Jim Cramer, the well-known host of CNBC’s ‘Mad Money’ program, has noted a shift in the markets, one that marks a change in potentially winning investment strategies. Last year, tech stocks were the place to go for profits, but this year they’ve been hit hard by the Fed’s rate hikes. Higher interest rates have made money and credit more expensive, which in turn has made it less attractive for investors to leverage buys into high-risk sectors like tech.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

But while higher interest rates have hurt the tech sector, they’ve been a boon for the banking industry. As Cramer puts it, “I always thought the group had the potential to become a leader again, but the banks could never pull it off because the Fed kept rates so low that it was hard for them to make money. Now that’s over… The Fed’s allowing these companies to make a ton of money by paying you next to nothing for your deposits and then reinvesting that money risk-free in short-term Treasuries.”

Wall Street’s analysts have also been giving the major banks a closer look recently, and some of them have liked what they’ve seen. Using TipRanks database, we’ve found that three of the banking majors have ‘Buy’ ratings and double-digit upside potential from the analysts. Let’s take a closer look.

Bank of America Corporation (BAC)

When ranked by total assets, Bank of America is the country’s second largest bank, with $3.11 trillion worth of assets on its books as of June 30 this year. The Charlotte-based bank generated over $96 billion in revenues last year, and is on track to beat that total this year. First half revenues came to $51.3 billion, up 8% from 1H21, and the 3Q22 revenue, released yesterday, was $24.5 billion – about flat year-over-year, but enough to keep on track for a full-year revenue beat, and was almost $1 billion more than had been forecast.

Overall, BoA’s Q3 report came in better than expected, which the bank attributed to gain in fixed income trading as well as increased interest income. The bank reported net income of 81 cents per diluted share, up from 77 cents in the year-ago quarter. Drilling down, BoA reported a net interest income of $13.8 billion, up 24% year-over-year. This represented a 2.06% net interest yield, a gain of 10% from Q2 and up 22% year-over-year.

While shares in Bank of America are down 25% so far this year, the stock jumped more than 6% after the Q3 numbers came out. Investors were clearly attracted by what has been

RBC Capital’s 5-star analyst Gerard Cassidy is also impressed with BoA’s execution in recent months, writing: “In our view, BAC’s 3Q22 results made it clear that the company has transformed itself from the height of the financial crisis through today. Over this period, the company strengthened its capital, liquidity and lowered its risk levels and materially reduced its credit problems… We anticipate the transformed and “de-risked” BAC will weather any economic storm that comes its way over the next 12-24 months significantly better than it did during the financial crisis. Furthermore, we believe the company will outperform its peers through the cycle in terms of credit quality and profitability.”

Quantifying his upbeat stance on the stock, Cassidy gives BAC shares a $40 price target, suggesting a one-year upside of 14% and backing up his Outperform (i.e. Buy) rating. (To watch Cassidy’s track record, click here)

Overall, BoA has 15 analyst reviews on file, with a 10 to 5 split between the Buys and Holds for a Moderate Buy consensus rating. The shares are currently selling for $34.94 and their average price target of $41.03 indicates potential for ~17% upside in the coming year. (See BAC stock forecast on TipRanks)

JPMorgan Chase & Co. (JPM)

The second bank on the list, JPMorgan Chase, holds some $3.95 trillion in total assets, making it the largest bank in the US by that measure. JPM saw $126.99 billion in revenues last year, and its top line in 1H22 was already more than half of last year’s total. The Q3 revenues came in at $32.7 billion, beating the forecast of $32.1 billion and growing 10% year-over-year.

The top line wasn’t the only good news for investors in JPM’s quarter performance. The financial release showed that the Fed’s rate hikes have been unalloyed good news for JPM – the bank’s interest income jumped more than expected, to $17.6 billion, an impressive gain of 34%. The net interest income beat expectations by more than $600 million.

JPM also reported a boost in Consumer & Business Banking, where net revenue grew 30% y/y to $8 billion. The bump came from a strong growth in deposits, and higher deposit margins.

However, the bank reported a total net income of $9.73 billion, with a diluted EPS of $3.12. Both of these metrics were down about 17% year-over-year.

We’ll check in again with RBC’s Gerard Cassidy, who has cast his eye on JPM in the wake of the financial release. Cassidy says of this bank: “Overall, relative to the uncertainty going into the quarter JPM posted better-than-expected third quarter results, driven by impressive net interest income growth. Net income for both the Corporate & Investment Banking and Asset & Wealth Management business segments exceeded our expectations. Furthermore, the company’s increased CET1 ratio and its expectation for it to increase to 13.0% (50 basis points above its regulatory minium) by year-end should give investors confidence that JPM will have the flexibility in managing its balance sheet in 2023.”

