It’s official: after this past Monday’s trading, the S&P 500 has joined the NASDAQ in a bear market. The index has fallen more than 21% year-to-date, not as deep a loss as the NASDAQ’s 31% but still enough to give investors indigestion. It also brings up a vital question: how to maintain the portfolio in a difficult stock environment?

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Enter Jim Cramer. The well-known host of CNBC’s ‘Mad Money’ program has never been at a loss for advice to give, and he’s come through once again. His word for stock investors now: keep it boring!

By boring, Cramer means avoid stocks with high volatility. That will be the key, in his view, to surviving the coming months of high inflation in a bear market.

“If you… bought common stocks of companies that make real things and do real things that return capital and trade at a reasonable valuation, you’re relatively fine… The problem is those stocks that go down less… they’re really boring,” Cramer opined.

So what should investors buy? We’ve checked in with some of Wall Street’s analysts to get an answer to that eternal question, while keeping Cramer’s choice of dull stocks in mind. Using TipRanks database, we found three low-volatility stocks that have Buy ratings from the Street’s analysts, and offer double-digit upside even in the current bear market. Let’s take a closer look.

Assurant (AIZ)

We’ll start with risk management, a fancy way of saying insurance. Assurant, a $9 billion firm with a sound niche in a major business sector. Assurant works it the global insurance market, offering a wide range of products, including home and renters insurance policies, flood insurance, vehicle policies, and end-of-live protections such as funeral coverage. Like many insurance companies, Assurant also offers financial services.

While the overall markets have been sliding this year, AIZ shares are up ~12%.

The company has shown solid financial performance, too. In its 1Q22 release, Assurant reported $2.46 billion in top line revenue. This was within the revenue range of the past two years – and beat the year-ago quarter’s $2.36 billion result. On earnings, Assurant did better, bringing in $3.80 in adjusted earnings per diluted share. This was up 17% from y/y, and beat the $2.84 expectation by a wide margin. The company reported liquid assets, as the end of Q1, totaling $738 million, exceeding management’s desired cash minimum of $225 million.

Assurant also pays out a dividend and maintains an active share buyback program. The company spent $280 million on both programs combined in Q1, of which $129 million went to dividends. The dividend came to 68 cents per common share, annualizing to $2.72 and yielding a modest – but reliable – 1.5%.

Morgan Stanley analyst Michael Phillips describes AIZ as a ‘preferred pick,’ writing: “For AIZ we expect continued steady overall growth and business mix shift to capital light to lead to stock outperformance. We also see the stock as a possible ‘safe haven’ for those investors concerned with recession fears, given product stickiness, lower monthly fees to consumers, and the counter-cyclical nature of its force-places homeowners insurance business.”

It’s a cheery outlook to warm investors in a cold market, and Phillips puts an Overweight (i.e. Buy) rating on the stock to go along with his comments. In addition, Phillips sets a $215 price target, implying a one-year upside of ~25% from current levels. (To watch Phillips’ track record, click here)

Turning now to the rest of the Street, other analysts are on the same page. With 3 Buys and no Holds or Sells, the word on the Street is that AIZ is a Strong Buy. The stock has a $172.69 average price target and a share price of $213.33, for a one-year upside potential of 23.5%. (See AIZ stock forecast on TipRanks)

CenterPoint Energy (CNP)

For the second stock, we’ll shift our view to a Houston-based utility company. CenterPoint Energy operates in electricity generation and transmission, and in natural gas distribution. The company counts some 7 million metered customers across the states of Texas, Louisiana, Mississippi, Minnesota, Ohio, and Indiana, and boasts some $35 billion in total assets as of March 31 this year.

CenterPoint holds a strong position, as shown by sound financial returns and earnings in recent months. The company saw 47 cents per share in non-GAAP earnings in 1Q22, up 30% from the prior-year quarter. Total revenues reached $2.76 billion, growing 8% year-over-year.

These results supported CenterPoint’s common share dividend, which was declared at 17 cents. The annualized rate of 68 cents gives a yield of 2.3%, slightly higher than average. The attractive point to CNP’s dividend is its reliability; the company has kept up its payments going all the way back to 1972. The payout was cut back in early 2020, during the corona crisis, but has been raised twice since then.

The company has seen its shares outperform the overall markets. While broader markets a sharply down year-to-date, CNP remains up ~4% for the year so far.

Among the bulls is BMO analyst James Thalacker who writes, “Although a quiet quarter (boring is good when you’re in re-rating mode), CNP’s 1Q22 call continued its streak of consistent execution and its modest acceleration of capital spending in the near term adds additional visibility to the company’s outlook. The company also increased its 5-year capex plan by $100mn to $19.3bn, but 2022 capital spend increased by $300mm. Finally, management completed its exit from its midstream operations nearly three quarters ahead of schedule…. We remain impressed with CNP’s consistent execution and ability to meet and exceed investors’ expectations.”

