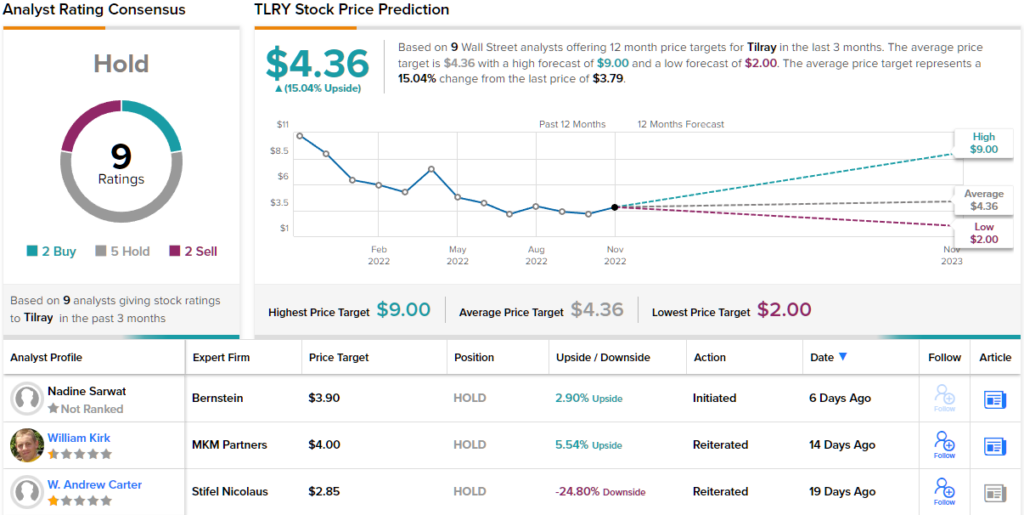

Elsewhere, Tilray gets a decidedly mixed reception on Wall Street. With 1 additional Buy, 5 Holds and 2 Sells, the analyst consensus rates the stock a Hold. At $4.36, the average target allows for gains of 15% in the months ahead. (See Tilray stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.