This is another stock that Cassidy rates as Outperform (i.e. Buy), and his $130 price target suggests it has room for ~10% upside in the next 12 months. (To watch Cassidy’s track record, click here)

What does the rest of the Street think? The 12 analyst reviews on file for JPM break down to 7 Buys, 4 Holds, and 1 Sell, giving the stock a Moderate Buy consensus rating. Shares are trading for $119.86 and the average price target of $137.67 implies a one-year gain of ~15%. (See JPM stock forecast on TipRanks)

Wells Fargo (WFC)

That last bank on the list, Wells Fargo, is the fourth largest in the US, with $1.88 trillion in total assets – and it’s also Jim Cramer’s favored pick to take advantage of gains in the banking sector. Cramer has noted that Wells Fargo leads its industry in net interest margin, or the spread between the bank’s return on investments and what it pays for client deposits.

“These guys are printing money thanks to the higher yield curve,” Cramer noted. Putting that outperformance into numbers, Wells Fargo management, in last week’s 3Q22 report, increased its expected net interest margin year-over-year growth for 2022 from 8% to 24%.

Like the banks above, Wells Fargo saw a bump in share value after that Q3 release; the stock climbed 3% even though the bank had to boost its loan loss reserves, a move that cut into profits. Factoring in regulatory matters, litigation, and customer remediation, the bank had to cut its EPS from $1.30 to 85 cents; this came in below the $1.09 forecast, and below the year-ago quarter’s $1.17. Investors were heartened, however, by the $19.5 billion in total revenue, which came in above the $18.8 billion expectation.

Also in the quarter, Well Fargo reported an increase of nearly $100 million in its average loan balance, which, with the higher interest rates, helped to drive the improvement in revenues and net interest margins.

Raymond James analyst David Long has long been bullish on WFC’s prospects. In his latest note on the bank, looking at the Q3 results, Long writes: “Absent $2.0B of added operating losses, core EPS would have been $1.30, above expectations. Its NIM expanded much more than anticipated, which should lead to positive revenue and EPS revisions. Core operating expenses were below expectations as expense rationalization efforts continue. Despite clean credit metrics, we agree with its move to add to loss reserves. We believe solid operating results will be appreciated by investors.”

Going forward, Long puts an Outperform (i.e. Buy) rating on WFC shares, and his price target of $52 implies a 16% upside on the one-year horizon. (To watch Long’s track record, click here)

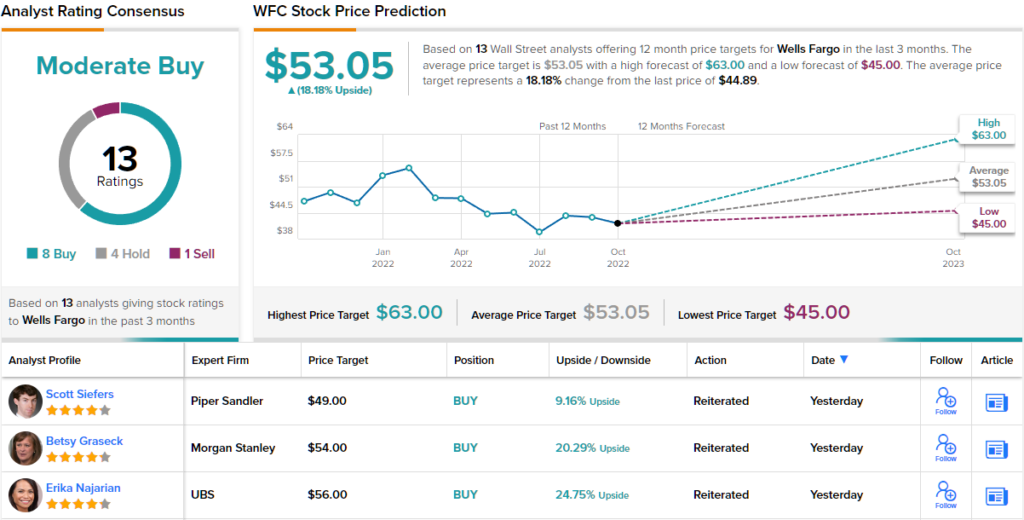

All in all, no fewer than 13 analysts have chimed in on Wells Fargo recently, and their reviews include 8 Buys, 4 Holds, a 1 Sell, to give the stock its Moderate Buy consensus rating. The average price target of $53.05 suggests an 18% upside potential from the current trading price of $44.87. (See WFC stock forecast on TipRanks)

To find good ideas for bank stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.