To this end, Thalacker gives CNP an Outperform (i.e. Buy) rating to go along with this bullish outlook, and quantifies it with a $35 price target to indicate potential for 22% upside in the year head. (To watch Thalacker’s track record, click here)

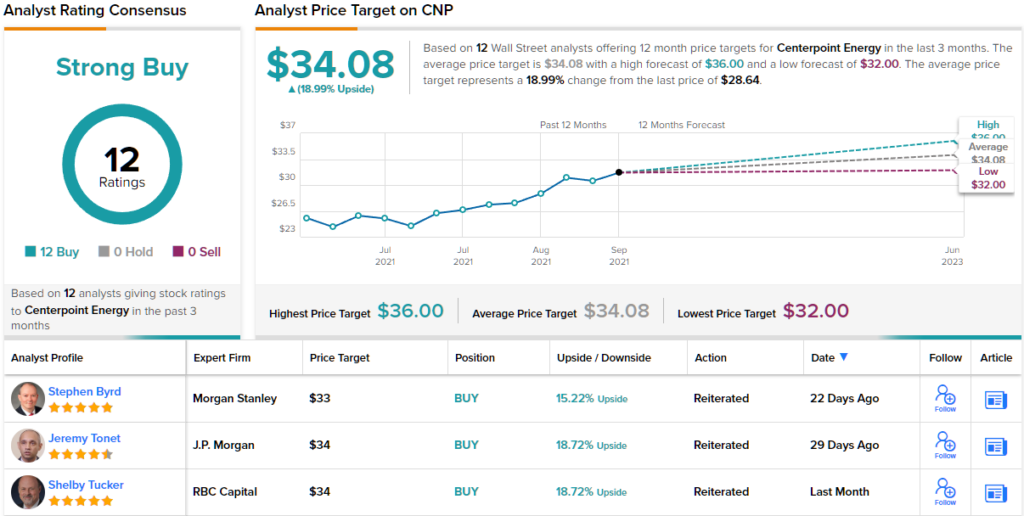

Overall, CNP boasts a unanimous Strong Buy analyst consensus based on 12 recent analyst reviews. CNP shares have an average price target of $34.08 and a share price of $28.64, implying a one-year upside of 19%. (See CNP stock forecast on TipRanks)

Public Service Enterprise Group (PEG)

Everyone needs power – and cooking gas – so the utility companies always have a market. Based in New Jersey, the Public Service Enterprise Group is a provider of natural gas and electric power services to customers in the greater metropolitan New York City area, including parts of Long Island, New Jersey, and the southeastern corner of Pennsylvania. The company is making moves toward cleaner ‘green’ power generation and has sold off its fossil fuel plants, removing them from its generation capacity. Public Service Enterprise Group serves as the holding company for Public Service Electric & Gas (PSE&G), its primary subsidiary and the operational arm of the company.

Public Service’s operations brought in $1.33 per share in non-GAAP earnings during the first quarter of this year, up from $1.28 in the year-ago quarter. These earnings were based on operating revenues of $2.3 billion. The company finished the quarter with $1.6 billion in total cash assets – a figure that includes cash, cash equivalents, and restricted cash.

Like the other stocks on this list, PEG pays out a regular dividend. The company has a long history of sticking to reliable payments, back to 2003. The current dividend, of 54 cents per common share, annualizes to $2.16 and yields 3.4%, well above average for S&P-listed firms.

In coverage of this stock for Wells Fargo, analyst Neil Kalton sees the steady, regular flow of work as a huge asset in the current environment. As he puts it, ‘PSE&G Continues to Chug Along.’ In detail, Kalton says, “We find it helpful to remind investors that PSE&G has been one of the top performing utilities within our coverage universe over the last decade. During the period 2011-2021, PSE&G delivered an EPS CAGR of 12%; twice the industry average. Looking ahead, we think the company is well-positioned to achieve a 6-7% CAGR through ’25 (of the 21A EPS of $2.87).”

Looking ahead, the analyst sees an $85 price target as appropriate here, indicating possible gains of 34% over the next 12 months. His rating on the stock is Overweight (i.e. Buy). (To watch Kalton’s track record, click here)

As for the rest of the Street, the bulls have it. PEG’s Moderate Buy consensus rating breaks down into 9 Buys and 4 Holds received in the last three months. The $77.62 average price target suggests shares could surge 23% in the next year. (See PEG stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.